Region:Middle East

Author(s):Rebecca

Product Code:KRAD2035

Pages:84

Published On:January 2026

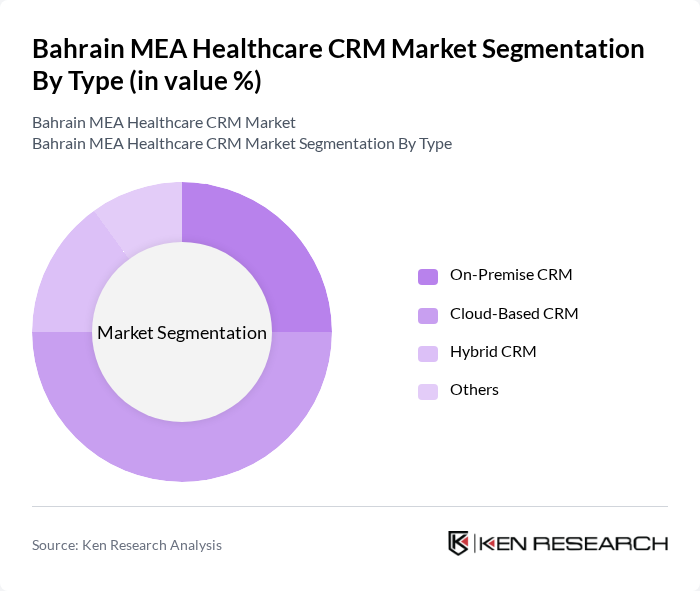

By Type:The market is segmented into On-Premise CRM, Cloud-Based CRM, Hybrid CRM, and Others. Among these, Cloud-Based CRM is gaining significant traction due to its flexibility, scalability, and cost-effectiveness, making it the preferred choice for many healthcare providers. The increasing need for remote access to patient data and the ability to integrate with other digital health solutions further bolster the demand for Cloud-Based CRM solutions.

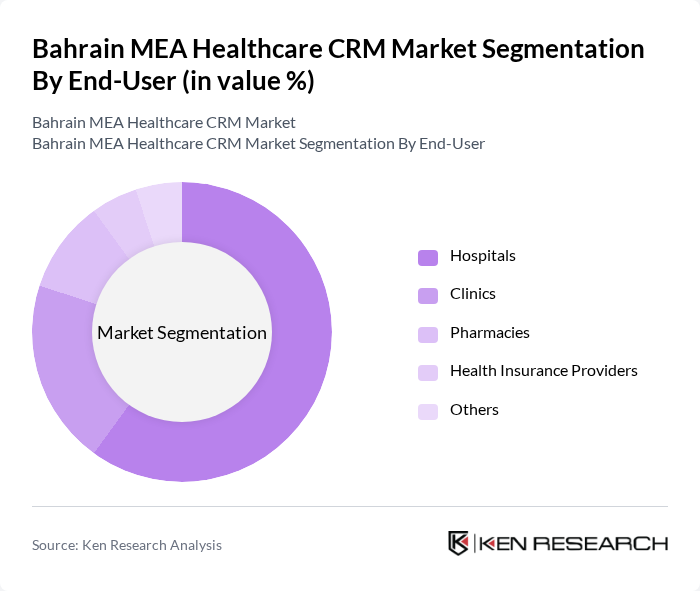

By End-User:The end-user segmentation includes Hospitals, Clinics, Pharmacies, Health Insurance Providers, and Others. Hospitals dominate the market due to their extensive need for patient management systems and the integration of CRM solutions to enhance patient care and operational efficiency. The increasing focus on patient engagement and personalized care is driving hospitals to adopt advanced CRM systems.

The Bahrain MEA Healthcare CRM Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, Microsoft Dynamics 365, Oracle Healthcare CRM, SAP Customer Experience, Zoho CRM, HubSpot CRM, Freshworks CRM, Pipedrive, SugarCRM, Infor CloudSuite, Veeva Systems, Meditech, Allscripts, Athenahealth, NextGen Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain MEA Healthcare CRM market appears promising, driven by advancements in digital infrastructure and a growing emphasis on patient-centric care. The integration of 5G technology and cloud services is expected to enhance data management and patient engagement capabilities in future. Additionally, the government's commitment to digital transformation will likely foster an environment conducive to CRM adoption, enabling healthcare providers to leverage innovative solutions for improved service delivery and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise CRM Cloud-Based CRM Hybrid CRM Others |

| By End-User | Hospitals Clinics Pharmacies Health Insurance Providers Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Functionality | Sales Management Marketing Automation Customer Service Analytics and Reporting Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Integration Capability | Standalone CRM Integrated CRM with EHR API-Enabled CRM Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital CRM Implementation | 100 | IT Managers, Hospital Administrators |

| Clinic CRM Usage | 80 | Practice Managers, Healthcare Providers |

| Patient Engagement Solutions | 70 | Patient Experience Officers, Marketing Managers |

| Telehealth CRM Integration | 60 | Telehealth Coordinators, IT Support Staff |

| Healthcare Analytics and CRM | 90 | Data Analysts, Business Intelligence Managers |

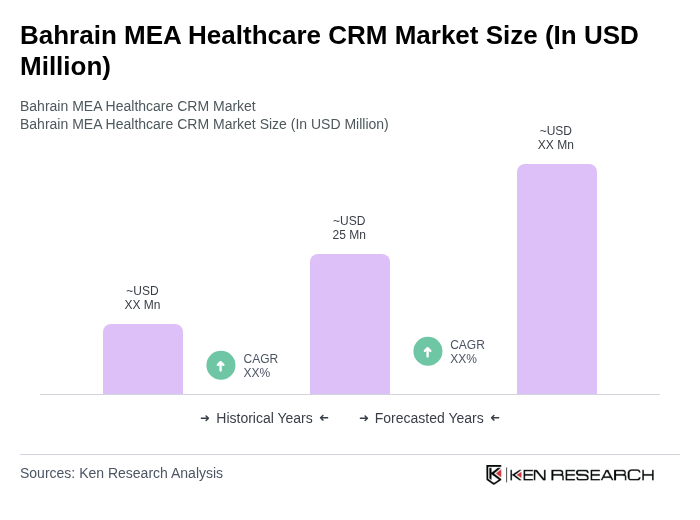

The Bahrain MEA Healthcare CRM Market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of digital health technologies and the rising prevalence of chronic diseases.