Oman Gastroretentive Drug Delivery Systems Outsourcing Market Overview

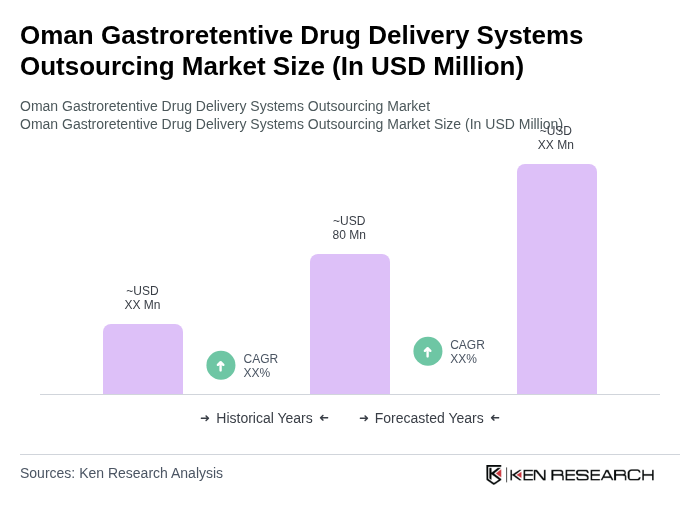

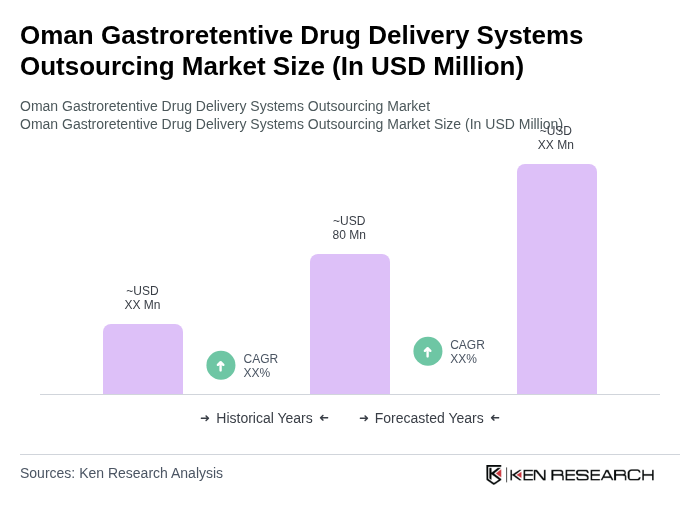

- The Oman Gastroretentive Drug Delivery Systems Outsourcing Market is valued at USD 80 million, based on a five-year historical analysis, taking into account Oman’s share within the broader Middle East gastroretentive drug delivery systems market and the scale of the national pharmaceuticals market. This growth is primarily driven by the increasing prevalence of gastrointestinal disorders and the rising demand for advanced drug delivery systems that enhance therapeutic efficacy and patient compliance, in line with global trends in gastroretentive systems. The market is also supported by technological advancements in drug formulation and delivery methods, including controlled-release and gastroretentive platforms that improve bioavailability and reduce dosing frequency.

- Key hubs influencing this market include Muscat, Salalah, and Sohar, which play a key role due to their strategic locations, concentration of tertiary care hospitals, and growing pharmaceutical and healthcare infrastructure. These cities are pivotal in facilitating access to healthcare services and fostering collaborations between pharmaceutical companies, contract manufacturers, and healthcare providers, supporting outsourcing of advanced drug delivery development and related services.

- In 2023, the Omani government further strengthened the regulatory environment for pharmaceuticals and drug delivery through the continued implementation of the Pharmacy and Drug Control Law issued by the Ministry of Health, and its implementing regulations, which set requirements for registration, quality control, pharmacovigilance, and Good Manufacturing Practice for all medicinal products and delivery technologies. These provisions include stringent guidelines for the approval and monitoring of innovative and gastroretentive drug delivery technologies, aimed at ensuring that products meet international safety, quality, and efficacy standards across their lifecycle.

Oman Gastroretentive Drug Delivery Systems Outsourcing Market Segmentation

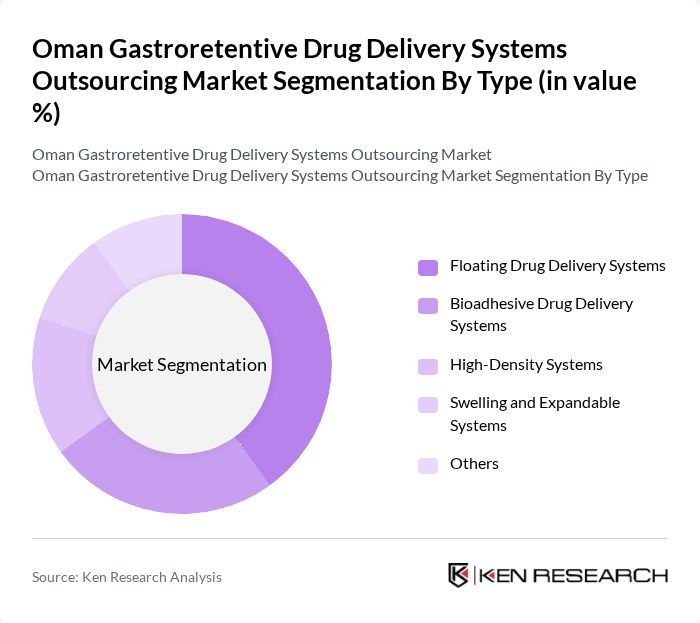

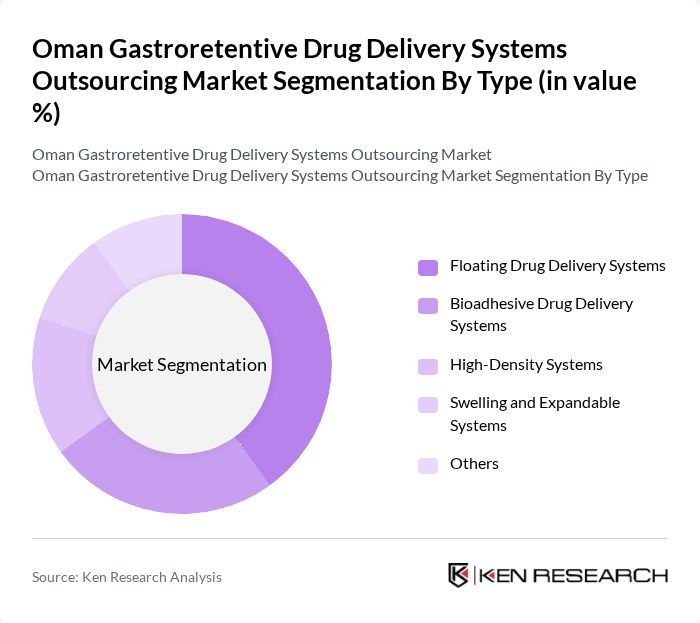

By Type:The market is segmented into various types of gastroretentive drug delivery systems, including Floating Drug Delivery Systems, Bioadhesive Drug Delivery Systems, High-Density Systems, Swelling and Expandable Systems, and Others, consistent with global gastroretentive technology classifications. Among these, Floating Drug Delivery Systems are gaining traction due to their ability to remain buoyant in the gastric environment, thereby enhancing drug absorption and therapeutic effectiveness, while Bioadhesive systems are increasingly used to prolong gastric residence time in chronic gastrointestinal conditions.

By End-User:The end-user segmentation includes Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Specialty Clinics, and Others, aligning with global and regional gastroretentive market segmentation by distribution channel. Hospital Pharmacies are leading this segment due to their critical role in providing specialized medications and personalized care to patients, particularly those with chronic gastrointestinal conditions that require complex, controlled-release, and gastroretentive formulations.

Oman Gastroretentive Drug Delivery Systems Outsourcing Market Competitive Landscape

The Oman Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca, Novartis, Pfizer, Roche, Merck & Co., Johnson & Johnson, GSK, Sanofi, Teva Pharmaceutical Industries, Amgen, Eli Lilly and Company, Bayer AG, AbbVie, Biogen, Astellas Pharma contribute to innovation, geographic expansion, and service delivery in this space, reflecting the presence of these companies in the broader gastroretentive and advanced drug delivery systems market globally and across the Middle East.

Oman Gastroretentive Drug Delivery Systems Outsourcing Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and hypertension in Oman is a significant growth driver for gastroretentive drug delivery systems. According to the World Health Organization, approximately 30% of the Omani population suffers from chronic conditions, leading to a higher demand for effective drug delivery solutions. This trend is expected to increase the need for innovative therapies that enhance patient outcomes and adherence to treatment regimens, thereby boosting market growth.

- Rising Demand for Advanced Drug Delivery Systems:The demand for advanced drug delivery systems in Oman is growing, driven by the need for more effective and targeted therapies. The Ministry of Health reported a 15% increase in the adoption of novel drug delivery technologies in recent years. This shift is largely due to the increasing awareness among healthcare providers and patients about the benefits of these systems, which improve bioavailability and therapeutic efficacy, thus propelling market expansion.

- Technological Advancements in Drug Formulation:Technological innovations in drug formulation are significantly enhancing the capabilities of gastroretentive systems. In future, the Omani pharmaceutical sector is expected to invest over $50 million in R&D for drug formulation technologies. This investment is aimed at developing more efficient delivery systems that can provide sustained release and improved patient compliance, thereby fostering growth in the outsourcing market for these systems.

Market Challenges

- High Development Costs:The high costs associated with the development of gastroretentive drug delivery systems pose a significant challenge. Development expenses can exceed $1 million per project, which can deter smaller companies from entering the market. This financial barrier limits innovation and competition, ultimately affecting the overall growth of the outsourcing market in Oman, where budget constraints are prevalent among local manufacturers.

- Regulatory Hurdles:Navigating the regulatory landscape in Oman can be complex and time-consuming, presenting a challenge for companies in the gastroretentive drug delivery sector. The Omani Food and Drug Authority has stringent guidelines that can delay product approvals by up to 18 months. These regulatory hurdles can hinder the timely introduction of new products, impacting the competitiveness of firms operating in this market.

Oman Gastroretentive Drug Delivery Systems Outsourcing Market Future Outlook

The future of the gastroretentive drug delivery systems outsourcing market in Oman appears promising, driven by increasing healthcare investments and a growing emphasis on patient-centric solutions. As the healthcare infrastructure expands, more opportunities for collaboration between pharmaceutical companies and research institutions are likely to emerge. Additionally, the integration of digital health technologies will enhance drug delivery efficiency, paving the way for innovative solutions that cater to the evolving needs of patients and healthcare providers alike.

Market Opportunities

- Expansion of Healthcare Infrastructure:The ongoing expansion of healthcare facilities in Oman presents a significant opportunity for the gastroretentive drug delivery systems market. With the government investing over $200 million in healthcare infrastructure in future, there will be increased demand for advanced drug delivery solutions that can support the growing patient population and improve treatment outcomes.

- Collaborations with Research Institutions:Collaborating with research institutions can unlock new avenues for innovation in drug delivery systems. By leveraging academic expertise, companies can enhance their R&D capabilities, leading to the development of cutting-edge technologies. Such partnerships are expected to increase, particularly as Oman aims to boost its pharmaceutical research output by 25% in future.