Region:Middle East

Author(s):Shubham

Product Code:KRAC0621

Pages:93

Published On:August 2025

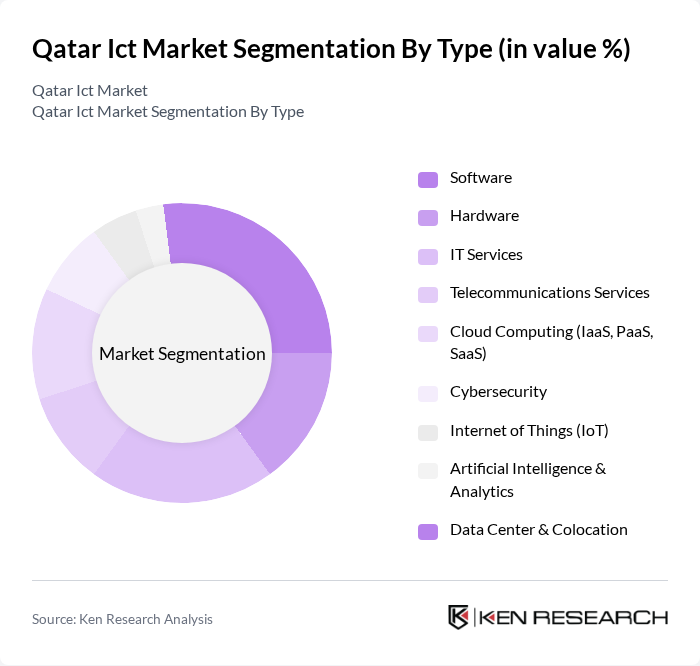

By Type:The Qatar ICT market is segmented into various types, including Software, Hardware, IT Services, Telecommunications Services, Cloud Computing (IaaS, PaaS, SaaS), Cybersecurity, Internet of Things (IoT), Artificial Intelligence & Analytics, and Data Center & Colocation. Each of these segments plays a crucial role in the overall market dynamics, with specific trends and consumer preferences shaping their growth trajectories.

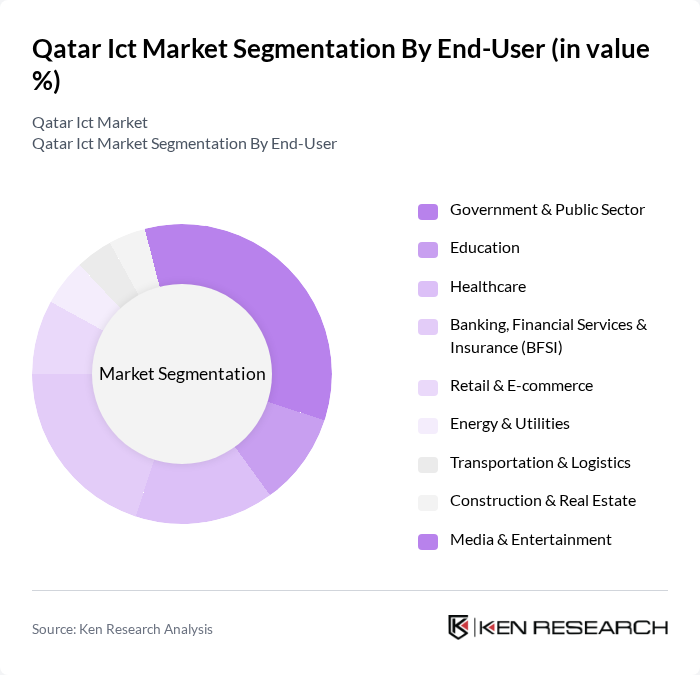

By End-User:The end-user segmentation of the Qatar ICT market includes Government & Public Sector, Education, Healthcare, Banking, Financial Services & Insurance (BFSI), Retail & E-commerce, Energy & Utilities, Transportation & Logistics, Construction & Real Estate, and Media & Entertainment. Each sector has unique requirements and challenges, influencing the demand for ICT solutions tailored to their specific needs.

The Qatar ICT market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo Q.P.S.C. (Ooredoo Qatar), Vodafone Qatar P.Q.S.C., Qatar National Broadband Network (QNBN), Microsoft Qatar L.L.C., Oracle Systems Qatar L.L.C., IBM Qatar L.L.C., Amazon Web Services (AWS) – Qatar (Doha) Region, Google Cloud – Qatar (Doha) Region, SAP Middle East (Qatar), Mannai Corporation Q.P.S.C. (Mannai InfoTech), MEEZA QSTP-LLC (MEEZA Data Centers), Gulf Bridge International (GBI), Malomatia (Qatar Shareholders Company), Qatar Free Zones Authority – Data Center & Cloud Ecosystem Partners, Qatar Computing Research Institute (QCRI), Hamad Bin Khalifa University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar ICT market appears promising, driven by ongoing digital transformation initiatives and technological advancements. With the rise of 5G technology and increased investment in smart city projects, the sector is poised for significant growth. Additionally, the focus on data privacy and cybersecurity will shape the regulatory landscape, encouraging businesses to adopt innovative solutions. As the demand for digital services continues to rise, the ICT market is expected to evolve rapidly, creating new opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Hardware IT Services Telecommunications Services Cloud Computing (IaaS, PaaS, SaaS) Cybersecurity Internet of Things (IoT) Artificial Intelligence & Analytics Data Center & Colocation |

| By End-User | Government & Public Sector Education Healthcare Banking, Financial Services & Insurance (BFSI) Retail & E-commerce Energy & Utilities Transportation & Logistics Construction & Real Estate Media & Entertainment |

| By Application | Enterprise Resource Planning (ERP) Customer Relationship Management (CRM) Network & Infrastructure Management Data Analytics & Business Intelligence Unified Communications & Collaboration Cybersecurity Operations (SOC, SIEM) Business Process Outsourcing (BPO) & IT Outsourcing (ITO) |

| By Distribution Channel | Direct (Vendor to Enterprise/Government) System Integrators & Managed Service Providers Value-Added Resellers & Distributors Online (Self-serve/Marketplace) |

| By Pricing Model | Subscription (Monthly/Annual) Pay-Per-Use/Consumption-Based One-Time License/Capex Managed Services (Fixed + Variable) |

| By Customer Size | Small Enterprises (1–49 employees) Medium Enterprises (50–249 employees) Large Enterprises (250+ employees) Government Ministries & State-Owned Enterprises |

| By Technology Adoption | Early Adopters Mainstream Users Late Adopters |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Services | 120 | Network Managers, Service Delivery Heads |

| IT Services and Solutions | 100 | IT Directors, Project Managers |

| Software Development Firms | 80 | Software Engineers, Product Managers |

| Cybersecurity Solutions | 70 | Security Analysts, Compliance Officers |

| Cloud Computing Services | 90 | Cloud Architects, IT Infrastructure Managers |

The Qatar ICT market is valued at approximately USD 13 billion, reflecting significant growth driven by digital transformation across various sectors, public-sector digitalization, and increasing demand for cloud services, cybersecurity, and managed services.