Region:Asia

Author(s):Geetanshi

Product Code:KRAA4029

Pages:95

Published On:January 2026

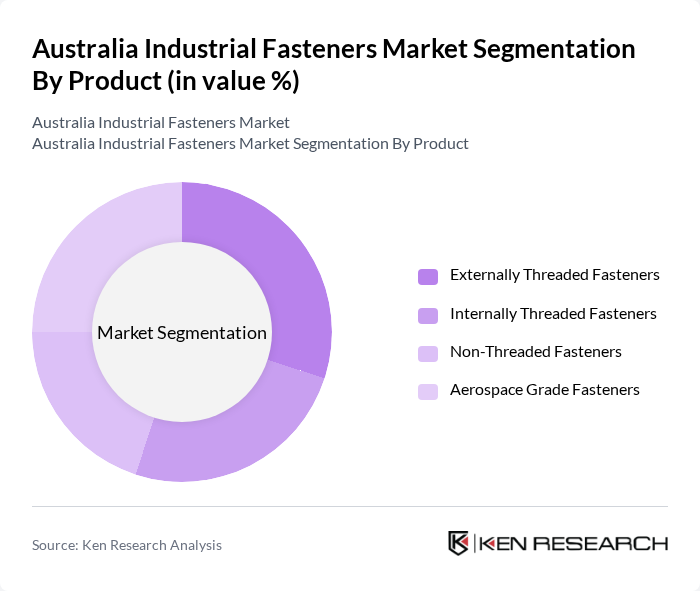

By Product:The product segmentation of the market includes various types of fasteners that cater to different industrial needs. The key subsegments are Externally Threaded Fasteners, Internally Threaded Fasteners, Non-Threaded Fasteners, and Aerospace Grade Fasteners. Each of these subsegments serves specific applications across industries, with varying demand based on the requirements of different sectors.

The Externally Threaded Fasteners subsegment is currently dominating the market due to their extensive use in construction, automotive, mining, and general industrial applications, aligning with research that identifies externally threaded fasteners as the leading product category in Australia and New Zealand. These fasteners are preferred for their ease of installation, mechanical strength, and reliability in securing components. The growing trend towards modular and prefabricated construction, as well as higher specifications for corrosion-resistant and high-strength assemblies, further boosts demand for these fasteners.

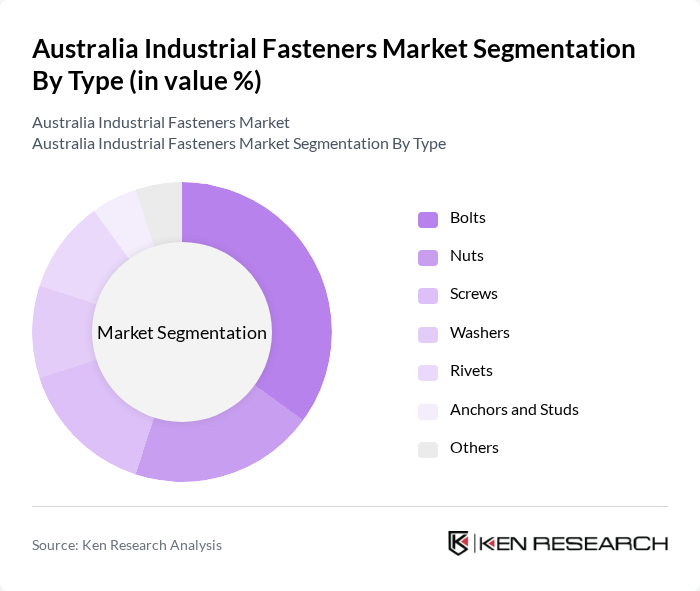

By Type:The market can also be segmented by type, which includes Bolts, Nuts, Screws, Washers, Rivets, Anchors and Studs, and Others. Each type serves distinct functions and is utilized across various applications, contributing to the overall market dynamics.

Among the types, Bolts are leading the market due to their versatility and critical role in structural steelwork, machinery assembly, and automotive components, consistent with broader findings that threaded fasteners account for the largest share of industrial fastener demand. The increasing complexity of modern structures and machinery necessitates the use of high-strength, fatigue-resistant bolts, often with protective coatings or stainless and alloy steels to meet durability and corrosion-resistance requirements. This trend is further supported by advancements in bolt and threaded fastener manufacturing technologies, including automated production, improved heat treatment, and precision cold-forming, enhancing their performance and reliability in demanding environments.

The Australia Industrial Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Australian Industrial Fasteners, Australian Anchor & Fixing (AAF Fasteners), BSC Industrial, Techsupply, Allfasteners Australia, Hobson Engineering, Boltmasters, Rudd Industrial & Farm Supplies, Blackwoods, Total Fasteners, Würth Australia, Coventry Group (Konnect Fastening Systems), Sydney Fasteners, Allthread Industries, Bremick Fasteners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia industrial fasteners market appears promising, driven by ongoing investments in infrastructure and technological advancements. As the construction and manufacturing sectors continue to expand, the demand for high-quality fasteners will likely increase. Additionally, the shift towards sustainable practices and eco-friendly materials is expected to shape product development. Companies that adapt to these trends and invest in innovation will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Product | Externally Threaded Fasteners Internally Threaded Fasteners Non-Threaded Fasteners Aerospace Grade Fasteners |

| By Type | Bolts Nuts Screws Washers Rivets Anchors and Studs Others |

| By Application | Building & Construction Automotive Aerospace & Defense Industrial Machinery & Equipment Energy, Mining & Oil and Gas Electrical & Electronics Furniture, Appliances & Others |

| By Material | Carbon Steel Alloy Steel Stainless Steel Aluminum Non-ferrous Alloys (Copper, Brass, Titanium, etc.) Plastic / Composite Others |

| By Coating / Finish | Zinc-Plated Hot-Dip Galvanized Electroplated (Nickel, Chrome, etc.) Black Oxide Organic / Specialty Coatings Others |

| By Distribution Channel | Direct Sales (OEM & Project Supply) Industrial Distributors Retail & Trade Stores Online / E-commerce Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania, ACT & Northern Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Fastener Usage | 100 | Project Managers, Procurement Officers |

| Automotive Fastener Applications | 80 | Manufacturing Engineers, Quality Control Managers |

| Aerospace Fastener Standards | 60 | Compliance Officers, Aerospace Engineers |

| General Manufacturing Fastener Needs | 90 | Operations Managers, Supply Chain Coordinators |

| Retail Fastener Distribution | 70 | Retail Managers, Inventory Specialists |

The Australia Industrial Fasteners Market is valued at approximately AUD 2.6 billion, driven by demand from sectors such as construction, automotive, mining, and industrial machinery, alongside public infrastructure projects across the country.