Malaysia Gastroretentive Drug Delivery Systems Outsourcing Market Overview

- The Malaysia Gastroretentive Drug Delivery Systems Outsourcing Market is valued at USD 145 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of gastrointestinal disorders, growing demand for targeted drug delivery systems, technological advancements in gastroretentive drug delivery systems, and a rising demand for patient-centric healthcare solutions. The market is also supported by the growing pharmaceutical industry, expanding manufacturing capabilities, increasing healthcare expenditure, and the need for innovative drug formulations that enhance therapeutic efficacy.

- Key players in this market include Kuala Lumpur, Penang, and Johor Bahru, which dominate due to their robust healthcare infrastructure, presence of pharmaceutical companies, and research institutions. These cities are also strategic hubs for logistics and distribution, facilitating efficient supply chain management and access to a larger patient population, thereby driving market growth.

- The National Pharmaceutical Regulatory Agency (NPRA) Guidelines for Registration of Modified Release Dosage Forms, 2020 issued by the Ministry of Health Malaysia, governs the approval process for gastroretentive drug delivery systems. This regulation requires comprehensive data on gastric retention profiles, in vitro dissolution testing aligned with gastric transit conditions, and bioequivalence studies for modified release products, ensuring compliance through product licensing with defined retention thresholds and manufacturing standards.

Malaysia Gastroretentive Drug Delivery Systems Outsourcing Market Segmentation

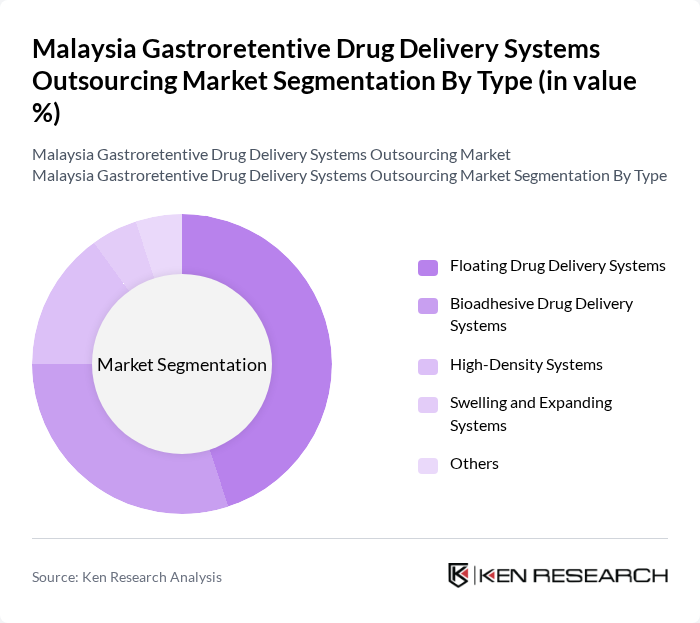

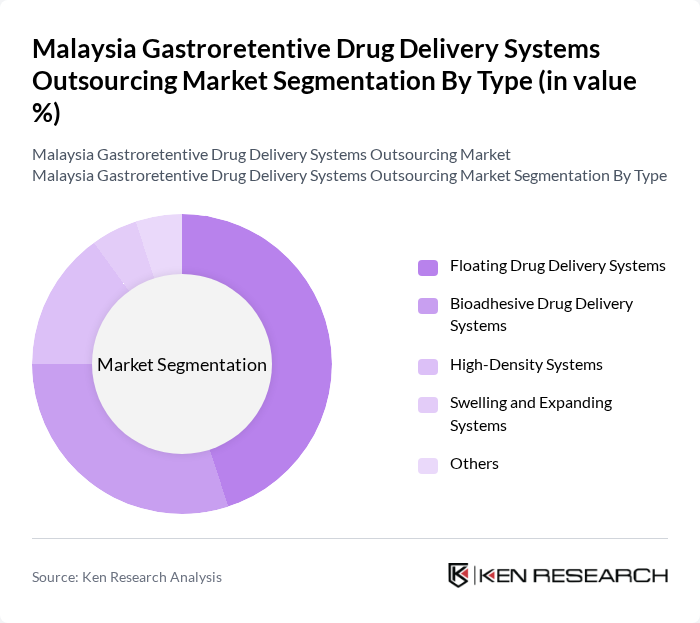

By Type:The market is segmented into various types of gastroretentive drug delivery systems, including Floating Drug Delivery Systems, Bioadhesive Drug Delivery Systems, High-Density Systems, Swelling and Expanding Systems, and Others. Among these, Floating Drug Delivery Systems are gaining traction due to their ability to prolong gastric retention time, enhancing drug absorption and therapeutic effectiveness. The increasing focus on chronic disease management and the need for sustained drug release profiles are driving the demand for these systems.

By Product Form:The market is also categorized by product form, which includes Tablets, Capsules, Powders, Liquids, and Granules. Tablets are the most widely used form due to their convenience, stability, and ease of administration. The growing trend towards personalized medicine and the demand for innovative formulations are further propelling the development of gastroretentive tablets, making them a preferred choice among healthcare providers and patients alike.

Malaysia Gastroretentive Drug Delivery Systems Outsourcing Market Competitive Landscape

The Malaysia Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pharmaniaga Berhad, Duopharma Biotech Berhad, Hovid Berhad, Kotra Pharma (M) Sdn Bhd, Apex Healthcare Berhad, YSP Southeast Asia Holding Berhad, CCM Duopharma Biotech Berhad, Mylan Malaysia Sdn Bhd, Sanofi-Aventis (Malaysia) Sdn Bhd, GlaxoSmithKline Malaysia Sdn Bhd, Pfizer Malaysia Sdn Bhd, Merck Sharp & Dohme (Malaysia) Sdn Bhd, Novartis Malaysia Sdn Bhd, Roche (Malaysia) Sdn Bhd, Bayer (Malaysia) Sdn Bhd contribute to innovation, geographic expansion, and service delivery in this space.

Malaysia Gastroretentive Drug Delivery Systems Outsourcing Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and hypertension in Malaysia is a significant growth driver for gastroretentive drug delivery systems. According to the Malaysian Ministry of Health, approximately 4 million adults were diagnosed with diabetes in future, representing a 25% increase from 2019. This growing patient population necessitates advanced drug delivery systems that enhance therapeutic efficacy and patient adherence, thereby driving market demand.

- Rising Demand for Advanced Drug Delivery Systems:The Malaysian healthcare sector is increasingly adopting advanced drug delivery systems to improve treatment outcomes. The market for these systems is projected to grow as healthcare providers seek innovative solutions to enhance bioavailability and reduce side effects. In future, the Malaysian government allocated RM 2 billion for healthcare innovation, indicating a strong commitment to advancing drug delivery technologies, which will further stimulate market growth.

- Technological Advancements in Drug Formulation:Continuous advancements in drug formulation technologies are propelling the gastroretentive drug delivery systems market in Malaysia. Innovations such as polymer-based formulations and nanotechnology are enhancing the effectiveness of these systems. The Malaysian Institute of Pharmaceuticals and Nutraceuticals reported a 20% increase in R&D investments in drug formulation technologies in future, highlighting the industry's focus on developing more efficient delivery systems to meet patient needs.

Market Challenges

- High Development Costs:One of the primary challenges facing the gastroretentive drug delivery systems market in Malaysia is the high cost of development. The average cost to develop a new drug delivery system can exceed RM 12 million, which poses a significant barrier for smaller companies. This financial burden can limit innovation and slow down the introduction of new products into the market, hindering overall growth.

- Regulatory Hurdles and Compliance Issues:Navigating the regulatory landscape in Malaysia presents challenges for companies in the gastroretentive drug delivery systems market. The Malaysian National Pharmaceutical Regulatory Agency (NPRA) has stringent guidelines that can delay product approvals. In future, the NPRA reported an average approval time of 16 months for new drug delivery systems, which can impede market entry and increase operational costs for manufacturers.

Malaysia Gastroretentive Drug Delivery Systems Outsourcing Market Future Outlook

The future of the gastroretentive drug delivery systems market in Malaysia appears promising, driven by increasing healthcare investments and a growing focus on patient-centric solutions. As the government continues to enhance healthcare infrastructure, the demand for innovative drug delivery systems is expected to rise. Additionally, the integration of digital health technologies will likely streamline drug development processes, making them more efficient and responsive to patient needs, thus fostering market growth.

Market Opportunities

- Expansion of Healthcare Infrastructure:The Malaysian government's commitment to expanding healthcare infrastructure presents significant opportunities for the gastroretentive drug delivery systems market. With an investment of RM 3 billion planned for new healthcare facilities by future, the demand for advanced drug delivery systems is expected to increase, providing a fertile ground for market players to introduce innovative solutions.

- Collaborations with Research Institutions:Collaborating with research institutions can unlock new opportunities for innovation in drug delivery systems. In future, several Malaysian universities are expected to launch joint research initiatives focused on drug formulation technologies, which could lead to breakthroughs in gastroretentive systems. Such partnerships can enhance R&D capabilities and accelerate the development of novel delivery methods.