Region:Asia

Author(s):Shubham

Product Code:KRAC0618

Pages:87

Published On:August 2025

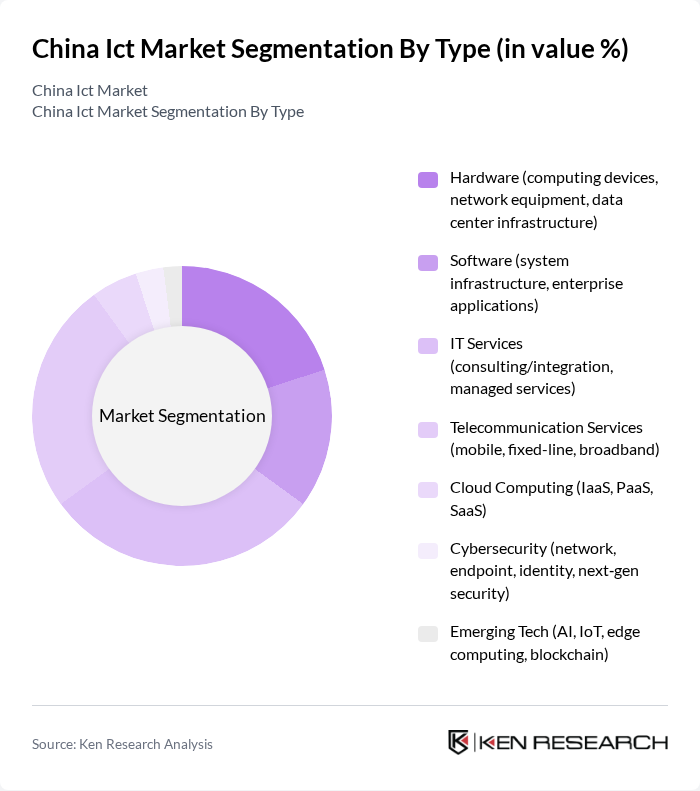

By Type:The China ICT market can be segmented into hardware, software, IT services, telecommunication services, cloud computing, cybersecurity, and emerging technologies. IT services and telecommunication services are significant pillars given large enterprise digital programs and nationwide networks; cloud computing and cybersecurity are expanding quickly as organizations modernize infrastructure, adopt IaaS/PaaS/SaaS, and strengthen compliance and data protection .

By End-User:The end-user segmentation of the China ICT market includes various sectors such as government, education, healthcare, retail, manufacturing, financial services, energy, IT & telecom, transportation, and logistics. Government and public sector demand is supported by smart city and e?government initiatives; manufacturing leads enterprise digitalization, while healthcare and education adoption of cloud, data platforms, and connectivity solutions continues to accelerate for service delivery and operational efficiency .

The China ICT market is characterized by a dynamic mix of regional and international players. Leading participants such as Huawei Technologies Co., Ltd., ZTE Corporation, China Mobile Limited, China Telecom Corporation Limited, China Unicom (Hong Kong) Limited, Alibaba Group Holding Limited, Tencent Holdings Limited, Baidu, Inc., Lenovo Group Limited, Inspur Group Co., Ltd., Xiaomi Corporation, JD.com, Inc., Meituan, DiDi Global Inc., NetEase, Inc., Baidu AI Cloud, Alibaba Cloud (Alibaba Cloud Computing Co., Ltd.), Tencent Cloud, Kingsoft Cloud Holdings Limited, Hikvision Digital Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China ICT market appears promising, driven by technological advancements and increasing digital adoption across sectors. With the government's commitment to enhancing digital infrastructure and the rapid expansion of 5G networks, the market is poised for significant growth. Additionally, the rise of artificial intelligence and IoT solutions will further transform industries, creating new opportunities for innovation and investment. As companies adapt to these changes, the ICT landscape will evolve, fostering a more competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware (computing devices, network equipment, data center infrastructure) Software (system infrastructure, enterprise applications) IT Services (consulting/integration, managed services) Telecommunication Services (mobile, fixed-line, broadband) Cloud Computing (IaaS, PaaS, SaaS) Cybersecurity (network, endpoint, identity, next?gen security) Emerging Tech (AI, IoT, edge computing, blockchain) |

| By End-User | Government & Public Sector Education Healthcare Retail & E-commerce Manufacturing & Industrial Financial Services (BFSI) Energy & Utilities IT & Telecom Transportation & Logistics Others |

| By Application | Business Operations & ERP Customer Engagement & CX Data Management & Analytics Network & Infrastructure Management Security & Compliance Management Communication & Collaboration Others |

| By Distribution Channel | Direct Sales Online Sales/Marketplaces Value?Added Resellers (VARs) Distributors/Systems Integrators Retail Outlets Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value?Based Pricing Penetration Pricing Consumption?Based/PAYG Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups & Digital?Native Businesses State?Owned Enterprises (SOEs) Others |

| By Service Type | Managed Services Professional Services Technical Support Consulting & Integration Services Cloud & Data Center Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Software Adoption | 120 | IT Directors, Software Development Managers |

| Telecommunications Infrastructure | 90 | Network Engineers, Telecom Project Managers |

| Cloud Computing Services | 100 | Cloud Architects, IT Operations Managers |

| Cybersecurity Solutions | 80 | Chief Information Security Officers, Risk Management Executives |

| Smart City Technologies | 70 | Urban Planners, Smart Technology Consultants |

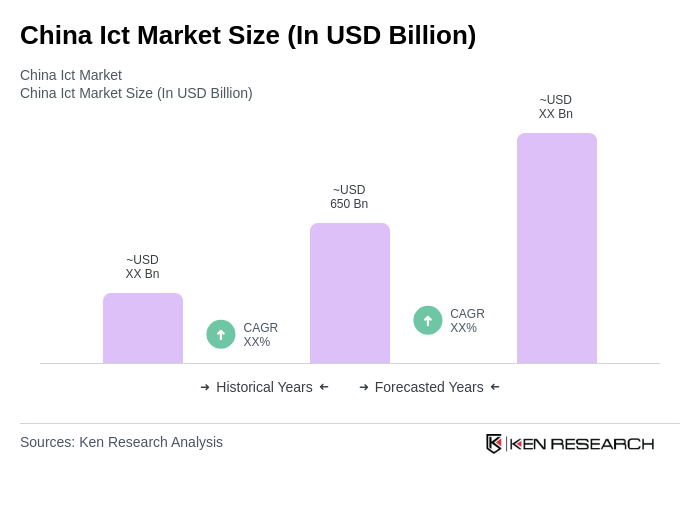

The China ICT market is valued at approximately USD 650 billion, reflecting significant growth driven by digital transformation, high internet penetration, and advancements in cloud computing and AI technologies across various sectors.