Region:Middle East

Author(s):Geetanshi

Product Code:KRAE4990

Pages:92

Published On:December 2025

By Service Type:The service type segmentation includes various categories such as Contract Development and Manufacturing Organizations (CDMOs), Contract Manufacturing Organizations (CMOs), Regulatory Affairs Outsourcing, and Product Design & Development Services. Among these, CDMOs are currently leading the market due to their ability to provide comprehensive services that cover the entire drug development process, from formulation to manufacturing. This trend is driven by the increasing need for outsourcing among pharmaceutical companies looking to reduce costs and enhance efficiency.

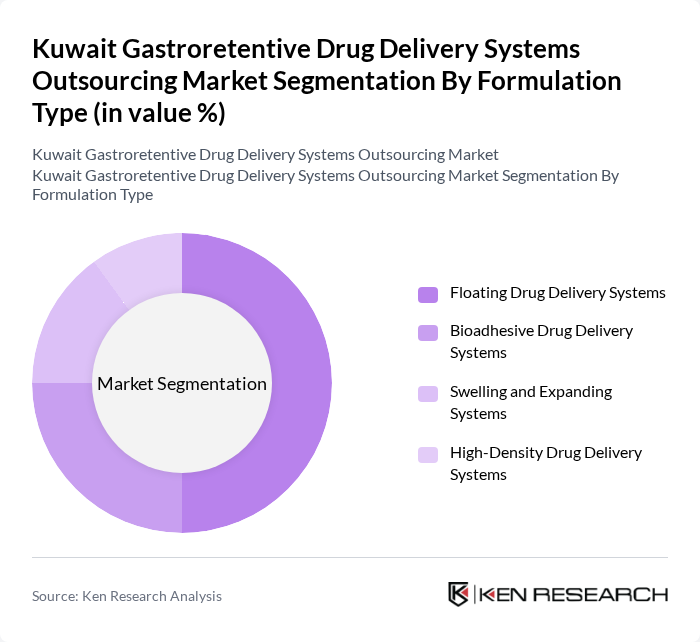

By Formulation Type:The formulation type segmentation encompasses Floating Drug Delivery Systems, Bioadhesive Drug Delivery Systems, Swelling and Expanding Systems, and High-Density Drug Delivery Systems. Floating Drug Delivery Systems are currently the most dominant sub-segment, as they offer prolonged gastric retention time, which is particularly beneficial for drugs with narrow absorption windows. This formulation type is increasingly favored by pharmaceutical companies aiming to enhance drug bioavailability and patient adherence.

The Kuwait Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Pharmaceutical Industries (Julphar), Kuwait Pharmaceutical Industries (KPI), Al-Dawaa Pharmacies, United Pharmacies, Al-Muhaidib Group, Al-Hokair Group, Al-Salam International Hospital, Kuwait Medical Center, Al-Bahar Group, Al-Mansoori Specialized Engineering, Kuwait Health Assurance Company, Kuwait International Pharmaceutical Industries, Al-Qabas Pharmaceutical Company, Al-Majed Group, Al-Faisal Holding contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gastroretentive drug delivery systems market in Kuwait appears promising, driven by increasing healthcare investments and a growing focus on patient-centric solutions. As the healthcare infrastructure expands, the demand for innovative drug delivery systems is expected to rise. Additionally, the integration of digital health technologies will enhance patient monitoring and adherence, further propelling market growth. Companies that adapt to these trends will likely find significant opportunities for expansion and collaboration within the sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Contract Development and Manufacturing Organizations (CDMOs) Contract Manufacturing Organizations (CMOs) Regulatory Affairs Outsourcing Product Design & Development Services |

| By Formulation Type | Floating Drug Delivery Systems Bioadhesive Drug Delivery Systems Swelling and Expanding Systems High-Density Drug Delivery Systems |

| By End-User | Pharmaceutical & Biopharmaceutical Companies Medical Device Companies Hospitals and Healthcare Providers Research and Academic Institutions |

| By Therapeutic Application | Gastrointestinal Disorders Chronic Disease Management Antimicrobial Treatments Other Therapeutic Applications |

| By Distribution Channel | Direct Sales to Pharmaceutical Companies Distributor Networks Online Platforms Other Channels |

| By Regulatory Compliance Level | GMP Compliant Services ISO Certified Services FDA Approved Facilities Other Compliance Standards |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 45 | Product Development Managers, Regulatory Affairs Specialists |

| Healthcare Providers | 38 | Gastroenterologists, Clinical Pharmacists |

| Research Institutions | 28 | Academic Researchers, Lab Directors |

| Patients Using Gastroretentive Systems | 42 | Chronic Disease Patients, Caregivers |

| Regulatory Bodies | 22 | Health Policy Analysts, Compliance Officers |

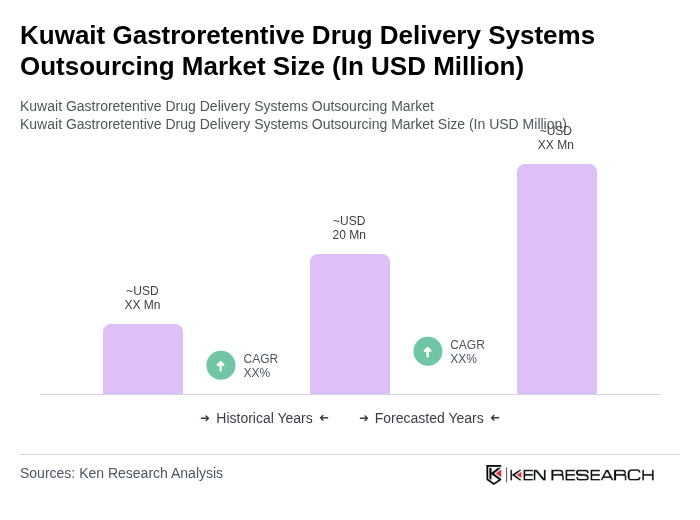

The Kuwait Gastroretentive Drug Delivery Systems Outsourcing Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of gastrointestinal disorders and the demand for advanced drug delivery systems.