Region:Global

Author(s):Geetanshi

Product Code:KRAC0027

Pages:100

Published On:August 2025

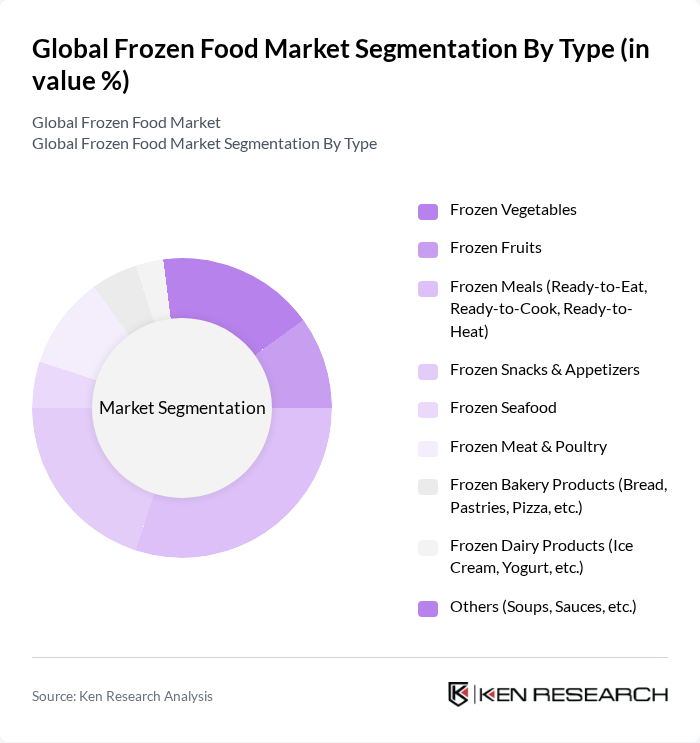

By Type:The frozen food market is segmented into various types, including frozen vegetables, frozen fruits, frozen meals (ready-to-eat, ready-to-cook, ready-to-heat), frozen snacks and appetizers, frozen seafood, frozen meat and poultry, frozen bakery products (bread, pastries, pizza, etc.), frozen dairy products (ice cream, yogurt, etc.), and others such as soups and sauces. Each of these subsegments caters to different consumer preferences and dietary needs, contributing to the overall market growth. The demand for frozen ready meals and snacks is particularly strong, driven by urbanization and busier lifestyles.

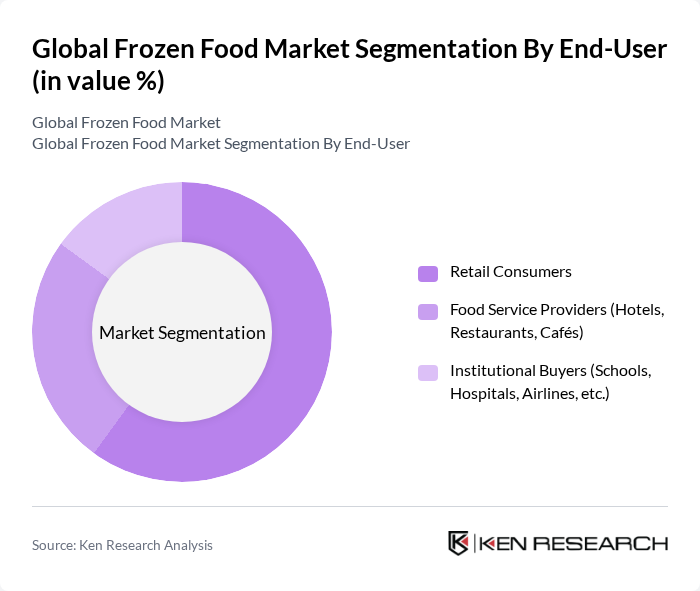

By End-User:The frozen food market serves various end-users, including retail consumers, food service providers, and institutional buyers. Retail consumers account for the largest share, driven by the convenience and variety of frozen products available in supermarkets, hypermarkets, and online platforms. Food service providers and institutional buyers such as schools, hospitals, and airlines also represent significant demand, often requiring bulk purchases and consistent supply.

The Global Frozen Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Unilever PLC, Conagra Brands, Inc., The Kraft Heinz Company, General Mills, Inc., Tyson Foods, Inc., McCain Foods Limited, Nomad Foods Limited, Ajinomoto Co., Inc., Dr. Oetker GmbH, Iceland Foods Ltd., Lamb Weston Holdings, Inc., B&G Foods, Inc., Greenyard NV, Birds Eye Limited contribute to innovation, geographic expansion, and service delivery in this space. These companies are focusing on product innovation, expanding their frozen food portfolios, and investing in sustainable packaging and supply chain improvements to meet evolving consumer demands.

The future of the frozen food market in None appears promising, driven by evolving consumer preferences and technological advancements. As more consumers prioritize convenience and health, the demand for innovative frozen products is expected to rise. Additionally, the integration of sustainable practices in production and packaging will likely enhance brand loyalty. Companies that adapt to these trends and invest in e-commerce capabilities will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Vegetables Frozen Fruits Frozen Meals (Ready-to-Eat, Ready-to-Cook, Ready-to-Heat) Frozen Snacks & Appetizers Frozen Seafood Frozen Meat & Poultry Frozen Bakery Products (Bread, Pastries, Pizza, etc.) Frozen Dairy Products (Ice Cream, Yogurt, etc.) Others (Soups, Sauces, etc.) |

| By End-User | Retail Consumers Food Service Providers (Hotels, Restaurants, Cafés) Institutional Buyers (Schools, Hospitals, Airlines, etc.) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Specialty Stores Foodservice Distributors |

| By Packaging Type | Bags Boxes Pouches Trays Others (Cups, Cartons, etc.) |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Form | Whole Sliced Diced Minced/Shredded Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Frozen Food Preferences | 120 | Household Decision Makers, Grocery Shoppers |

| Food Service Industry Insights | 60 | Restaurant Owners, Catering Managers |

| Retail Frozen Food Sales Strategies | 50 | Retail Managers, Category Buyers |

| Frozen Food Supply Chain Dynamics | 40 | Logistics Coordinators, Supply Chain Analysts |

| Health and Nutrition Trends in Frozen Foods | 45 | Nutritional Experts, Health Food Advocates |

The Global Frozen Food Market is valued at approximately USD 310 billion, reflecting significant growth driven by increasing consumer demand for convenience foods and advancements in freezing technology.