Region:Middle East

Author(s):Shubham

Product Code:KRAD5434

Pages:84

Published On:December 2025

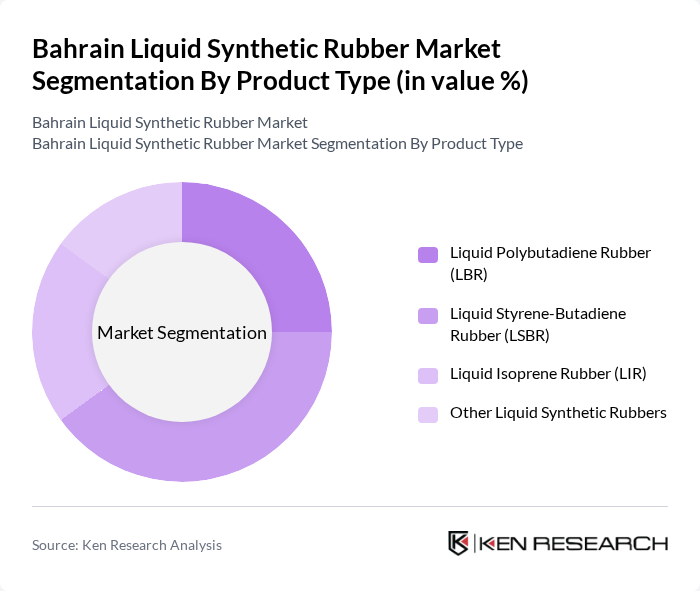

By Product Type:The product type segmentation includes Liquid Polybutadiene Rubber (LBR), Liquid Styrene-Butadiene Rubber (LSBR), Liquid Isoprene Rubber (LIR), and Other Liquid Synthetic Rubbers. Among these, Liquid Styrene-Butadiene Rubber (LSBR) is the leading subsegment due to its extensive use in tire manufacturing and other applications requiring high durability and performance. The increasing demand for high-performance tires in the automotive sector significantly drives the LSBR market, making it a preferred choice for manufacturers.

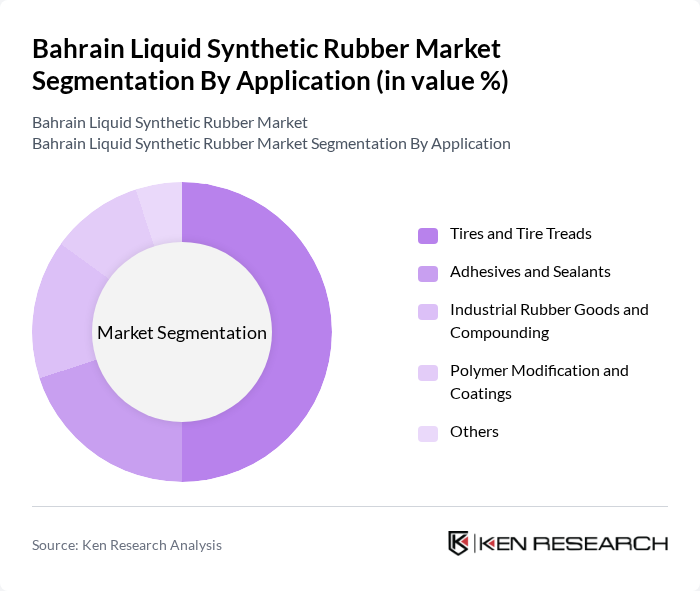

By Application:The application segmentation includes Tires and Tire Treads, Adhesives and Sealants, Industrial Rubber Goods and Compounding, Polymer Modification and Coatings, and Others. The Tires and Tire Treads application dominates the market due to the increasing production of vehicles and the growing demand for high-performance tires. The automotive industry's shift towards more durable and efficient tire materials is a significant factor contributing to the growth of this segment.

The Bahrain Liquid Synthetic Rubber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Oil Company (Saudi Aramco) – via Aramco Performance Materials, Saudi Basic Industries Corporation (SABIC), Saudi Kayan Petrochemical Company, Petro Rabigh, Qatar Petrochemical Company (QAPCO), Kumho Petrochemical Co., Ltd., JSR Corporation, Synthos S.A., Lanxess AG, Zeon Corporation, Bahrain Petroleum Company (Bapco Energies), Gulf Petrochemical Industries Company (GPIC), BASF Middle East, Borouge, Local and Regional Rubber Compounders / Distributors (Bahrain and GCC) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain liquid synthetic rubber market is poised for growth, driven by increasing demand from key sectors such as automotive and construction. As technological advancements continue to enhance production efficiency, manufacturers are likely to focus on developing sustainable products. Additionally, the government's commitment to infrastructure development will further stimulate market activity. However, companies must navigate challenges related to raw material price volatility and regulatory compliance to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Liquid Polybutadiene Rubber (LBR) Liquid Styrene-Butadiene Rubber (LSBR) Liquid Isoprene Rubber (LIR) Other Liquid Synthetic Rubbers |

| By Application | Tires and Tire Treads Adhesives and Sealants Industrial Rubber Goods and Compounding Polymer Modification and Coatings Others |

| By End-Use Industry | Automotive and Transportation Construction and Infrastructure Industrial Manufacturing Footwear and Consumer Goods Others |

| By Distribution Channel | Direct Sales (B2B / Contract Supply) Traders and Distributors Online / E?procurement Platforms Others |

| By Region | Capital Governorate (Manama) Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Production / Sourcing Process | Import from Global Producers Toll / Contract Manufacturing in GCC Local Blending and Formulation Others |

| By Price Band (CIF Bahrain) | Below USD 2,000 per Ton USD 2,000–3,000 per Ton Above USD 3,000 per Ton Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Managers, R&D Engineers |

| Construction Sector Usage | 80 | Project Managers, Procurement Specialists |

| Consumer Goods Manufacturing | 70 | Operations Managers, Quality Assurance Leads |

| Industrial Applications | 60 | Supply Chain Managers, Technical Directors |

| Research & Development Insights | 50 | Innovation Managers, Laboratory Technicians |

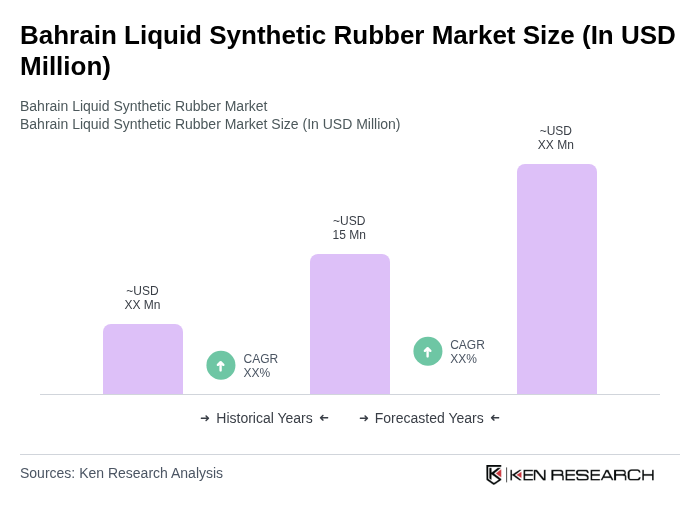

The Bahrain Liquid Synthetic Rubber Market is valued at approximately USD 15 million, reflecting a steady growth driven by increasing demand in automotive and construction applications, as well as advancements in production technologies.