Region:Asia

Author(s):Dev

Product Code:KRAC0488

Pages:84

Published On:August 2025

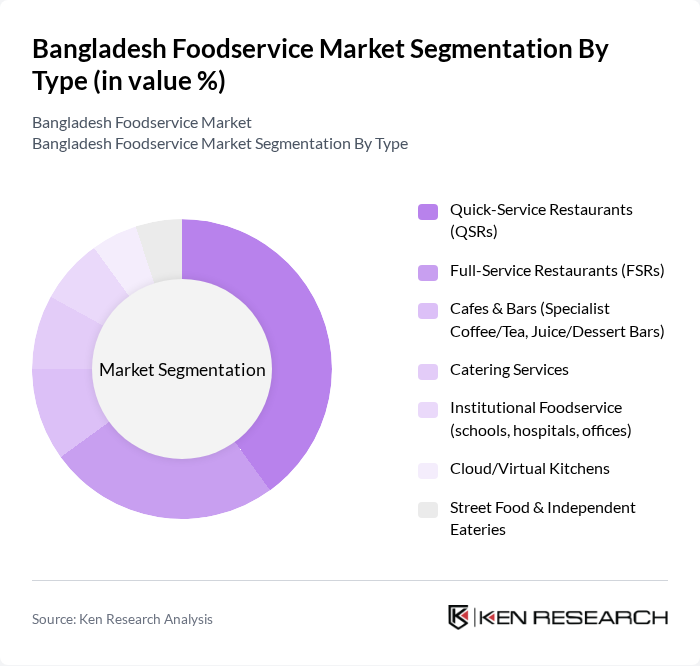

By Type:The foodservice market can be segmented into various types, including Quick-Service Restaurants (QSRs), Full-Service Restaurants (FSRs), Cafes & Bars, Catering Services, Institutional Foodservice, Cloud/Virtual Kitchens, and Street Food & Independent Eateries. Among these, Quick-Service Restaurants are particularly popular due to their convenience and affordability, and have expanded in outlet numbers in recent years; cloud/virtual kitchens are also among the fastest-growing formats as delivery platforms scale .

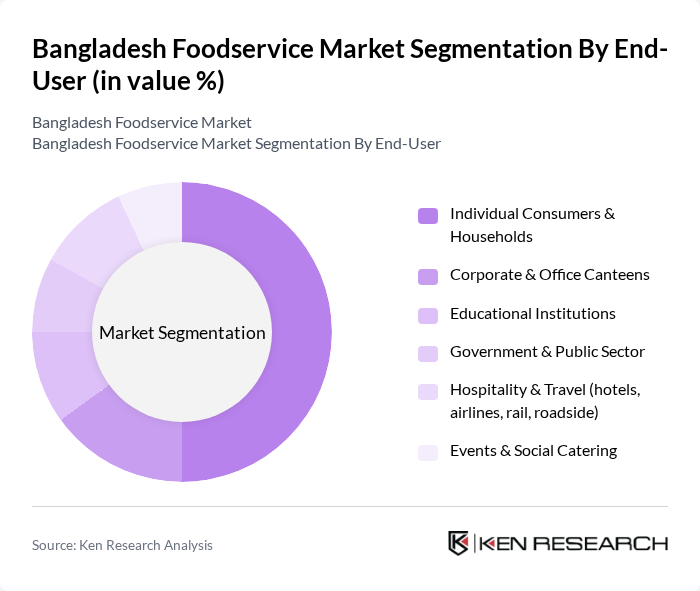

By End-User:The end-user segmentation includes Individual Consumers & Households, Corporate & Office Canteens, Educational Institutions, Government & Public Sector, Hospitality & Travel, and Events & Social Catering. Individual Consumers & Households represent the largest segment, supported by the rising middle class, expanding QSR and café networks, and broader access to delivery platforms that cater to at-home and on-the-go consumption .

The Bangladesh Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as KFC Bangladesh, Pizza Hut Bangladesh, Best Fried Chicken (BFC), Star Kabab & Restaurant, Fakruddin Foods (Haji Mohammad Fakruddin Biryani), Gloria Jean’s Coffees Bangladesh, Nando’s Bangladesh, Burger King Bangladesh, Madchef, Kazi Farms Kitchen, Shawarma House, TakeOut, Tasty Treat (PRAN-RFL), Panshi Restaurant, Foodpanda Bangladesh contribute to innovation, geographic expansion, and service delivery in this space. Chains like KFC, Pizza Hut, and Domino’s have expanded outlets in recent years, while aggregators and cloud kitchen initiatives have supported rapid delivery-led growth .

The future of the Bangladesh foodservice market appears promising, driven by urbanization and rising disposable incomes. As consumer preferences shift towards convenience and quality, foodservice operators are likely to innovate their offerings. The integration of technology in ordering and delivery processes will enhance customer experiences. Additionally, the growing trend of health-conscious dining will encourage restaurants to adapt their menus, catering to the evolving demands of a more affluent and urbanized population, thus shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Quick-Service Restaurants (QSRs) Full-Service Restaurants (FSRs) Cafes & Bars (Specialist Coffee/Tea, Juice/Dessert Bars) Catering Services Institutional Foodservice (schools, hospitals, offices) Cloud/Virtual Kitchens Street Food & Independent Eateries |

| By End-User | Individual Consumers & Households Corporate & Office Canteens Educational Institutions Government & Public Sector Hospitality & Travel (hotels, airlines, rail, roadside) Events & Social Catering |

| By Sales Channel | Dine-In Takeaway/Counter Pick-up Online Ordering (first-party apps/web) Third-Party Delivery Platforms Drive-Thru/On-the-go |

| By Cuisine Type | Local Bangladeshi South Asian (Indian, Pakistani) Chinese & Pan-Asian Western Fast Food & Pizza Middle Eastern (shawarma, kebab) Bakery & Confectionery Others (fusion, continental) |

| By Price Range | Budget Mid-Range Premium Luxury/Fine Dining |

| By Location/Outlet Placement | Urban Tier-1 (Dhaka, Chattogram, Sylhet) Urban Tier-2/3 Cities Suburban & Peri-Urban Rural & Highway/Travel Retail, Leisure & Lodging Venues |

| By Outlet Type | Independent Outlets Chained Outlets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Quick-Service Restaurants | 120 | Franchise Owners, Store Managers |

| Full-Service Restaurants | 100 | Restaurant Owners, Head Chefs |

| Catering Services | 80 | Catering Managers, Event Coordinators |

| Food Delivery Services | 70 | Operations Managers, Delivery Coordinators |

| Consumer Dining Preferences | 140 | General Consumers, Food Enthusiasts |

The Bangladesh Foodservice Market is valued at approximately USD 4.3 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and an increasing preference for dining out among consumers.