Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4028

Pages:82

Published On:January 2026

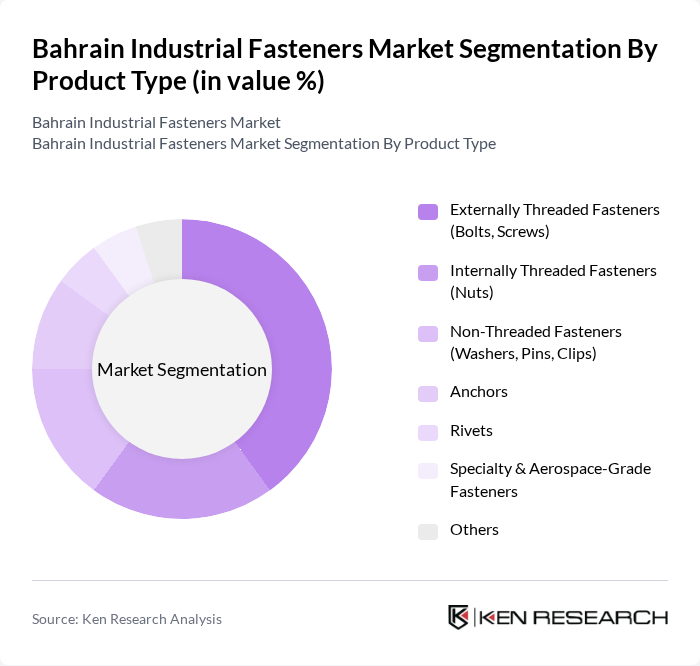

By Product Type:The product type segmentation includes various categories such as externally threaded fasteners, internally threaded fasteners, non-threaded fasteners, anchors, rivets, specialty and aerospace-grade fasteners, and others. At a global and regional level, externally threaded fasteners, particularly bolts and screws, represent the dominant category because of their extensive use in structural connections, machinery assembly, and automotive applications. In Bahrain, similar patterns are observed, with construction, oil and gas–related fabrication, and automotive maintenance activities driving higher demand for bolts and screws compared with other product categories, making them the leading subsegment.

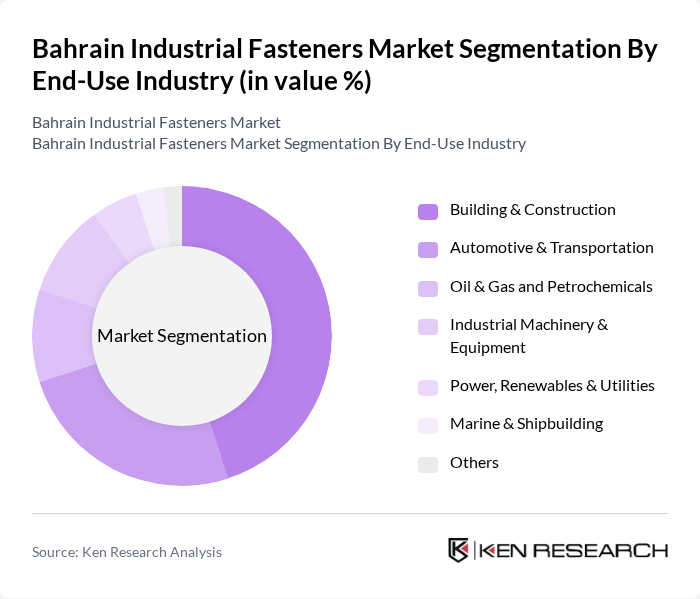

By End-Use Industry:The end-use industry segmentation encompasses building and construction, automotive and transportation, oil and gas and petrochemicals, industrial machinery and equipment, power, renewables and utilities, marine and shipbuilding, and others. In Bahrain, public and private investment in infrastructure, housing, and industrial zones positions the building and construction sector as the primary consumer of industrial fasteners. Growth in automotive and transportation, as well as ongoing oil and gas and petrochemical activities, further sustain demand, as these sectors require reliable and durable fastening solutions for equipment, pipelines, structural steel, and vehicle assembly and maintenance.

The Bahrain Industrial Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Fasteners & Steel Fabrication W.L.L., Bahrain Mechanical Construction Company W.L.L. (MECC), Awal Screw & Fasteners, Gulf Fasteners & Hardware, Al Manar Hardware & Fasteners, Bahrain Steel & Fasteners Trading, Al Ahlia Structural Steel & Fasteners, Eastern Industrial Supplies & Fasteners, Arabian International Fasteners Trading, Bahrain Metal Industries Co., Al Zayani Trading & Fasteners, Al Jazeera Industrial Supply & Fasteners, Al Sharif Mechanical & Fasteners, United Gulf Fasteners & Bolts Co., Al Noor Engineering & Fasteners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain industrial fasteners market appears promising, driven by ongoing investments in infrastructure and manufacturing. As the government continues to prioritize economic diversification, the demand for high-quality fasteners is expected to rise. Additionally, advancements in manufacturing technologies will likely enhance production efficiency. Companies that adapt to these trends and focus on sustainability will be well-positioned to capitalize on emerging opportunities in the market, ensuring long-term growth and stability.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Externally Threaded Fasteners (Bolts, Screws) Internally Threaded Fasteners (Nuts) Non-Threaded Fasteners (Washers, Pins, Clips) Anchors Rivets Specialty & Aerospace-Grade Fasteners Others |

| By End-Use Industry | Building & Construction Automotive & Transportation Oil & Gas and Petrochemicals Industrial Machinery & Equipment Power, Renewables & Utilities Marine & Shipbuilding Others |

| By Material | Carbon Steel Alloy Steel Stainless Steel Aluminum & Non-Ferrous Alloys Plastic & Composites Others |

| By Coating / Corrosion Protection | Zinc-Plated Hot-Dip Galvanized Electroplated / Mechanical Plated Organic & Polymer Coatings Others |

| By Sales / Distribution Channel | Direct Sales to OEMs & Projects Industrial Distributors & Traders Retail & Hardware Stores Online & E-Procurement Platforms Others |

| By Application | Structural & Civil Works Mechanical & Assembly Applications Electrical & Instrumentation Maintenance, Repair & Operations (MRO) Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Fasteners | 120 | Project Managers, Site Engineers |

| Automotive Fasteners | 90 | Procurement Managers, Quality Control Inspectors |

| Manufacturing Fasteners | 85 | Production Supervisors, Supply Chain Managers |

| Distribution Channels | 75 | Logistics Coordinators, Sales Representatives |

| Retail Fasteners | 95 | Store Managers, Inventory Analysts |

The Bahrain Industrial Fasteners Market is valued at approximately USD 35 million, reflecting its growth driven by increasing demand from the construction and automotive sectors, as well as the expansion of industrial activities in the region.