Region:Asia

Author(s):Geetanshi

Product Code:KRAA4030

Pages:81

Published On:January 2026

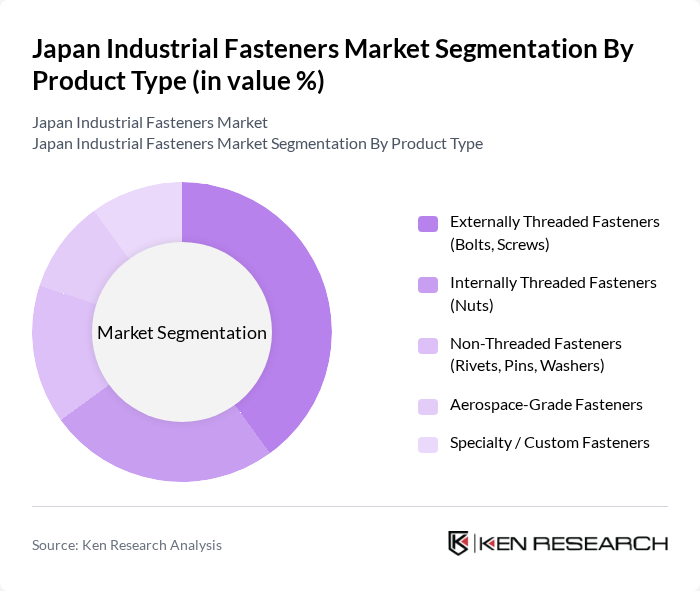

By Product Type:The product type segmentation includes various categories of fasteners, each serving distinct applications across industries. The dominant sub-segment is Externally Threaded Fasteners, which includes bolts and screws, widely used in construction, automotive, and machinery sectors due to their versatility, high load-bearing capability, and suitability for automated assembly. Internally Threaded Fasteners, such as nuts, also hold significant market share, driven by their essential role in mechanical joints and assembly processes across automotive, industrial equipment, and infrastructure projects. Non-Threaded Fasteners, including rivets, pins, and washers, are extensively used where permanent or vibration-resistant joints are required, particularly in construction, transport equipment, and appliances. Aerospace-Grade Fasteners are engineered for high strength-to-weight ratio, fatigue resistance, and stringent certification requirements, serving aircraft, defense systems, and space-related applications. Specialty/Custom Fasteners cater to niche and high-precision uses such as electric vehicles, electronics miniaturization, and renewable energy equipment, and are gaining traction as OEMs demand application-specific geometries, materials, and surface treatments.

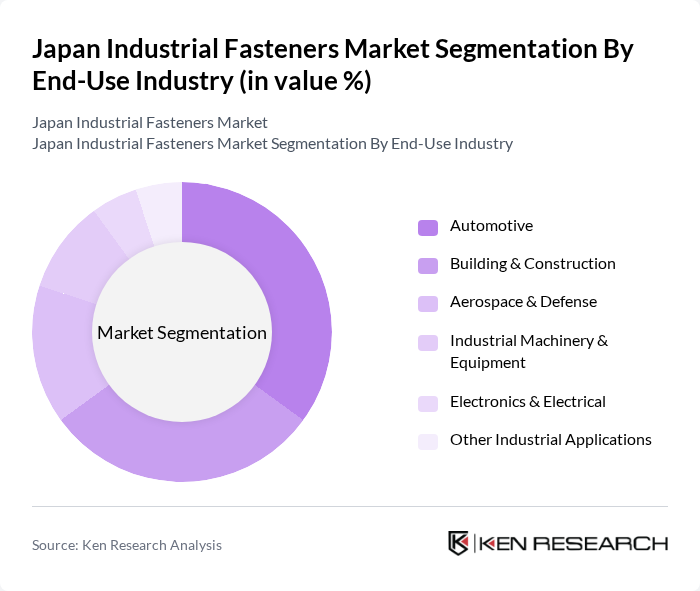

By End-Use Industry:The end-use industry segmentation highlights the diverse applications of fasteners across various sectors. The automotive industry is the largest consumer, driven by Japan’s strong vehicle production base and the need for durable, lightweight, and corrosion-resistant fastening solutions in internal combustion, hybrid, and electric vehicles. The building and construction sector follows closely, with fasteners being critical for structural connections, seismic-resistant assemblies, and infrastructure projects such as transport, commercial, and residential developments. Aerospace & Defense applications require certified high-performance fasteners for airframes, engines, and defense hardware, supporting stable demand in this segment. Industrial Machinery & Equipment uses fasteners extensively in factory automation systems, machine tools, robotics, and production lines, benefiting from ongoing industrial automation and productivity upgrades. Electronics & Electrical applications include consumer electronics, electronic components, and electrical equipment, where miniaturized and precision fasteners are required to support compact designs. Other industrial applications include shipbuilding, rail, energy, and general engineering, where specialized fasteners support demanding operating environments and long service lives.

The Japan Industrial Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nitto Seiko Co., Ltd., Meidoh Co., Ltd., Meira Corporation, Rashi Co., Ltd., Topura Co., Ltd., Yoshikawa Kogyo Co., Ltd., Tokyo Byora Koki Co., Ltd., Kato Seisakusho Co., Ltd., Sunco Industries Co., Ltd., MISUMI Group Inc., NejiLaw Inc., Nifco Inc., Tokai Rika Co., Ltd. (Fastener Division), Toyota Boshoku Corporation (Fastener & Component Business), Other Notable Domestic Fastener Manufacturers contribute to innovation, geographic expansion, and service delivery in this space, leveraging capabilities in precision cold-forming, surface treatment, just-in-time delivery, and customized engineering support for automotive, machinery, construction, and electronics customers.

The Japan industrial fasteners market is poised for significant transformation driven by technological advancements and sustainability initiatives. As manufacturers increasingly adopt automation and digitalization, production efficiency is expected to improve, allowing for faster response times to market demands. Additionally, the growing emphasis on eco-friendly materials will likely lead to the development of innovative fasteners that meet environmental standards. These trends will shape the competitive landscape, fostering a more resilient and adaptive market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Externally Threaded Fasteners (Bolts, Screws) Internally Threaded Fasteners (Nuts) Non-Threaded Fasteners (Rivets, Pins, Washers) Aerospace-Grade Fasteners Specialty / Custom Fasteners |

| By End-Use Industry | Automotive Building & Construction Aerospace & Defense Industrial Machinery & Equipment Electronics & Electrical Other Industrial Applications |

| By Material | Carbon Steel Stainless Steel Alloy Steel & Titanium Non-Ferrous Metals (Aluminum, Copper, Others) Plastics & Composites |

| By Coating / Finish | Zinc Plated Hot-Dip Galvanized Black Oxide Phosphate & Other Conversion Coatings Advanced Corrosion-Resistant / Specialty Coatings |

| By Sales Channel | Direct (OEM & Key Accounts) Indirect / Distributors Online / E-commerce Trading Houses & Others |

| By Application Function | Structural & Load-Bearing Assembly & Mounting Electrical & Electronics Assembly High-Performance / Safety-Critical |

| By Region | Kanto Region Kansai / Kinki Region Central / Chubu Region Hokkaido & Tohoku Region Chugoku & Shikoku Region Kyushu & Okinawa Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Fasteners | 110 | Procurement Managers, Quality Control Engineers |

| Construction Fasteners | 85 | Project Managers, Site Supervisors |

| Electronics Fasteners | 65 | Product Development Engineers, Supply Chain Analysts |

| Industrial Fasteners | 95 | Operations Managers, Manufacturing Engineers |

| Specialty Fasteners | 50 | R&D Managers, Technical Sales Representatives |

The Japan Industrial Fasteners Market is valued at approximately USD 6.1 billion, reflecting a steady growth driven by demand from sectors such as automotive, electronics, and construction, alongside advancements in manufacturing technologies.