Region:Europe

Author(s):Shubham

Product Code:KRAB0675

Pages:87

Published On:August 2025

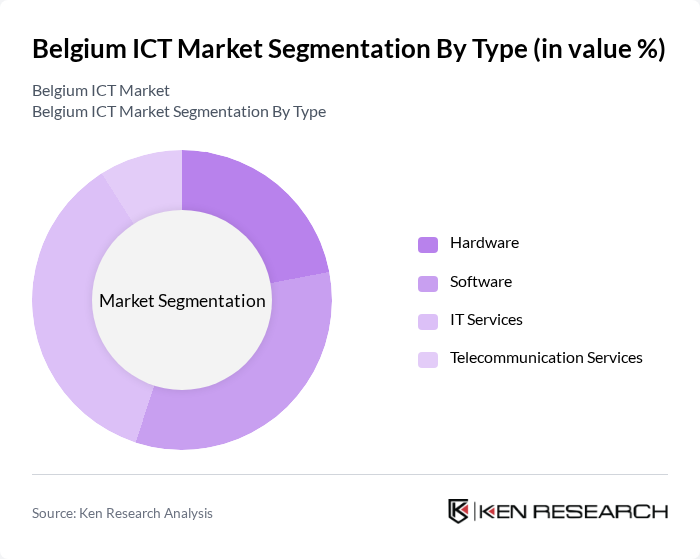

By Type:

By Size of Enterprise:

The Belgium ICT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Proximus, Orange Belgium, Telenet Group, Atos Belgium, IBM Belgium, Accenture Belgium, Capgemini Belgium, Telindus (Proximus ICT), Inetum Belgium, Dimension Data Belgium (NTT Ltd.), Devoteam Belgium, Sopra Steria Benelux, CGI Belgium, NTT Data Belgium, Axxes, Microsoft Belgium, Google Belgium, AWS Belgium, Cegeka, NRB contribute to innovation, geographic expansion, and service delivery in this space.

The Belgium ICT market is poised for transformative growth, driven by advancements in technology and evolving consumer demands. The integration of artificial intelligence and the expansion of 5G networks are expected to redefine service delivery and operational efficiency. Additionally, the emphasis on sustainable ICT practices will shape future investments, aligning with global environmental goals. As businesses adapt to these changes, the focus will shift towards innovative solutions that enhance user experience and operational resilience, ensuring competitiveness in a rapidly evolving digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software IT Services Telecommunication Services |

| By Size of Enterprise | Small and Medium Enterprises Large Enterprises |

| By Industry Vertical | BFSI (Banking, Financial Services, and Insurance) IT and Telecom Government Retail and E-commerce Manufacturing Energy and Utilities Transport and Logistics Other Industry Verticals |

| By Geography | Flanders Wallonia Brussels-Capital Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Software Solutions | 100 | IT Managers, CTOs, Business Analysts |

| Cloud Computing Services | 80 | Cloud Architects, IT Directors, System Administrators |

| Cybersecurity Solutions | 70 | Security Officers, Risk Managers, Compliance Officers |

| Telecommunications Infrastructure | 60 | Network Engineers, Telecom Managers, Operations Directors |

| IT Consulting Services | 50 | Consultants, Project Managers, Business Development Leads |

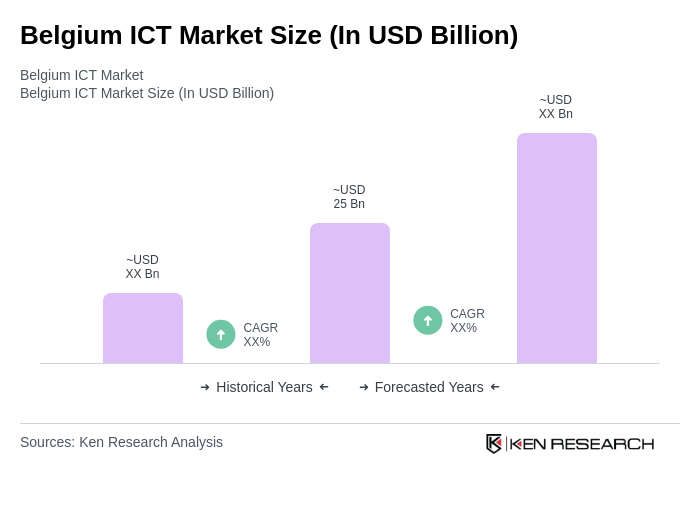

The Belgium ICT market is valued at approximately USD 25 billion, driven by the increasing adoption of digital technologies, cloud computing, and remote work solutions. This growth reflects a significant demand for IT services and software solutions across various sectors.