Region:Middle East

Author(s):Dev

Product Code:KRAB7256

Pages:92

Published On:October 2025

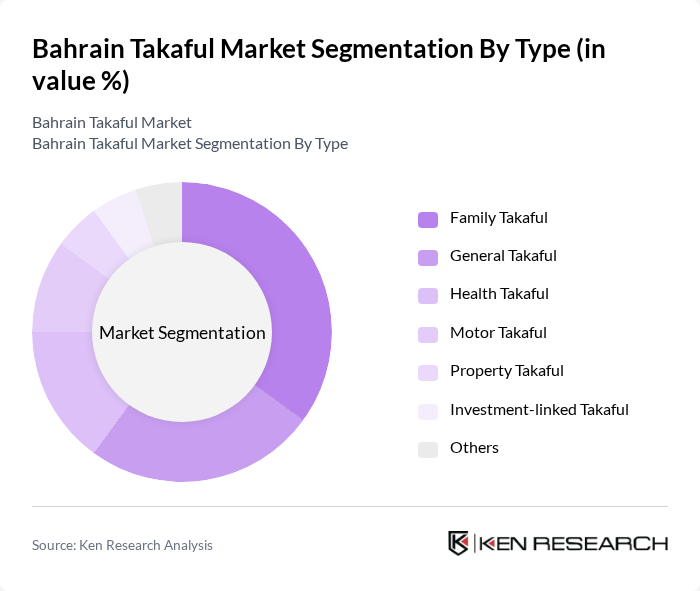

By Type:The Takaful market can be segmented into various types, including Family Takaful, General Takaful, Health Takaful, Motor Takaful, Property Takaful, Investment-linked Takaful, and Others. Among these, Family Takaful has emerged as a leading segment due to the increasing focus on family protection and savings plans. The growing awareness of the importance of life insurance and the rising disposable income among consumers have further fueled the demand for Family Takaful products.

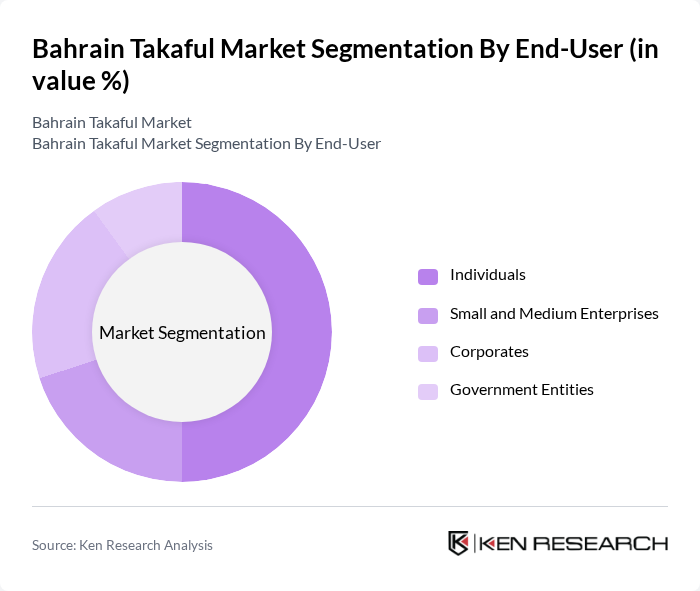

By End-User:The Takaful market is segmented by end-users, including Individuals, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. The Individual segment dominates the market, driven by the increasing awareness of personal financial planning and the need for family protection. The rise in disposable income and changing consumer attitudes towards insurance have led to a significant uptick in the number of individuals seeking Takaful solutions.

The Bahrain Takaful Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Islamic Bank, Takaful International, Al-Ahlia Insurance Company, Solidarity Bahrain, Gulf Takaful, Bahrain National Holding Company, Arab Insurance Group (ARIG), Qatar Islamic Insurance Company, Al Baraka Takaful, Ahlia Insurance Company, Al-Madina Takaful, Emirates Takaful, Noor Takaful, Al-Futtaim Takaful, Takaful Emarat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain Takaful market appears promising, driven by increasing consumer awareness and government support. As the population becomes more educated about Islamic finance, Takaful products are likely to gain traction. Additionally, the integration of technology in service delivery will enhance customer engagement and streamline operations. The market is expected to evolve with innovative product offerings tailored to meet diverse consumer needs, positioning Takaful as a competitive alternative in the insurance landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Family Takaful General Takaful Health Takaful Motor Takaful Property Takaful Investment-linked Takaful Others |

| By End-User | Individuals Small and Medium Enterprises Corporates Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Product Offering | Standard Takaful Plans Customized Takaful Solutions Group Takaful Policies |

| By Customer Demographics | Age Group (Under 30, 30-50, 50+) Income Level (Low, Middle, High) Occupation (Employed, Self-Employed, Retired) |

| By Risk Coverage | Life Coverage Health Coverage Property Coverage Liability Coverage |

| By Policy Duration | Short-term Policies Long-term Policies Renewable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Takaful Policyholders | 150 | Policyholders, Financial Advisors |

| Corporate Takaful Clients | 100 | HR Managers, Finance Directors |

| Takaful Product Distributors | 80 | Insurance Agents, Brokers |

| Regulatory Bodies | 50 | Regulators, Compliance Officers |

| Industry Experts and Analysts | 30 | Market Analysts, Academic Researchers |

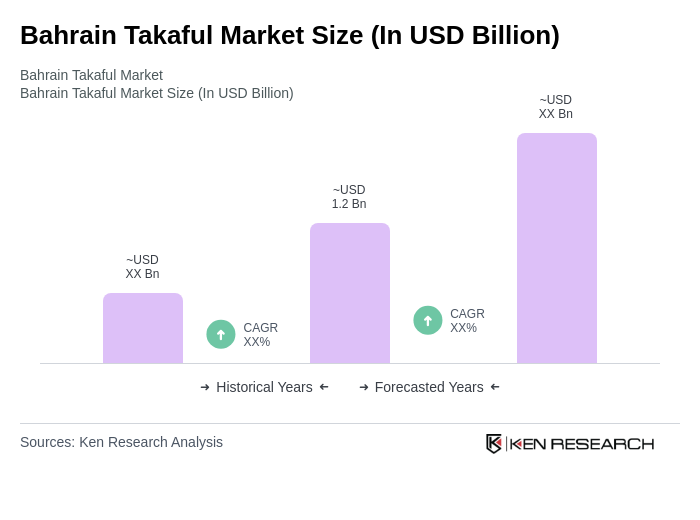

The Bahrain Takaful Market is valued at approximately USD 1.2 billion, reflecting a steady growth driven by increased consumer awareness of Sharia-compliant financial products and a rising demand for risk management solutions among individuals and businesses.