Region:Middle East

Author(s):Rebecca

Product Code:KRAC1917

Pages:97

Published On:October 2025

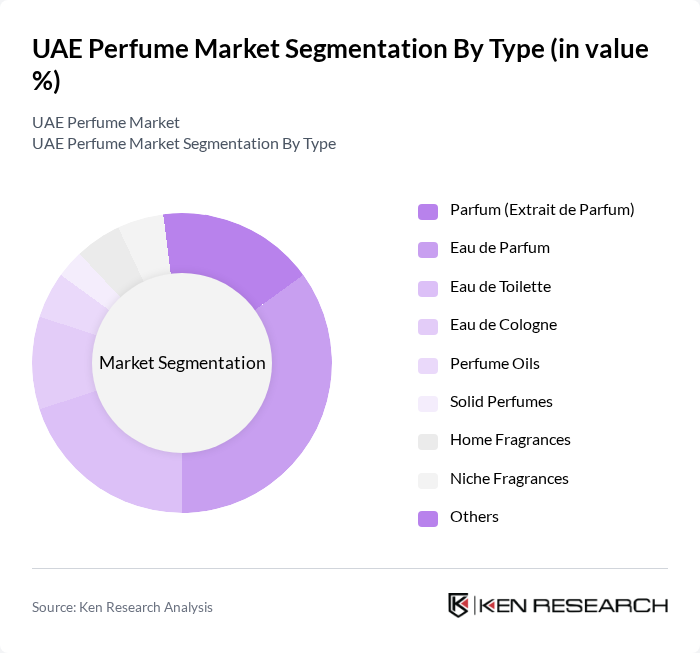

By Type:The market is segmented into various types of perfumes, including Parfum (Extrait de Parfum), Eau de Parfum, Eau de Toilette, Eau de Cologne, Perfume Oils, Solid Perfumes, Home Fragrances, Niche Fragrances, and Others. Among these, Eau de Parfum is the most popular choice among consumers due to its balance of longevity and affordability, making it suitable for daily wear and special occasions.

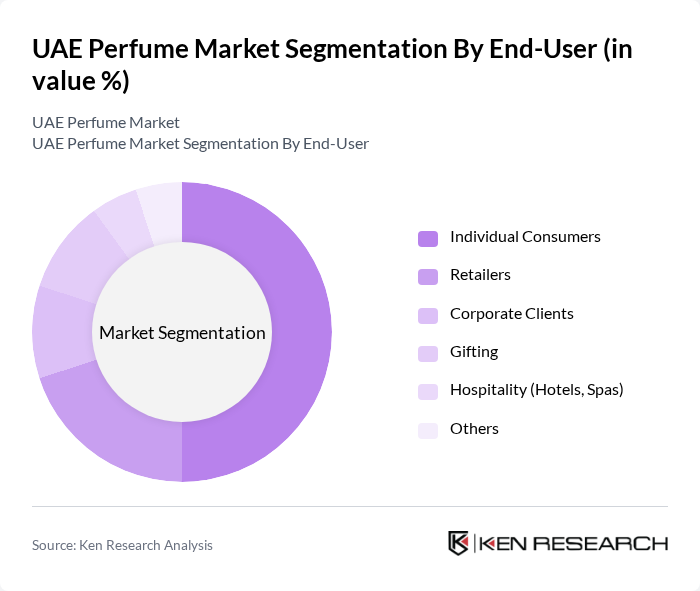

By End-User:The end-user segmentation includes Individual Consumers, Retailers, Corporate Clients, Gifting, Hospitality (Hotels, Spas), and Others. Individual Consumers dominate the market, driven by personal preferences and the cultural significance of perfumes in the UAE. The trend of gifting perfumes during special occasions also contributes significantly to market growth.

The UAE Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Ajmal Perfumes, Swiss Arabian Perfumes, Rasasi Perfumes, Abdul Samad Al Qurashi, Arabian Oud, Nabeel Perfumes, Al Rehab Perfumes, Afnan Perfumes, The Body Shop, Dior, Chanel, Gucci, Versace, Tom Ford, Maison Francis Kurkdjian, Penhaligon's, Amouage, Lattafa Perfumes, Khaltat Blends of Love contribute to innovation, geographic expansion, and service delivery in this space.

The UAE perfume market is poised for continued growth, driven by evolving consumer preferences and a strong cultural affinity for fragrances. As disposable incomes rise, consumers are increasingly seeking personalized and unique scent experiences. The expansion of e-commerce platforms will further facilitate access to a diverse range of products, enhancing market dynamics. Additionally, the influence of social media marketing is expected to shape consumer choices, promoting niche and artisanal brands that resonate with younger demographics, thereby transforming the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Parfum (Extrait de Parfum) Eau de Parfum Eau de Toilette Eau de Cologne Perfume Oils Solid Perfumes Home Fragrances Niche Fragrances Others |

| By End-User | Individual Consumers Retailers Corporate Clients Gifting Hospitality (Hotels, Spas) Others |

| By Distribution Channel | Online Retail (E-commerce, Brand Websites) Department Stores Specialty Perfume Stores Duty-Free Shops Hypermarkets & Supermarkets Others |

| By Price Range | Premium/Luxury Mid-Range Economy/Mass Market Others |

| By Brand Type | Designer Brands Celebrity Brands Local/Arabic Brands Niche/Artisanal Brands Others |

| By Packaging Type | Glass Bottles Plastic Bottles Metal/Aluminum Containers Refillable Packaging Others |

| By Fragrance Family | Floral Woody Oriental (Oud, Amber, Musk) Fresh (Citrus, Aquatic, Green) Gourmand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Perfume Retailers | 50 | Store Managers, Brand Representatives |

| Mass-Market Fragrance Consumers | 120 | General Consumers, Retail Shoppers |

| Niche Perfume Brands | 40 | Founders, Marketing Directors |

| Online Perfume Retailers | 40 | E-commerce Managers, Digital Marketing Specialists |

| Fragrance Industry Experts | 40 | Market Analysts, Industry Consultants |

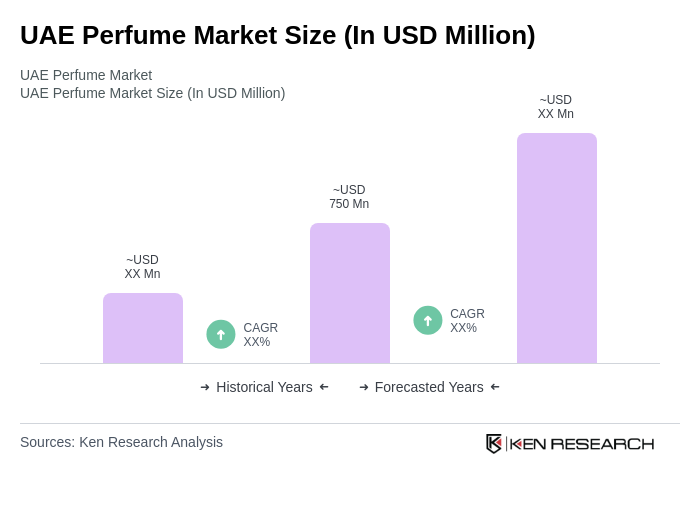

The UAE perfume market is valued at approximately USD 750 million, driven by a strong demand for luxury and niche fragrances, cultural significance, and an increase in disposable income among consumers.