Region:Middle East

Author(s):Rebecca

Product Code:KRAC1921

Pages:99

Published On:October 2025

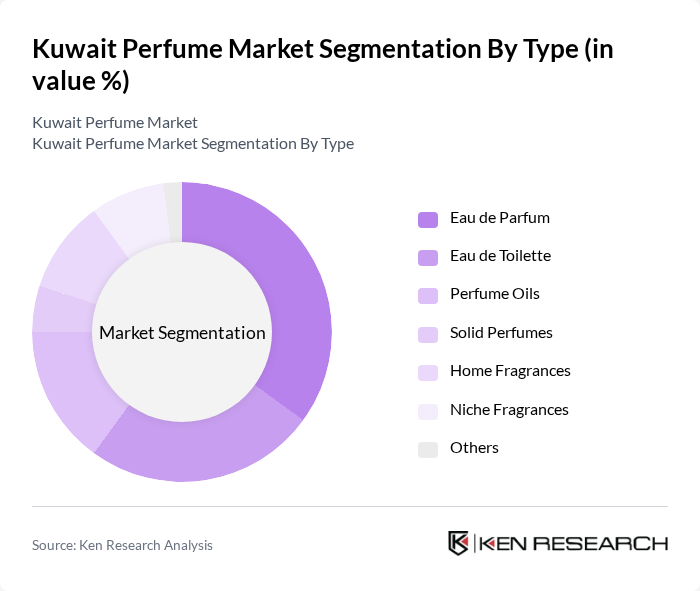

By Type:The market is segmented into various types of perfumes, including Eau de Parfum, Eau de Toilette, Perfume Oils, Solid Perfumes, Home Fragrances, Niche Fragrances, and Others. Among these, Eau de Parfum is the leading segment due to its higher concentration of fragrance oils, which appeals to consumers seeking long-lasting scents. The trend towards personalization and unique fragrance experiences has also bolstered the popularity of niche fragrances, catering to a discerning clientele. Premium products represent the largest share, driven by a strong cultural affinity for luxury, high disposable incomes, and the influence of digital platforms .

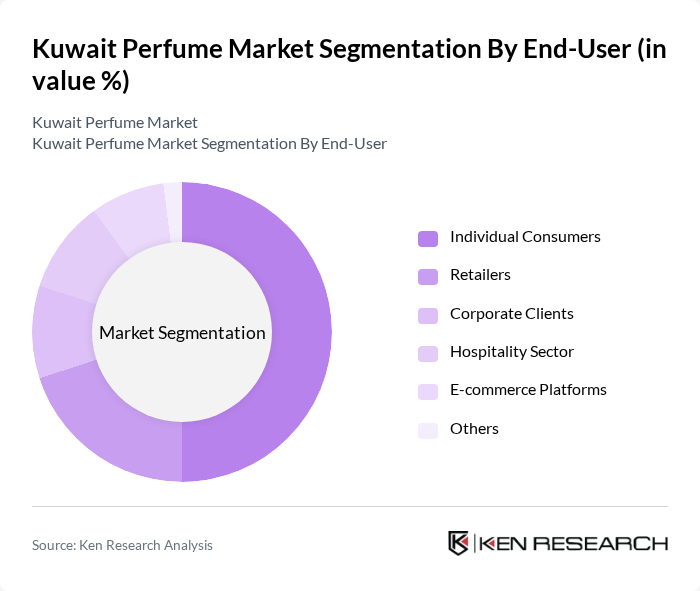

By End-User:The end-user segmentation includes Individual Consumers, Retailers, Corporate Clients, Hospitality Sector, E-commerce Platforms, and Others. Individual Consumers dominate the market, driven by a growing interest in personal grooming and the desire for unique fragrances. The rise of e-commerce platforms has also facilitated access to a wider range of products, further enhancing consumer choice and convenience. The hospitality sector and corporate gifting are also emerging as notable end-user segments, reflecting the broader use of fragrances in business and leisure environments .

The Kuwait Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Ajmal Perfumes, Swiss Arabian Perfumes, Abdul Samad Al Qurashi, Rasasi Perfumes, Al Rehab Perfumes, Arabian Oud, Afnan Perfumes, Nabeel Perfumes, The Fragrance Kitchen, Maison Alhambra, Amouage, Bvlgari, Dior, Chanel, Tom Ford, Creed contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait perfume market is poised for significant growth, driven by evolving consumer preferences and increasing disposable incomes. The trend towards online shopping is expected to continue, with more brands investing in digital platforms to reach consumers. Additionally, the rising interest in sustainable and eco-friendly products will likely shape the market, as consumers become more conscious of their purchasing decisions. This evolving landscape presents opportunities for innovation and differentiation among local and international brands.

| Segment | Sub-Segments |

|---|---|

| By Type | Eau de Parfum Eau de Toilette Perfume Oils Solid Perfumes Home Fragrances Niche Fragrances Others |

| By End-User | Individual Consumers Retailers Corporate Clients Hospitality Sector E-commerce Platforms Others |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Duty-Free Shops Supermarkets/Hypermarkets Others |

| By Price Range | Premium Mid-Range Economy Luxury Others |

| By Fragrance Family | Floral Woody Oriental Fresh Others |

| By Packaging Type | Glass Bottles Plastic Bottles Metal Containers Eco-Friendly Packaging Others |

| By Brand Ownership | Local Brands International Brands Private Labels Others |

| By Premium and Mass Products | Premium Products Mass Products |

| By Gender | Male Female Unisex |

| By Perfume Type | Arabic French Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Perfume Retailers | 60 | Store Managers, Brand Representatives |

| Mass Market Fragrance Consumers | 120 | General Consumers, Online Shoppers |

| Fragrance Industry Experts | 40 | Market Analysts, Brand Strategists |

| Perfume Manufacturers | 50 | Production Managers, R&D Specialists |

| Fragrance Enthusiasts | 45 | Bloggers, Influencers, Collectors |

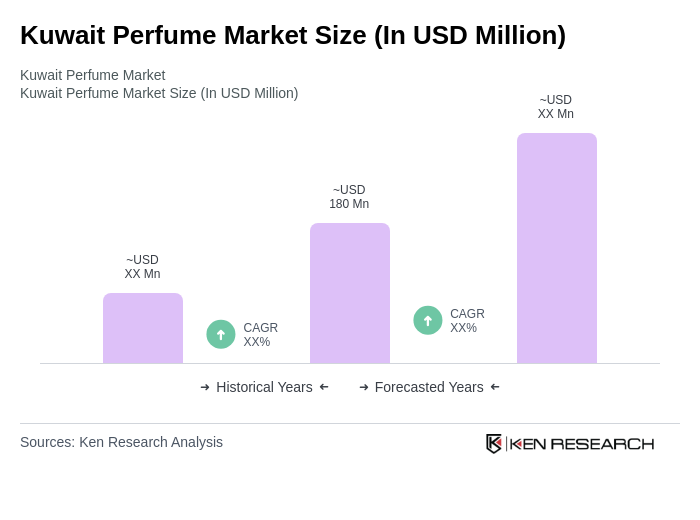

The Kuwait perfume market is valued at approximately USD 180 million, reflecting a growing demand for luxury and niche fragrances, personal grooming, and cultural significance associated with gifting perfumes in the region.