Region:Middle East

Author(s):Shubham

Product Code:KRAD5360

Pages:80

Published On:December 2025

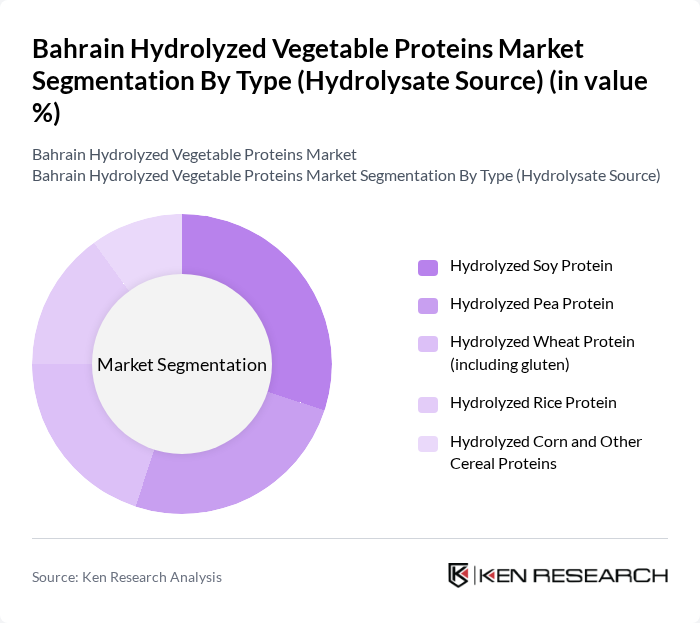

By Type (Hydrolysate Source):The market is segmented into various types based on the source of hydrolysate. The primary types include Hydrolyzed Soy Protein, Hydrolyzed Pea Protein, Hydrolyzed Wheat Protein (including gluten), Hydrolyzed Rice Protein, and Hydrolyzed Corn and Other Cereal Proteins. Each type caters to different consumer preferences and applications in the food industry.

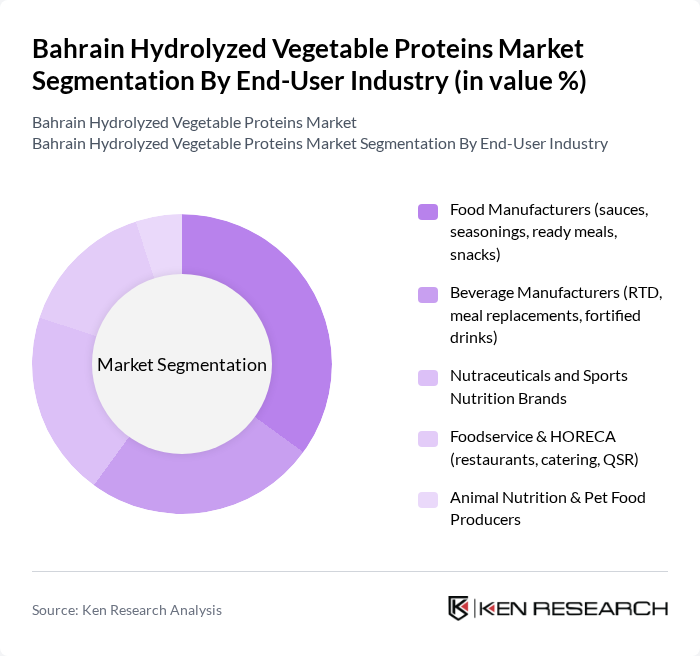

By End-User Industry:The hydrolyzed vegetable proteins market is further segmented by end-user industries, which include Food Manufacturers, Beverage Manufacturers, Nutraceuticals and Sports Nutrition Brands, Foodservice & HORECA, and Animal Nutrition & Pet Food Producers. Each segment has unique requirements and applications for hydrolyzed proteins.

The Bahrain Hydrolyzed Vegetable Proteins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kerry Group plc, Tate & Lyle PLC, Roquette Frères, Givaudan SA, Ajinomoto Co., Inc., Griffith Foods International Inc., Sensient Technologies Corporation, Symrise AG, Mane Group, Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, CHS Inc., Emsland Group, AGT Food and Ingredients Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrolyzed vegetable proteins market in Bahrain appears promising, driven by increasing health consciousness and a shift towards plant-based diets. As consumers become more aware of the benefits of these proteins, demand is expected to rise. Additionally, technological advancements in protein extraction and formulation will likely enhance product quality and variety, making hydrolyzed vegetable proteins more appealing to a broader audience, including athletes and health enthusiasts.

| Segment | Sub-Segments |

|---|---|

| By Type (Hydrolysate Source) | Hydrolyzed Soy Protein Hydrolyzed Pea Protein Hydrolyzed Wheat Protein (including gluten) Hydrolyzed Rice Protein Hydrolyzed Corn and Other Cereal Proteins |

| By End-User Industry | Food Manufacturers (sauces, seasonings, ready meals, snacks) Beverage Manufacturers (RTD, meal replacements, fortified drinks) Nutraceuticals and Sports Nutrition Brands Foodservice & HORECA (restaurants, catering, QSR) Animal Nutrition & Pet Food Producers |

| By Application in Food & Beverages | Flavor Enhancers and Bouillons Meat Analogues and Extenders Dairy Alternatives and Vegan Desserts Bakery, Snacks, and Savory Products Clinical, Infant, and Medical Nutrition |

| By Distribution Channel | B2B Ingredient Supply (direct to manufacturers) Foodservice Distributors Specialized Ingredient Importers & Traders Online B2B Platforms Retail & E-commerce (finished products) |

| By Form | Dry Powder Liquid Paste Granules and Other Formats |

| By Processing Method | Acid-Hydrolyzed Vegetable Protein (HVP) Enzymatically Hydrolyzed Vegetable Protein Mixed/Other Hydrolysis Processes |

| By Claim & Certification | Clean Label and Natural Non-GMO Halal-Certified Organic Conventional |

| By Governorate in Bahrain | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 60 | Production Managers, Quality Assurance Managers |

| Retail Outlets and Supermarkets | 50 | Store Managers, Category Buyers |

| Health and Nutrition Experts | 40 | Dietitians, Nutrition Consultants |

| Food Processing Equipment Suppliers | 40 | Sales Representatives, Technical Support Staff |

| Importers and Distributors of Plant-Based Products | 50 | Logistics Managers, Procurement Specialists |

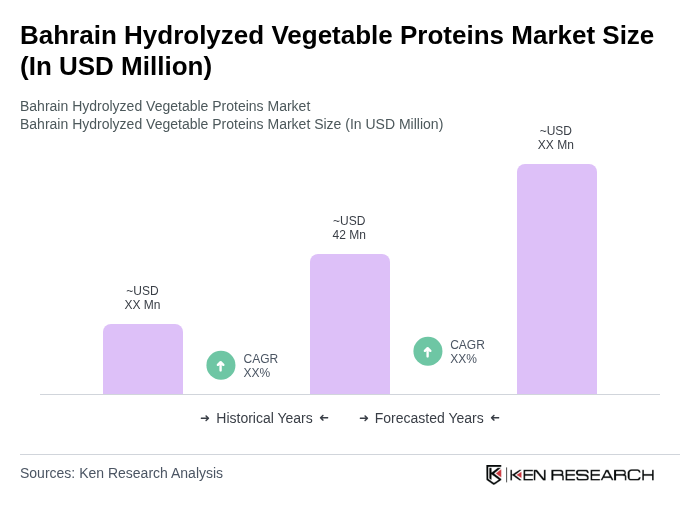

The Bahrain Hydrolyzed Vegetable Proteins Market is valued at approximately USD 42 million, reflecting a growing demand for plant-based protein sources and the expansion of the food and beverage industry in the region.