Region:Central and South America

Author(s):Dev

Product Code:KRAC0492

Pages:99

Published On:August 2025

By Type:

The Chile ICT market is segmented into various types, including Communication Services, IT Services, Software, Cloud Services, Cybersecurity Solutions, Hardware, and Data Center & Colocation Services. Among these, Communication Services, which encompass mobile, fixed, and broadband services, remain foundational and significant in spend due to widespread connectivity needs; meanwhile, IT services and SaaS/cloud have expanded rapidly as enterprises modernize, migrate workloads, and strengthen cybersecurity in line with sectoral digitization.

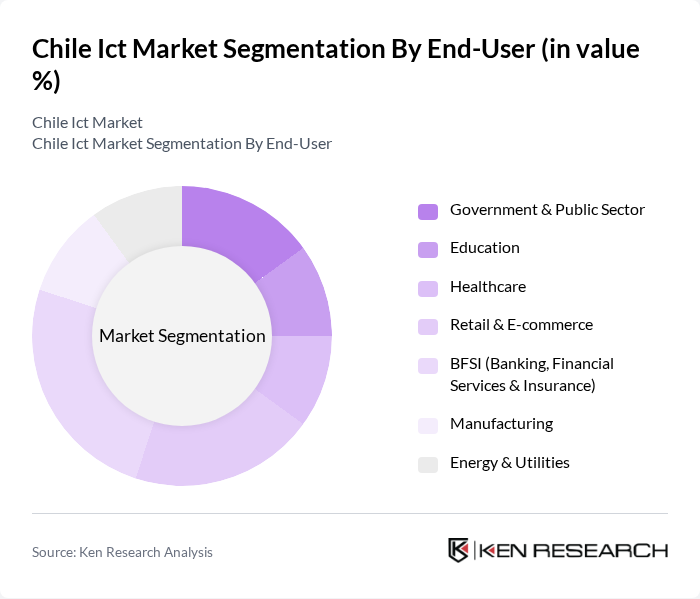

By End-User:

The end-user segmentation of the Chile ICT market includes Government & Public Sector, Education, Healthcare, Retail & E-commerce, BFSI (Banking, Financial Services & Insurance), Manufacturing, and Energy & Utilities. The BFSI sector is among the leading adopters due to secure digital banking, fintech expansion, and regulatory-driven cybersecurity spending; retail also accounts for a significant share of ICT spend, supported by e?commerce and omnichannel transformation.

The Chile ICT market is characterized by a dynamic mix of regional and international players. Leading participants such as Entel S.A., Movistar Chile (Telefónica Chile), Claro Chile (América Móvil), VTR Comunicaciones S.A., Grupo GTD (GTD Grupo Teleductos S.A.), WOM Chile, Sonda S.A., Kyndryl Chile, Telsur S.A. (Telefónica del Sur, parte de Grupo GTD), Kibernum S.A., SONDA Data Center (Servicios de Data Center de Sonda), EdgeConneX Chile SpA, Ascenty Chile (Digital Realty/Ascenty), Microsoft Chile, AWS Chile (Amazon Web Services) contribute to innovation, geographic expansion, and service delivery in this space.

The Chile ICT market is poised for significant transformation as digital adoption accelerates across various sectors. With the expansion of 5G networks and increased investment in cloud computing, businesses are expected to enhance operational efficiency and customer engagement. Additionally, the growing emphasis on digital transformation will drive innovation, particularly in sectors like EdTech and FinTech, creating a robust ecosystem for ICT development. As these trends unfold, the market will likely witness a surge in new startups and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Communication Services (Mobile, Fixed, Broadband) IT Services (Consulting, Integration, Managed Services) Software (On-premises & SaaS) Cloud Services (IaaS, PaaS, SaaS) Cybersecurity Solutions Hardware (Network Equipment, End-User Devices, Data Center) Data Center & Colocation Services |

| By End-User | Government & Public Sector Education Healthcare Retail & E-commerce BFSI (Banking, Financial Services & Insurance) Manufacturing Energy & Utilities |

| By Application | Cloud Migration & Modernization Cybersecurity & Compliance CRM & ERP Supply Chain & Asset Management (incl. IoT) Data Analytics & AI Unified Communications & Collaboration |

| By Distribution Channel | Direct (Vendors/Telcos) Channel Partners & VARs Online Marketplaces Distributors & Wholesalers Systems Integrators |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Customer Segment | Private Sector Public Sector Startups & Tech Innovators Non-Profit Organizations |

| By Policy Support | Digital Inclusion & Connectivity Programs Tax Incentives & Investment Promotion Cybersecurity & Data Protection Frameworks Spectrum & 5G Deployment Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Providers | 120 | Network Managers, Business Development Managers |

| Software Development Firms | 90 | CTOs, Project Managers |

| IT Services and Consulting | 100 | Consultants, Service Delivery Managers |

| Educational Technology Solutions | 60 | IT Directors, Educational Administrators |

| Healthcare IT Systems | 70 | Healthcare IT Managers, Compliance Officers |

The Chile ICT market is valued at approximately USD 17.5 billion, reflecting significant growth driven by digital transformation across various sectors, including government, healthcare, retail, and financial services.