Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4027

Pages:83

Published On:January 2026

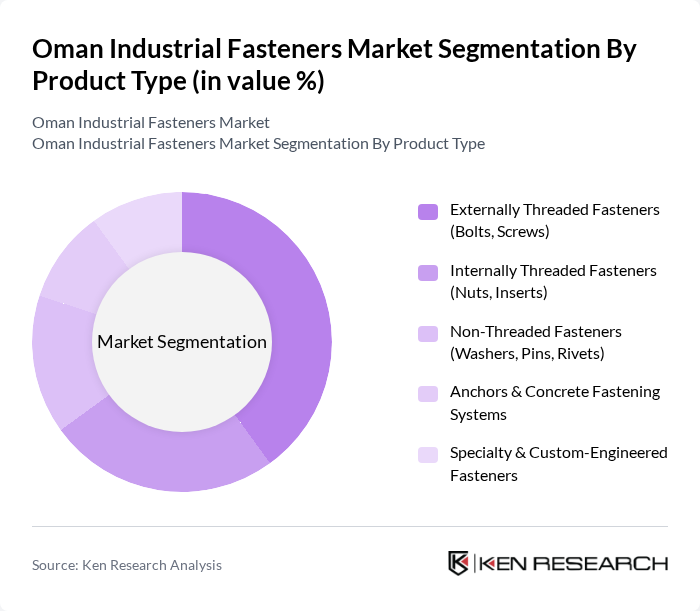

By Product Type:The product type segmentation includes various categories such as externally threaded fasteners, internally threaded fasteners, non-threaded fasteners, anchors & concrete fastening systems, and specialty & custom-engineered fasteners. This structure is consistent with regional and global industrial fastener classifications, which group products into externally threaded, internally threaded, and non-threaded categories, along with application-specific anchor systems. Among these, externally threaded fasteners, particularly bolts and screws, dominate the market due to their widespread application in construction, machinery, automotive, and oil & gas installations, mirroring broader Middle East and Africa market patterns where externally threaded fasteners are the largest segment. The increasing construction activities, expansion of industrial facilities, and the need for reliable, high-strength fastening solutions in steel structures, pipelines, and equipment drive the demand for these products.

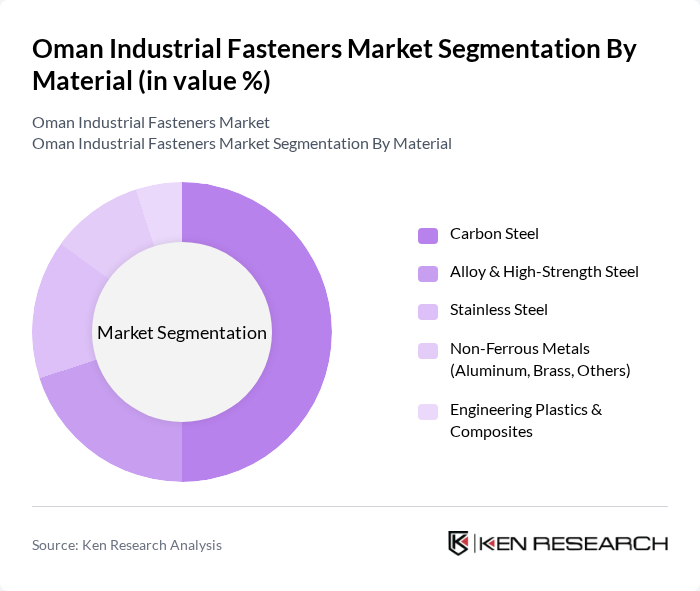

By Material:The material segmentation encompasses carbon steel, alloy & high-strength steel, stainless steel, non-ferrous metals, and engineering plastics & composites. This aligns with regional and global practice, where steel (including carbon and alloy steels) represents the dominant raw material group in industrial fasteners, complemented by stainless steel and non-ferrous alloys. Carbon steel fasteners are the most widely used due to their strength, availability, and cost-effectiveness, making them ideal for a broad range of applications in construction, general engineering, and industrial machinery. The growing trend towards high-strength and corrosion-resistant materials, particularly alloy and stainless steels, is also influencing the market, as industries in Oman’s oil & gas, petrochemical, marine, and infrastructure sectors increasingly specify durable fasteners with improved performance and protective coatings.

The Oman Industrial Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Fasteners LLC, Hilti Oman, Al Arabia Fasteners LLC, Muscat Threaded Fasteners, Al Mahroos Trading & Contracting, Oman International Fasteners Industry, Al Hazm Building Materials & Fasteners, Bahwan Engineering Company (Fasteners Division), Al Muheet Hardware & Fasteners, Al Sahwa Building Materials, Oman Metal Industries & Contracting Co., Al Mansoori Specialized Engineering, Al Jazeera Steel Products Co. SAOG, Assarain Group of Companies (Building Materials & Fasteners), Oman Cables Industry SAOG contribute to innovation, geographic expansion, and service delivery in this space, supported by broader Middle East industrial fastener demand and the presence of regional construction and engineering conglomerates.

The Oman industrial fasteners market is poised for significant growth, driven by increasing construction activities and a robust oil and gas sector. As the government continues to invest in infrastructure, the demand for high-quality fasteners will rise. Additionally, technological advancements in manufacturing processes will enhance production efficiency. However, challenges such as fluctuating raw material prices and competition from international players will require local manufacturers to adapt and innovate to maintain market share and profitability.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Externally Threaded Fasteners (Bolts, Screws) Internally Threaded Fasteners (Nuts, Inserts) Non-Threaded Fasteners (Washers, Pins, Rivets) Anchors & Concrete Fastening Systems Specialty & Custom-Engineered Fasteners |

| By Material | Carbon Steel Alloy & High-Strength Steel Stainless Steel Non-Ferrous Metals (Aluminum, Brass, Others) Engineering Plastics & Composites |

| By End-Use Industry | Building & Construction Oil & Gas and Petrochemicals Power & Renewable Energy Industrial Machinery & OEM Manufacturing Automotive & Transportation Marine & Ports Electrical & HVAC Installations Others |

| By Performance / Specification Class | Standard-Duty Commercial Fasteners High-Strength Structural Fasteners Corrosion-Resistant / Coastal-Grade Fasteners High-Temperature & Critical-Service Fasteners |

| By Coating & Surface Treatment | Zinc-Plated & Electro-Galvanized Hot-Dip Galvanized Mechanical Galvanizing Organic / Epoxy / PTFE Coated Others |

| By Sales Channel | Direct Sales to Projects & OEMs Industrial Distributors & Traders Construction & Hardware Retail Online & E-Procurement Platforms Others |

| By Region | Muscat Sohar Salalah Duqm Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Fasteners | 120 | Project Managers, Procurement Officers |

| Automotive Fasteners | 90 | Supply Chain Managers, Quality Control Engineers |

| Industrial Fasteners for Manufacturing | 80 | Operations Managers, Production Supervisors |

| Fasteners in Electronics | 60 | Product Development Engineers, R&D Managers |

| Fasteners for Oil & Gas Sector | 50 | Maintenance Managers, Safety Officers |

The Oman Industrial Fasteners Market is valued at approximately USD 220 million, reflecting a robust growth trajectory driven by increasing demand from key sectors such as construction and oil & gas, which are vital to the Omani economy.