Region:Asia

Author(s):Geetanshi

Product Code:KRAA4025

Pages:86

Published On:January 2026

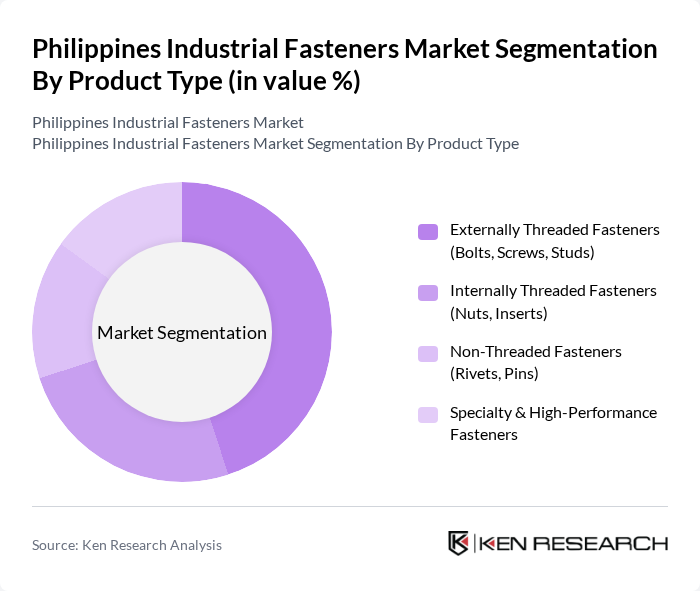

By Product Type:The product type segmentation includes various categories of fasteners that cater to different industrial needs. The primary subsegments are Externally Threaded Fasteners (Bolts, Screws, Studs), Internally Threaded Fasteners (Nuts, Inserts), Non-Threaded Fasteners (Rivets, Pins), and Specialty & High-Performance Fasteners. Among these, Externally Threaded Fasteners dominate the market due to their widespread application in building and civil construction, automotive and commercial vehicles, general engineering, and industrial equipment, where they are essential for structural integrity, assembly processes, and maintenance activities.

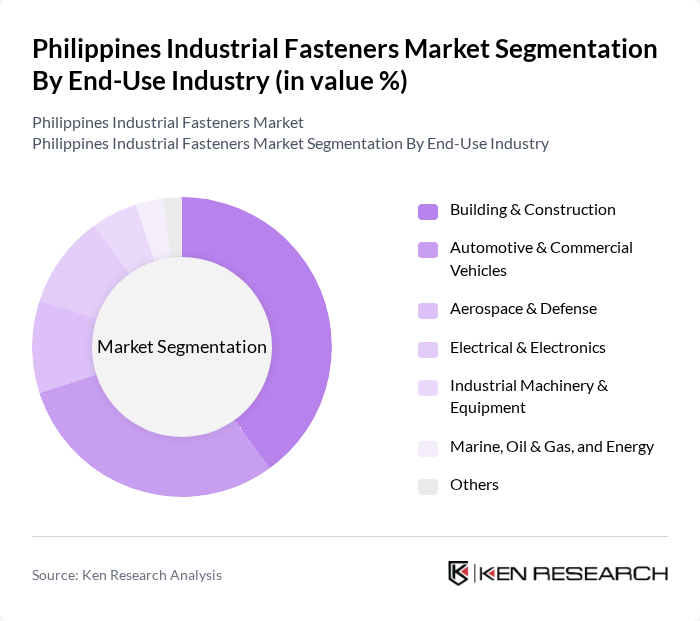

By End-Use Industry:The end-use industry segmentation encompasses various sectors that utilize fasteners in their operations. The primary subsegments include Building & Construction, Automotive & Commercial Vehicles, Aerospace & Defense, Electrical & Electronics, Industrial Machinery & Equipment, Marine, Oil & Gas, and Energy, and Others. The Building & Construction sector leads the market, driven by ongoing infrastructure programs, transport projects, industrial parks, and residential and commercial developments, which require a vast array of fasteners for steel structures, concrete anchoring, roofing, facades, and interior works. Automotive and transportation equipment manufacturing, electrical and electronics assembly, and industrial machinery fabrication are also significant fastener consumers, supported by rising investments in manufacturing and logistics capacity.

The Philippines Industrial Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fastenal Philippines, Hilti (Philippines) Inc., Würth Philippines, Rivit Fasteners Philippines, Stanley Black & Decker (Philippines), HBS Bolts & Nuts Inc., JEA Steel Industries, Inc., Unifix Philippines Inc., Allfasten Hardware & Industrial Supply, Philsteel Group (Industrial Fastening Solutions), YKK Philippines Inc. (Industrial Fastening Systems), Bossard Group (Philippines Operations), SFC (Sundram Fasteners Company) – Regional Presence, Local OEM-focused Fastener Manufacturers, Emerging E-commerce and Distributor-led Fastener Players contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines industrial fasteners market is poised for significant growth, driven by ongoing infrastructure projects and rising manufacturing activities. As the government continues to invest in construction and the automotive sector expands, demand for fasteners will likely increase. Additionally, the adoption of advanced manufacturing technologies and a focus on sustainability will shape the market landscape. Companies that adapt to these trends and invest in innovation will be well-positioned to capitalize on emerging opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Externally Threaded Fasteners (Bolts, Screws, Studs) Internally Threaded Fasteners (Nuts, Inserts) Non?Threaded Fasteners (Rivets, Pins) Specialty & High?Performance Fasteners |

| By End-Use Industry | Building & Construction Automotive & Commercial Vehicles Aerospace & Defense Electrical & Electronics Industrial Machinery & Equipment Marine, Oil & Gas, and Energy Others |

| By Material | Carbon Steel Alloy Steel Stainless Steel Non?Ferrous Metals (Aluminum, Brass, Copper, Titanium) Engineered Plastics & Composites |

| By Coating / Finish | Zinc-Plated Hot-Dip Galvanized Black Oxide & Phosphate Specialty Corrosion-Resistant & Decorative Coatings |

| By Sales / Distribution Channel | Direct to OEMs Industrial Distributors & Traders Retail & Hardware Channels E-commerce & Digital Platforms |

| By Application | Structural & Civil Applications Assembly & Fabrication Maintenance, Repair & Operations (MRO) Electrical, HVAC & Plumbing Systems Others |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Fasteners | 120 | Project Managers, Procurement Officers |

| Automotive Fasteners | 90 | Supply Chain Managers, Quality Control Engineers |

| Industrial Fasteners for Manufacturing | 80 | Operations Managers, Production Supervisors |

| Fasteners in Electronics | 70 | Product Development Engineers, R&D Managers |

| Retail Fasteners | 60 | Store Managers, Inventory Control Specialists |

The Philippines Industrial Fasteners Market is valued at approximately USD 190 million, driven by growth in the construction sector, automotive production, and demand for industrial machinery and electronics assembly.