Region:Asia

Author(s):Geetanshi

Product Code:KRAC0068

Pages:89

Published On:August 2025

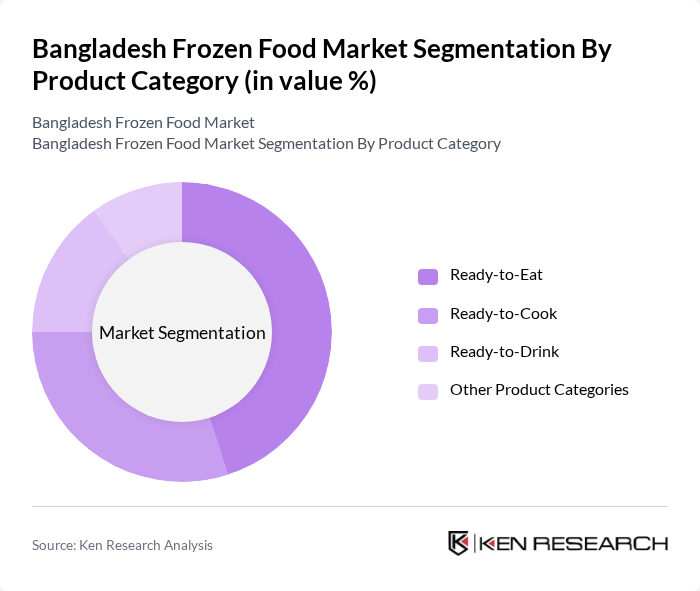

By Product Category:The product category segmentation includes Ready-to-Eat, Ready-to-Cook, Ready-to-Drink, and Other Product Categories. Among these, Ready-to-Eat products are leading the market due to their convenience and time-saving attributes, appealing to busy urban consumers. Additionally, the trend toward healthier eating is driving demand for frozen fruits and vegetables, which are increasingly popular as nutritious meal options .

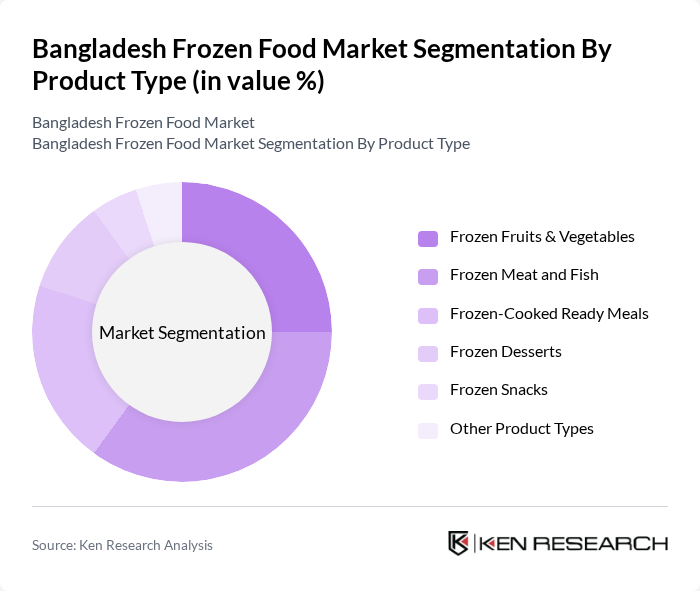

By Product Type:The product type segmentation includes Frozen Fruits & Vegetables, Frozen Meat and Fish, Frozen-Cooked Ready Meals, Frozen Desserts, Frozen Snacks, and Other Product Types. Frozen Meat and Fish are currently the dominant segments, driven by increasing demand for protein-rich foods and the convenience of longer shelf life. The accessibility of frozen products through modern retail and improved cold chain logistics has made them a preferred choice for many households .

The Bangladesh Frozen Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as PRAN-RFL Group, ACI Limited, Kazi Farms Group, Square Food & Beverage Ltd., Bashundhara Food & Beverage Industries Ltd., City Group, Sinha Group, Fresh Foods Limited, Aftab Frozen Foods Ltd., Ameer Agro Limited, ACI Logistics Ltd. (Shwapno), Aftab Bahumukhi Farms Ltd., ACI Foods Ltd., Golden Harvest Agro Industries Ltd., and Paragon Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bangladesh frozen food market appears promising, driven by urbanization and rising disposable incomes. As consumer preferences shift towards convenience, the demand for frozen foods is expected to grow. Companies are likely to invest in improving supply chain efficiencies and quality control measures to address current challenges. Additionally, the increasing focus on health and sustainability will shape product offerings, with more brands likely to introduce innovative and health-conscious frozen food options to cater to evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Ready-to-Eat Ready-to-Cook Ready-to-Drink Other Product Categories |

| By Product Type | Frozen Fruits & Vegetables Frozen Meat and Fish Frozen-Cooked Ready Meals Frozen Desserts Frozen Snacks Other Product Types |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail Stores Other Distribution Channels |

| By End-User | Retail Consumers Food Service Industry Institutional Buyers Export Markets |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels Regional Brands |

| By Consumer Demographics | Age Group Income Level Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Food Sales | 120 | Store Managers, Category Buyers |

| Wholesale Distribution Channels | 90 | Wholesale Managers, Supply Chain Coordinators |

| Frozen Food Processing Facilities | 60 | Operations Managers, Quality Control Supervisors |

| Consumer Preferences and Trends | 140 | End Consumers, Food Enthusiasts |

| Export Market Insights | 50 | Export Managers, Trade Analysts |

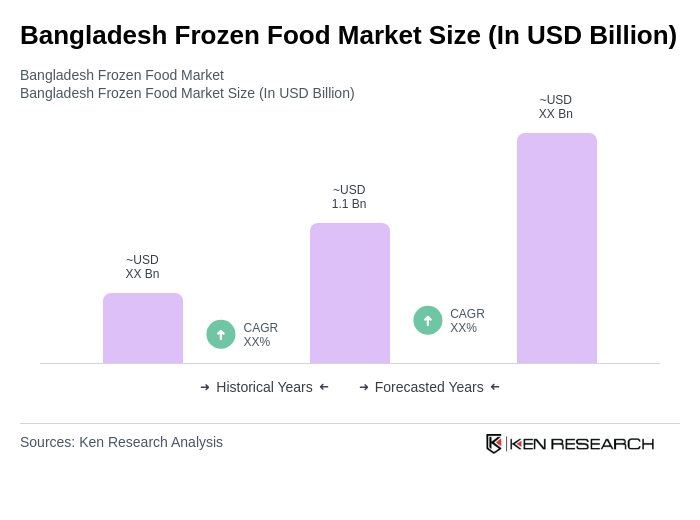

The Bangladesh Frozen Food Market is valued at approximately USD 1.1 billion, driven by factors such as urbanization, rising disposable incomes, and an increasing demand for convenience foods among the working population.