Region:Global

Author(s):Geetanshi

Product Code:KRVN4347

Pages:114

Published On:December 2025

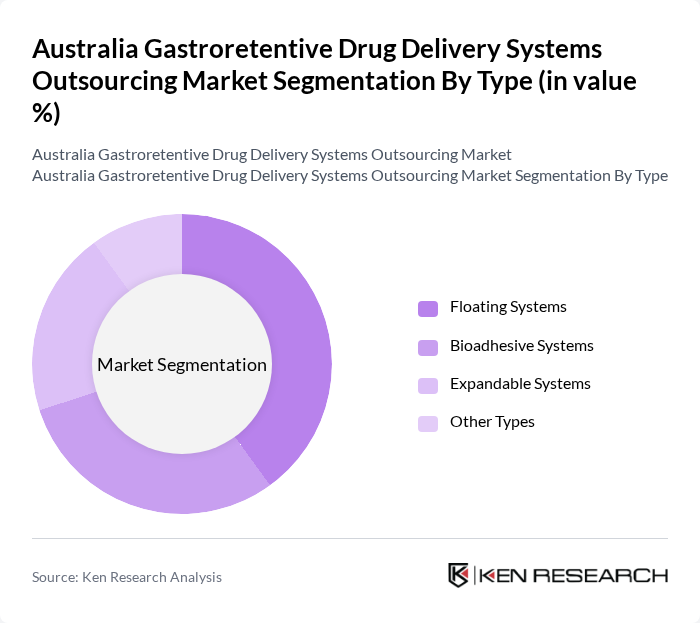

By Type:The market is segmented into various types of gastroretentive systems, including **Floating Systems**, **Bioadhesive Systems**, **Expandable Systems**, and Other Types. Each type serves specific therapeutic needs and offers unique advantages in drug delivery, influencing their adoption rates among healthcare providers.

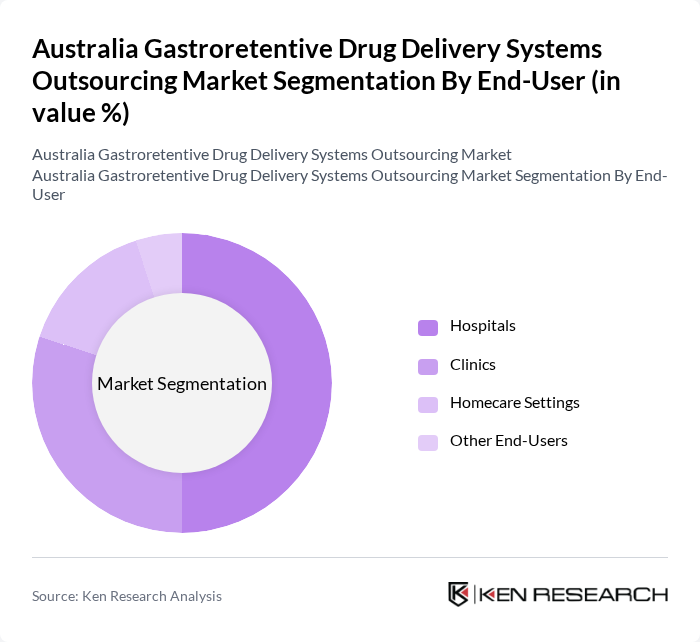

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Settings, and Other End-Users. Each segment reflects the diverse settings in which gastroretentive drug delivery systems are utilized, with hospitals and clinics being the primary users due to their need for advanced therapeutic solutions.

The Australia Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as CSL Limited, Pfizer Australia, AstraZeneca Australia, Novartis Australia, Merck Sharp & Dohme (Australia) Pty Ltd, GlaxoSmithKline Australia, Sanofi Australia, Johnson & Johnson Medical Pty Ltd, Roche Products Pty Ltd, Amgen Australia, Sandoz Australia, Teva Pharmaceuticals Australia, Mylan Australia, Biogen Australia, UCB Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gastroretentive drug delivery systems market in Australia appears promising, driven by ongoing advancements in technology and increasing healthcare demands. As the prevalence of chronic gastrointestinal conditions rises, the need for innovative drug delivery solutions will intensify. Furthermore, the integration of digital health technologies is expected to enhance patient engagement and adherence. Companies that invest in research and development, while navigating regulatory challenges, will likely find significant opportunities for growth and collaboration in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Floating Systems Bioadhesive Systems Expandable Systems Other Types |

| By End-User | Hospitals Clinics Homecare Settings Other End-Users |

| By Application | Chronic Diseases Acute Conditions Preventive Care Other Applications |

| By Distribution Channel | Online Pharmacies Retail Pharmacies Hospital Pharmacies Other Channels |

| By Region | New South Wales Victoria Queensland Other Regions |

| By Formulation Type | Tablets Capsules Suspensions Other Formulations |

| By Others | Custom Formulations Combination Therapies Other Innovations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Departments | 110 | R&D Managers, Formulation Scientists |

| Healthcare Professionals | 90 | Pharmacists, Physicians, Clinical Researchers |

| Regulatory Affairs | 60 | Regulatory Managers, Compliance Officers |

| Market Analysts | 70 | Market Research Analysts, Business Development Managers |

| Manufacturing and Production | 50 | Production Managers, Quality Assurance Specialists |

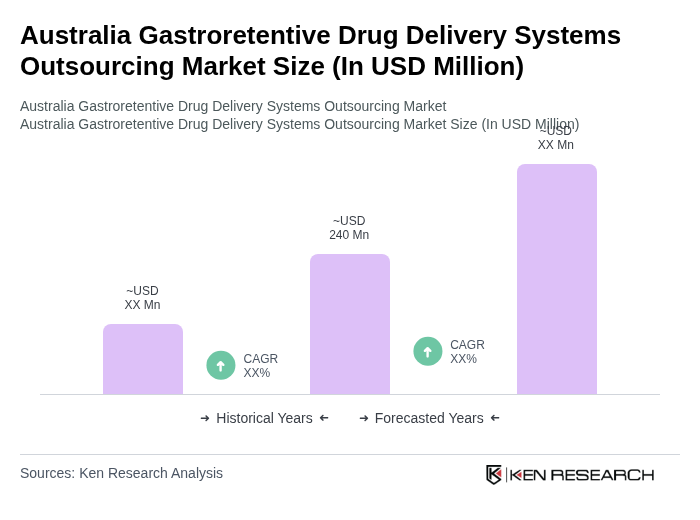

The Australia Gastroretentive Drug Delivery Systems Outsourcing Market is valued at approximately USD 240 million, reflecting a significant growth driven by chronic disease prevalence and advancements in drug delivery technologies.