GCC Perfume Market Overview

- The GCC Perfume Market is valued at USD 3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for luxury and niche fragrances, rising consumer preference for personal grooming, and self-expression through scents. The market benefits from the region's deep cultural affinity for perfumes, which are integral to tradition and social practices. High disposable incomes, robust tourism, and the expansion of online retail channels further accelerate market growth. Premium customization, sustainable ingredients, and AI-driven product innovation are emerging as key trends enhancing consumer engagement and market expansion .

- Key players in this market include Saudi Arabia, the United Arab Emirates, and Kuwait. These countries dominate the market due to their affluent consumer base, high disposable incomes, and a strong cultural inclination towards fragrance products. The UAE, particularly Dubai, serves as a global hub for luxury goods, further enhancing its market position. Saudi Arabia currently holds the largest market share, supported by both traditional attars and modern fragrance blends .

- In 2023, the Saudi Arabian government implemented regulations to promote the local perfume industry, mandating that a certain percentage of ingredients used in perfumes must be sourced from local suppliers. This initiative is governed by the “Executive Regulations for the Control of Perfume Products, 2023” issued by the Saudi Food and Drug Authority (SFDA). The regulation requires perfume manufacturers to ensure at least 30% of raw materials are procured from certified local suppliers, with compliance monitored through periodic audits and licensing renewals. This policy aims to boost domestic production, create jobs, and reduce reliance on imported fragrances, thereby enhancing the overall sustainability of the market .

GCC Perfume Market Segmentation

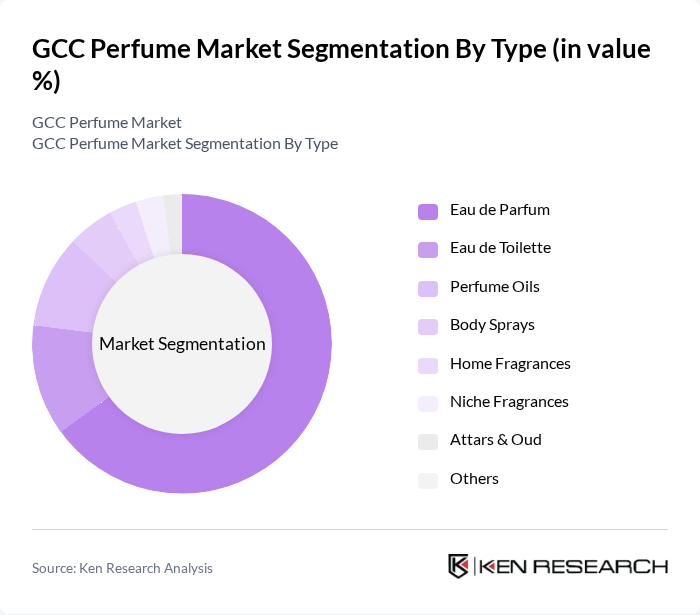

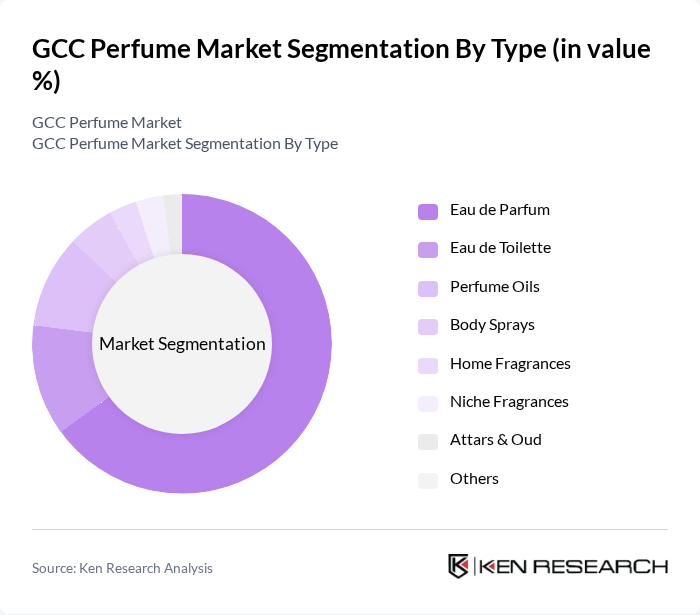

By Type:The market is segmented into various types of fragrances, including Eau de Parfum, Eau de Toilette, Perfume Oils, Body Sprays, Home Fragrances, Niche Fragrances, Attars & Oud, and Others. Among these, Eau de Parfum is the most popular, accounting for the largest share due to its long-lasting scent and cultural significance in the region. Perfume Oils and Attars & Oud also hold substantial importance, reflecting traditional preferences. The demand for niche fragrances is rising as consumers seek unique and personalized scent experiences, driven by luxury positioning and influencer collaborations. Sustainable and halal-certified fragrances are gaining traction, especially among younger consumers .

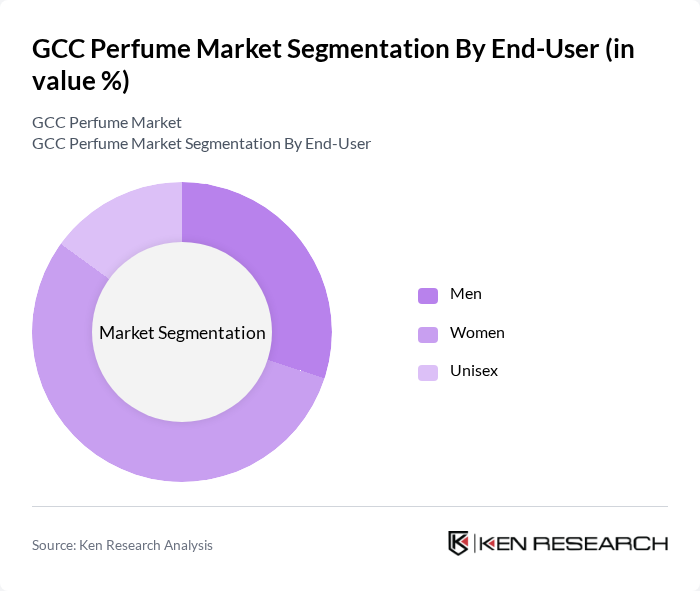

By End-User:The market is categorized based on end-users, including Men, Women, and Unisex. The women's segment holds the largest share, driven by a wide variety of fragrance options and targeted marketing strategies. The men's segment is growing rapidly as personal grooming and fragrance adoption increase among male consumers. Unisex fragrances are gaining popularity, reflecting modern preferences for versatile and gender-neutral scents .

GCC Perfume Market Competitive Landscape

The GCC Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Ajmal Perfumes, Swiss Arabian Perfumes, Abdul Samad Al Qurashi, Rasasi Perfumes, Arabian Oud, Afnan Perfumes, Nabeel Perfumes, Al-Rehab Perfumes, Asgharali Perfumes, Yas Perfumes, The Body Shop, Dior, Chanel, Gucci, Versace, LVMH (Louis Vuitton Moët Hennessy), Kering contribute to innovation, geographic expansion, and service delivery in this space.

GCC Perfume Market Industry Analysis

Growth Drivers

- Increasing Demand for Luxury Fragrances:The GCC region has witnessed a significant rise in the demand for luxury fragrances, with the market valued at approximatelyUSD 1.5 billionin future. This growth is driven by a burgeoning affluent population, with over1.5 million high-net-worth individualsin the UAE alone. The luxury segment is projected to account for60 percentof total fragrance sales, reflecting a cultural affinity for premium products and gifting traditions during festivals and celebrations.

- Rising Disposable Income:The GCC countries have experienced a steady increase in disposable income, with an average growth rate of4.5 percent annually. In future, the average disposable income per capita is expected to reachUSD 30,000, enabling consumers to spend more on luxury and personal care products. This economic uplift is particularly evident in Saudi Arabia and the UAE, where consumer spending on fragrances has surged, contributing to a robust market environment for premium brands.

- Cultural Significance of Perfumes in GCC:Perfumes hold a deep cultural significance in the GCC, where fragrance is integral to social identity and hospitality. The market for traditional Arabic perfumes, such as oud and bakhoor, is estimated atUSD 800 millionin future. This cultural affinity drives consistent demand, with consumers purchasing fragrances for personal use and as gifts, particularly during religious and cultural events, ensuring sustained market growth.

Market Challenges

- Intense Competition:The GCC perfume market is characterized by intense competition, with over200 brandsvying for market share. Major international players, such as Chanel and Dior, compete alongside local brands, creating a saturated environment. This competition has led to aggressive pricing strategies, impacting profit margins. In future, the average profit margin for fragrance brands in the region was reported at15 percent, down from 20 percent in previous years, highlighting the challenges faced by companies.

- Regulatory Compliance Issues:The GCC perfume market faces stringent regulatory compliance challenges, particularly concerning the importation of fragrance ingredients. In future, over30 percentof imported fragrance materials were delayed due to compliance issues with local regulations. Brands must navigate complex labeling requirements and safety standards, which can lead to increased operational costs and delays in product launches, ultimately affecting market competitiveness.

GCC Perfume Market Future Outlook

The GCC perfume market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing popularity of personalized fragrances and the rise of e-commerce platforms are expected to reshape the retail landscape. Additionally, brands are likely to invest in sustainable practices, aligning with global trends towards eco-friendly products. As the market adapts to these changes, opportunities for innovation and differentiation will emerge, fostering a dynamic environment for both established and new entrants.

Market Opportunities

- Growth of E-commerce Platforms:The rise of e-commerce platforms presents a significant opportunity for fragrance brands in the GCC. Online sales of perfumes are projected to reachUSD 500 millionin future, driven by increased internet penetration and consumer preference for convenience. Brands can leverage digital marketing strategies to enhance visibility and reach a broader audience, capitalizing on the growing trend of online shopping.

- Increasing Interest in Niche Fragrances:There is a growing consumer interest in niche fragrances, with sales expected to increase by20 percent annually. This trend is fueled by a desire for unique and personalized scents, allowing brands to differentiate themselves in a crowded market. By focusing on artisanal and bespoke offerings, companies can tap into this lucrative segment, appealing to discerning consumers seeking exclusivity.