Region:Europe

Author(s):Dev

Product Code:KRAA1508

Pages:86

Published On:August 2025

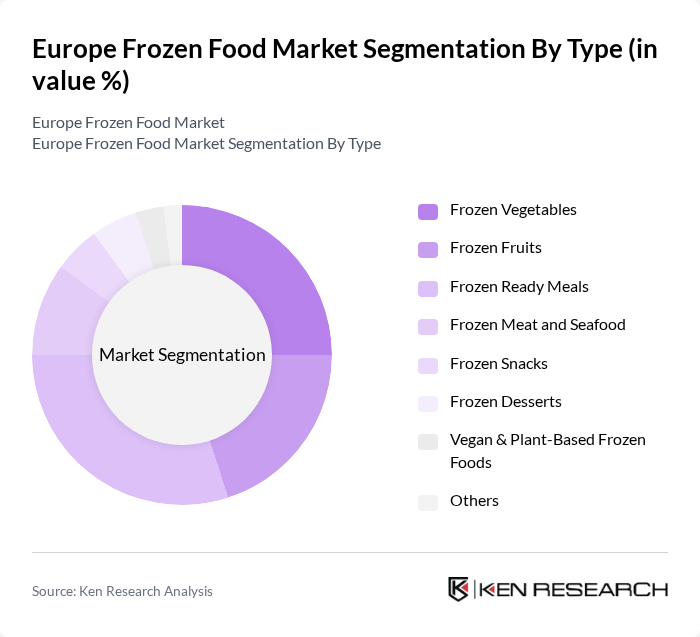

By Type:The frozen food market can be segmented into various types, including frozen vegetables, frozen fruits, frozen ready meals, frozen meat and seafood, frozen snacks, frozen desserts, vegan & plant-based frozen foods, and others. Each of these subsegments caters to different consumer preferences and dietary needs. The market is witnessing increased demand for organic, gluten-free, and low-calorie frozen products, as well as a growing focus on plant-based and vegan options .

The frozen ready meals segment is currently dominating the market due to the increasing demand for convenient meal options among busy consumers. This trend is particularly strong in urban areas where time constraints make ready-to-eat meals appealing. Additionally, the rise in single-person households has led to a greater preference for portion-controlled frozen meals. The variety of flavors and dietary options available in this segment further enhances its attractiveness, making it a key driver of market growth. The segment is also benefiting from innovations in freezing and packaging technologies that help preserve taste and nutrition .

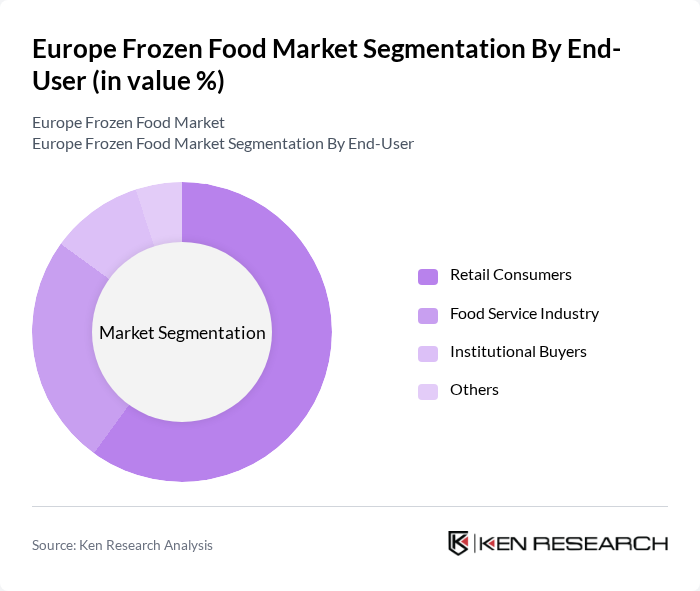

By End-User:The market can be segmented based on end-users, including retail consumers, food service industry, institutional buyers, and others. Each segment has unique requirements and purchasing behaviors that influence the overall market dynamics. Retailers are expanding their frozen food sections to meet the demand for quick, nutritious meals, while the food service industry is increasingly relying on frozen ingredients for consistent quality and reduced food waste .

Retail consumers represent the largest segment in the frozen food market, driven by the convenience of purchasing frozen products from supermarkets and online platforms. The growing trend of home cooking, especially during the pandemic, has led to increased purchases of frozen foods as consumers stock up on essentials. The food service industry follows closely, as restaurants and catering services increasingly rely on frozen ingredients for their operations, ensuring consistent quality and reducing food waste. The institutional segment, including schools and hospitals, is also adopting frozen foods for efficiency and safety .

The Europe Frozen Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Unilever PLC, Conagra Brands, Inc., The Kraft Heinz Company, McCain Foods Limited, General Mills, Inc., Dr. August Oetker KG, Birds Eye (Nomad Foods Limited), Findus Group (Nomad Foods Limited), Iglo Group (Nomad Foods Limited), FRoSTA AG, Bakkavor Group PLC, Greencore Group PLC, Aryzta AG, Iceland Foods Ltd., Orkla ASA, Lantmännen Unibake International, Fevita Hungary Zrt., Dawtona Frozen, Good Food Group A/S, Handsman Sp. z o.o., Friall, s.r.o., Minit Slovakia, ULTRACONGELADOS VIRTO, SAU, THIS.CO, Cargill Inc., JBS S.A., BRF S.A., Ajinomoto Co., Inc., CONGELADOS CIENTOCINCO, S.L. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European frozen food market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for plant-based and organic frozen products continues to rise, manufacturers are likely to innovate and diversify their offerings. Additionally, the growth of e-commerce will facilitate greater market penetration, allowing brands to reach a broader audience. Sustainability initiatives will also play a crucial role, as consumers increasingly seek environmentally friendly options in their frozen food choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Vegetables Frozen Fruits Frozen Ready Meals Frozen Meat and Seafood Frozen Snacks Frozen Desserts Vegan & Plant-Based Frozen Foods Others |

| By End-User | Retail Consumers Food Service Industry Institutional Buyers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Discount Stores Wholesale Distributors Others |

| By Packaging Type | Bags Boxes Trays Flexible Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe |

| By Consumer Demographics | Age Group Income Level Family Size Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Food Sales | 100 | Store Managers, Category Buyers |

| Food Service Sector Insights | 80 | Restaurant Owners, Catering Managers |

| Consumer Preferences in Frozen Foods | 120 | Household Consumers, Health-Conscious Shoppers |

| Distribution Channel Analysis | 60 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 40 | Product Development Managers, Marketing Executives |

The Europe Frozen Food Market is valued at approximately USD 150 billion, reflecting a significant growth trend driven by increasing consumer demand for convenience foods and healthier eating options.