Region:Middle East

Author(s):Rebecca

Product Code:KRAC1918

Pages:95

Published On:October 2025

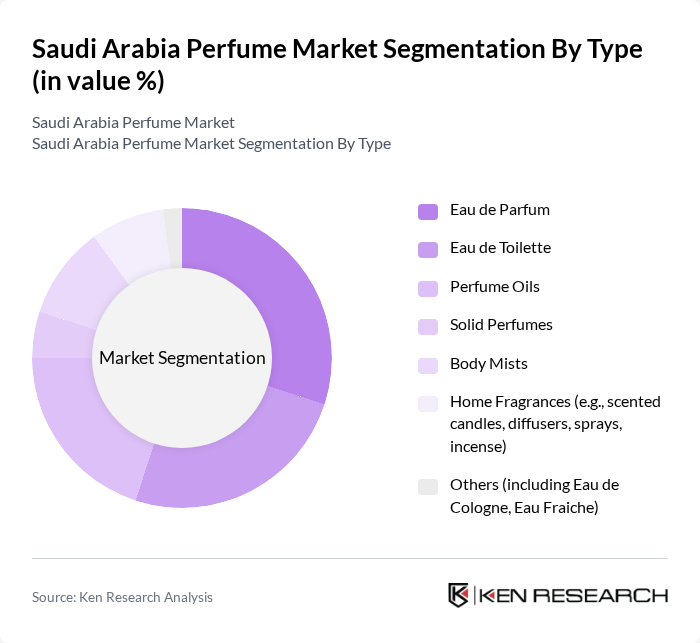

By Type:The market is segmented into various types of perfumes, including Eau de Parfum, Eau de Toilette, Perfume Oils, Solid Perfumes, Body Mists, Home Fragrances, and Others. Each type caters to different consumer preferences and occasions, with Eau de Parfum and Eau de Toilette favored for daily and formal use, Perfume Oils reflecting traditional tastes, and Home Fragrances gaining popularity for personal and gifting purposes. The rise of niche and unisex offerings is also notable, reflecting evolving consumer sophistication .

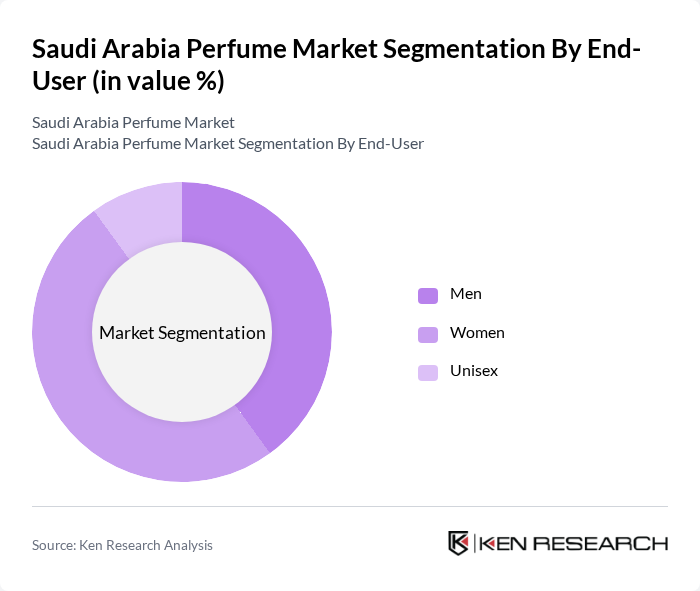

By End-User:The end-user segmentation includes Men, Women, and Unisex categories. Each segment reflects distinct preferences and purchasing behaviors, with women’s fragrances leading the market share, followed by men’s and a growing unisex segment. Marketing strategies are increasingly tailored to appeal to these demographics, with unisex and niche fragrances gaining popularity among younger consumers .

The Saudi Arabia Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abdul Samad Al Qurashi, Arabian Oud, Ajmal Perfumes, Rasasi Perfumes, Swiss Arabian Perfumes Group, Al Haramain Perfumes, Al Rehab Perfumes, Nabeel Perfumes, Afnan Perfumes, Anfasic Dokhoon, Oudh Al Anfar, The Fragrance Kitchen, Ahmed Al Maghribi Perfumes, Rashat, and Maison Alhambra contribute to innovation, geographic expansion, and service delivery in this space. These companies leverage heritage, product diversification, and digital strategies to strengthen their presence in both traditional and modern retail channels .

The Saudi Arabian perfume market is poised for dynamic growth, driven by evolving consumer preferences and increasing disposable incomes. The trend towards personalization in fragrances is expected to gain momentum, with brands offering bespoke options to cater to individual tastes. Additionally, the rise of eco-conscious consumers will likely push brands to adopt sustainable practices, including eco-friendly packaging and sourcing. These trends will shape the market landscape, fostering innovation and enhancing consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Eau de Parfum Eau de Toilette Perfume Oils Solid Perfumes Body Mists Home Fragrances (e.g., scented candles, diffusers, sprays, incense) Others (including Eau de Cologne, Eau Fraiche) |

| By End-User | Men Women Unisex |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Duty-Free Shops Supermarkets/Hypermarkets Convenience Stores Others |

| By Price Range | Premium Mid-range Economy |

| By Occasion | Daily Wear Special Occasions Gifting |

| By Fragrance Family | Floral Woody Oriental Fresh Fruity Gourmand |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Fragrance | 120 | General Consumers, Fragrance Enthusiasts |

| Retail Insights from Perfume Stores | 80 | Store Managers, Sales Associates |

| Distribution Channel Effectiveness | 60 | Distributors, Wholesalers |

| Brand Loyalty and Marketing Impact | 100 | Marketing Managers, Brand Strategists |

| Trends in E-commerce Perfume Sales | 70 | E-commerce Managers, Digital Marketing Specialists |

The Saudi Arabia perfume market is valued at approximately USD 1.9 billion, driven by increasing demand for luxury fragrances, cultural significance, and rising consumer spending on personal grooming and luxury items.