Region:Middle East

Author(s):Shubham

Product Code:KRAA1835

Pages:95

Published On:August 2025

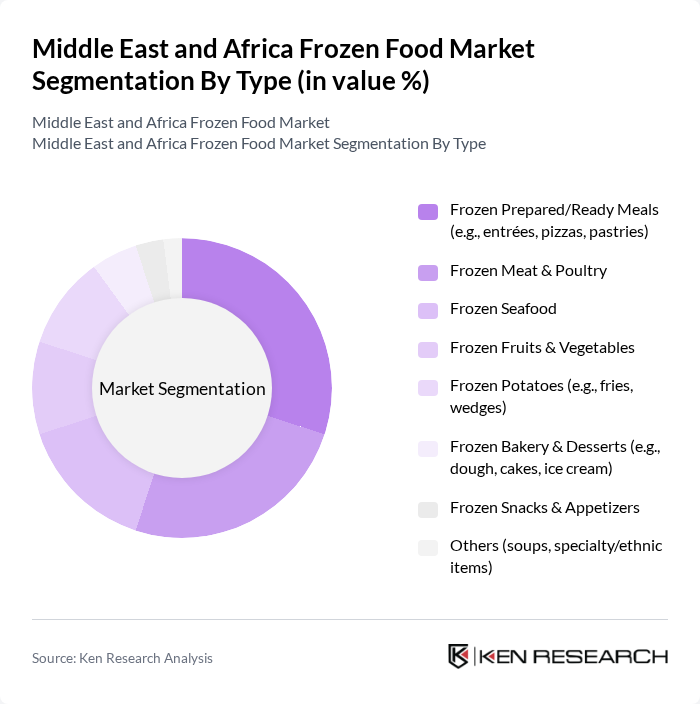

By Type:The frozen food market can be segmented into various types, including frozen prepared/ready meals, frozen meat & poultry, frozen seafood, frozen fruits & vegetables, frozen potatoes, frozen bakery & desserts, frozen snacks & appetizers, and others. Each of these subsegments caters to different consumer preferences and dietary needs, contributing to the overall market dynamics. In MEA, ready meals, meat/poultry, and potato products are widely adopted in retail and HORECA due to convenience and consistent quality, while frozen fruits and vegetables benefit from year-round availability supported by IQF and cold-chain expansion .

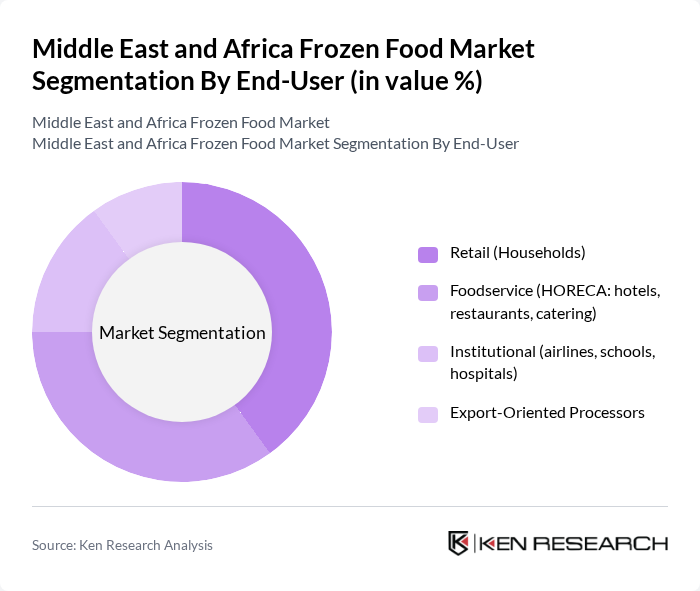

By End-User:The end-user segmentation includes retail (households), foodservice (HORECA: hotels, restaurants, catering), institutional (airlines, schools, hospitals), and export-oriented processors. Each segment has unique requirements and purchasing behaviors that influence the overall market landscape. Retail and foodservice are the leading channels in MEA, as modern trade expansion and QSR growth drive volume in frozen potatoes, poultry, ready meals, and bakery, while institutional demand focuses on standardized menus and cost-efficient bulk packs .

The Middle East and Africa Frozen Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Nestlé Middle East & North Africa), Unilever PLC (Walls/Langnese, foodservice), McCain Foods Limited, Sunbulah Group (Saudi Modern Food Factory Co.), Al Kabeer Group (IFFCO Group), Americana Group (Americana Foods), Al Islami Foods, BRF S.A. (Sadia, OneFoods/BRF MENA), Almarai Company (IDJ Frozen Bakery, distribution), National Food Products Company (NFPC), Bidfood Middle East (Bidfood UAE, KSA, Jordan, Bahrain), Sea Harvest Group Limited (South Africa), I&J – Irvin & Johnson Limited (AVI Limited, South Africa), RCL Foods Limited (Foodservice and frozen value-added, South Africa), Tiger Brands Limited (Enterprise brand, frozen foods) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the frozen food market in the Middle East and Africa appears promising, driven by urbanization and changing consumer preferences. As the population continues to grow, the demand for convenient meal solutions will likely increase. Innovations in freezing technology and sustainable practices will also play a crucial role in shaping the market. Companies that adapt to these trends and invest in product diversification will be well-positioned to capitalize on emerging opportunities in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Prepared/Ready Meals (e.g., entrées, pizzas, pastries) Frozen Meat & Poultry Frozen Seafood Frozen Fruits & Vegetables Frozen Potatoes (e.g., fries, wedges) Frozen Bakery & Desserts (e.g., dough, cakes, ice cream) Frozen Snacks & Appetizers Others (soups, specialty/ethnic items) |

| By End-User | Retail (Households) Foodservice (HORECA: hotels, restaurants, catering) Institutional (airlines, schools, hospitals) Export-Oriented Processors |

| By Distribution Channel | Supermarkets/Hypermarkets Online & Quick-Commerce (E-grocery, delivery apps) Convenience & Grocery Stores Wholesale/Cash & Carry |

| By Packaging Type | Bags Boxes/Cartons Pouches Bulk/Institutional Packs |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | International Brands Private Labels (Retailer-owned) Local/Regional Brands |

| By Consumer Demographics | Age Group Income Level Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Food Sales | 140 | Store Managers, Category Buyers |

| Food Service Sector Insights | 100 | Restaurant Owners, Catering Managers |

| Consumer Preferences in Frozen Foods | 150 | Household Decision Makers, Health-Conscious Consumers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

The Middle East and Africa Frozen Food Market is valued at approximately USD 15 billion, based on a five-year historical analysis. This figure aligns with various industry estimates, indicating a stable market growth trajectory driven by urbanization and changing consumer preferences.