Region:Middle East

Author(s):Rebecca

Product Code:KRAC1920

Pages:90

Published On:October 2025

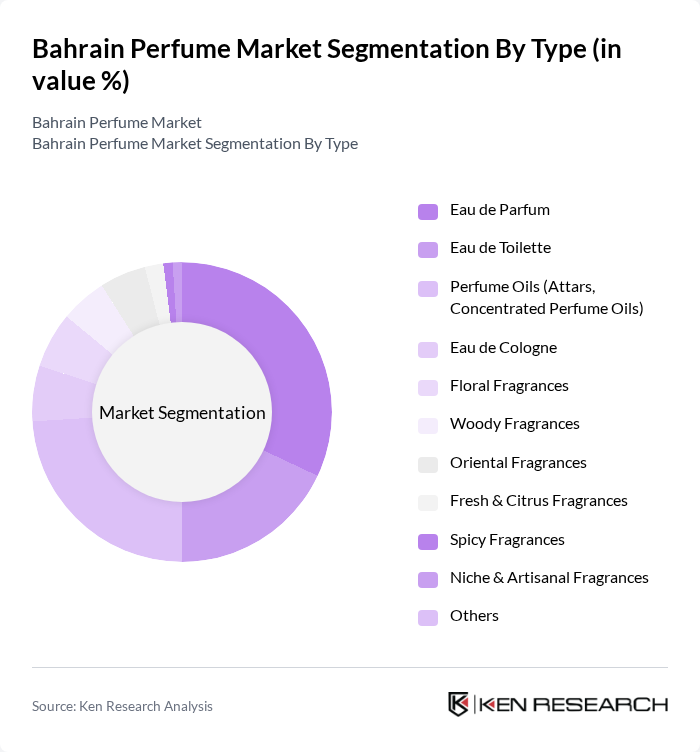

By Type:The market is segmented into various types of fragrances, including Eau de Parfum, Eau de Toilette, Perfume Oils (Attars, Concentrated Perfume Oils), Eau de Cologne, Floral Fragrances, Woody Fragrances, Oriental Fragrances, Fresh & Citrus Fragrances, Spicy Fragrances, Niche & Artisanal Fragrances, and Others. Among these, Eau de Parfum and Perfume Oils are particularly popular due to their long-lasting scents and cultural significance in the region. The preference for high-quality, concentrated fragrances reflects the consumers' inclination towards luxury and personalized experiences.

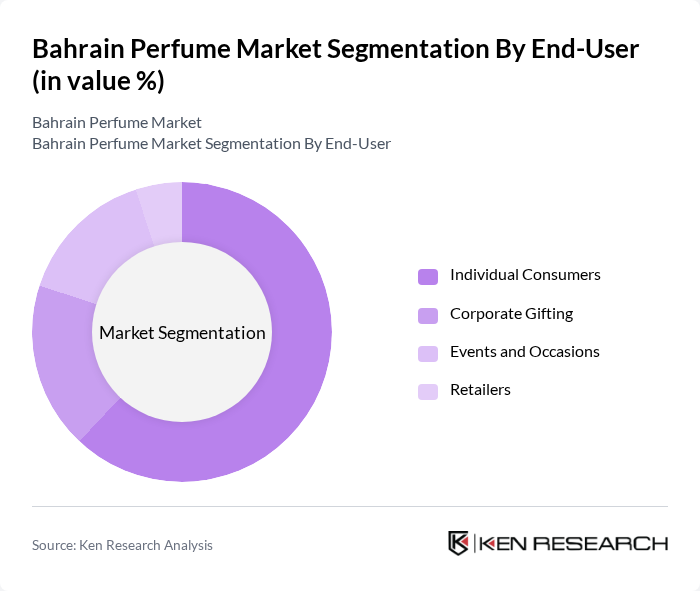

By End-User:The end-user segmentation includes Individual Consumers, Corporate Gifting, Events and Occasions, and Retailers. Individual Consumers dominate the market, driven by a growing trend of personal grooming and the desire for unique fragrances. Corporate gifting is also significant, particularly during festive seasons and special events, as businesses seek to enhance relationships with clients and employees through personalized gifts.

The Bahrain Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Ajmal Perfumes, Swiss Arabian Perfumes, Abdul Samad Al Qurashi, Rasasi Perfumes, Arabian Oud, Al Rehab Perfumes, Nabeel Perfumes, Afnan Perfumes, Junaid Perfumes, The Fragrance Kitchen, Maison Francis Kurkdjian, Dior, Chanel, Gucci, Versace, Tom Ford contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain perfume market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and eco-friendly products is expected to shape the market landscape, with consumers favoring brands that prioritize environmental responsibility. Additionally, the rise of experiential retail environments will enhance customer engagement, allowing brands to create memorable shopping experiences. As tourism continues to grow, the fragrance sector will likely benefit from increased foot traffic and demand for unique local offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Eau de Parfum Eau de Toilette Perfume Oils (Attars, Concentrated Perfume Oils) Eau de Cologne Floral Fragrances Woody Fragrances Oriental Fragrances Fresh & Citrus Fragrances Spicy Fragrances Niche & Artisanal Fragrances Others |

| By End-User | Individual Consumers Corporate Gifting Events and Occasions Retailers |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Duty-Free Shops |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Glass Bottles Plastic Bottles Refillable Options |

| By Brand Positioning | Luxury Brands Designer Brands Niche Brands |

| By Distribution Mode | Direct Sales Indirect Sales Franchise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Perfume | 120 | Fragrance Buyers, Luxury Goods Consumers |

| Retail Insights on Perfume Sales | 60 | Store Managers, Sales Representatives |

| Distribution Channel Effectiveness | 50 | Distributors, E-commerce Managers |

| Brand Loyalty and Awareness | 80 | Brand Managers, Marketing Executives |

| Trends in Niche Perfume Markets | 40 | Perfume Artisans, Niche Brand Owners |

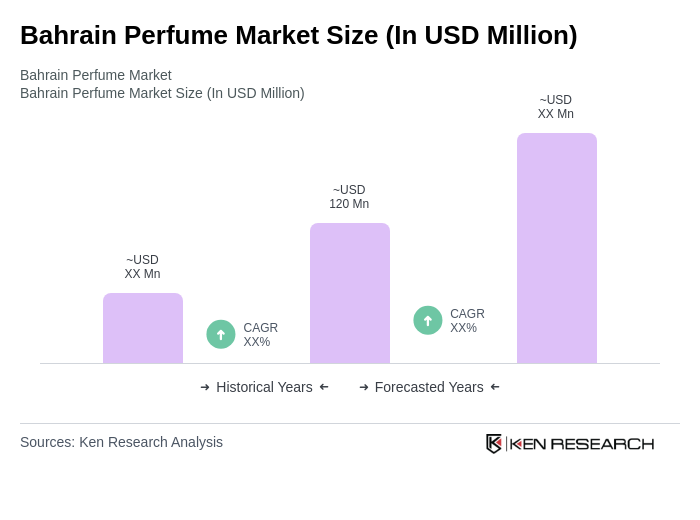

The Bahrain perfume market is valued at approximately USD 120 million, reflecting a growing demand for luxury and niche fragrances, as well as an increasing trend in personal grooming and self-care among consumers.