Region:Middle East

Author(s):Dev

Product Code:KRAD6386

Pages:99

Published On:December 2025

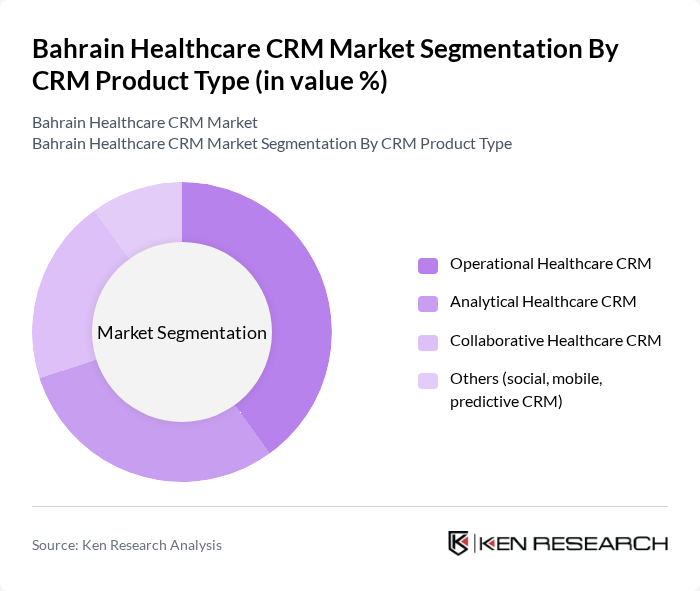

By CRM Product Type:The CRM product type segmentation includes various subsegments such as Operational Healthcare CRM, Analytical Healthcare CRM, Collaborative Healthcare CRM, and Others (social, mobile, predictive CRM). Each of these subsegments plays a crucial role in enhancing the efficiency and effectiveness of healthcare services.

The Operational Healthcare CRM subsegment is currently dominating the market due to its focus on streamlining day-to-day operations, enhancing patient management, and improving service delivery. Healthcare providers are increasingly adopting operational CRM solutions to automate administrative tasks, manage patient interactions, and optimize resource allocation. This trend is driven by the need for efficiency and cost-effectiveness in healthcare delivery, making operational CRM a critical component of healthcare IT strategies.

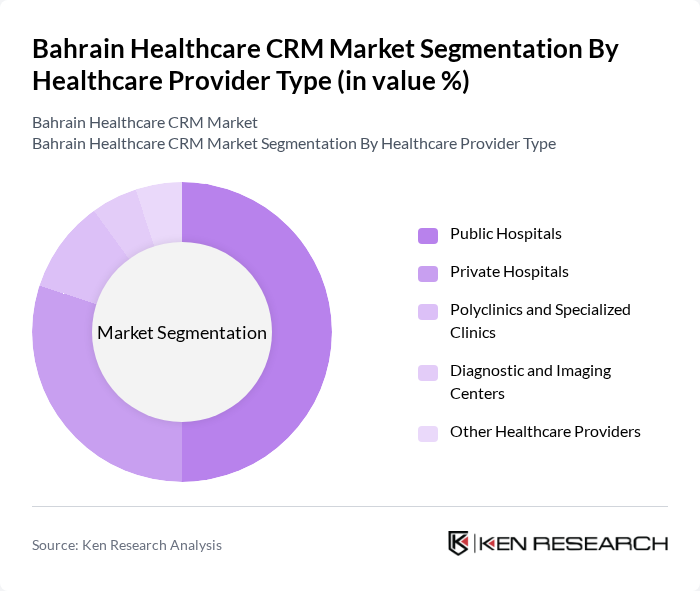

By Healthcare Provider Type:The healthcare provider type segmentation includes Public Hospitals, Private Hospitals, Polyclinics and Specialized Clinics, Diagnostic and Imaging Centers, and Other Healthcare Providers. Each type has unique requirements and challenges that CRM solutions aim to address.

Public Hospitals are the leading subsegment in the healthcare provider type category, primarily due to their large patient volumes and the necessity for efficient patient management systems. These institutions are increasingly investing in CRM solutions to enhance patient engagement, streamline operations, and comply with government regulations. The focus on improving healthcare outcomes and patient satisfaction in public hospitals drives the demand for comprehensive CRM systems tailored to their specific needs.

The Bahrain Healthcare CRM Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Health (Oracle Corporation), Salesforce, Inc. (Health Cloud), Microsoft Corporation (Dynamics 365 for Healthcare), SAP SE (SAP for Healthcare), Cerner Corporation (Oracle Cerner), InterSystems Corporation, TCS Healthcare Technologies (Tata Consultancy Services), OCSHI – Open Connected Health Information (regional health IT provider), Naseej for Technology (Naseej Arabian Advanced Systems), Inovar (Inovar Middle East), EMMA Systems, Altibbi, Vezeeta, Orion Health, Intermedic (regional healthcare IT integrator) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain healthcare CRM market appears promising, driven by technological advancements and a growing emphasis on patient engagement. As healthcare providers increasingly recognize the value of data-driven decision-making, the integration of AI and machine learning into CRM systems is expected to enhance operational efficiency. Additionally, the expansion of telehealth services will further necessitate the adoption of CRM solutions, ensuring seamless communication and improved patient outcomes in the evolving healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By CRM Product Type | Operational Healthcare CRM Analytical Healthcare CRM Collaborative Healthcare CRM Others (social, mobile, predictive CRM) |

| By Healthcare Provider Type | Public Hospitals Private Hospitals Polyclinics and Specialized Clinics Diagnostic and Imaging Centers Other Healthcare Providers |

| By Core Healthcare CRM Functionality | Patient Engagement & Communication Management Care Coordination & Case Management Marketing & Outreach (campaign and referral management) Population Health & Analytics Others (donor and foundation management) |

| By Deployment Model | On-Premise Web / Cloud-Based Hybrid Others |

| By Governorate | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Healthcare Organization Size | Large Healthcare Networks and Hospital Groups Medium-Sized Hospitals and Clinics Small Clinics and Single-Specialty Practices Others |

| By Service Type | Consulting and Strategy Services Implementation and Integration Services Training, Support and Managed Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital CRM Implementation | 100 | IT Managers, Hospital Administrators |

| Clinic CRM Usage | 80 | Practice Managers, Healthcare Providers |

| Patient Engagement Solutions | 70 | Patient Experience Officers, Marketing Managers |

| Telehealth CRM Integration | 60 | Telehealth Coordinators, IT Support Staff |

| Healthcare Analytics and CRM | 90 | Data Analysts, Business Intelligence Managers |

The Bahrain Healthcare CRM Market is valued at approximately USD 25 million, reflecting a significant growth trend driven by the adoption of digital health solutions and the demand for personalized healthcare services.