Region:Asia

Author(s):Dev

Product Code:KRAC0548

Pages:97

Published On:August 2025

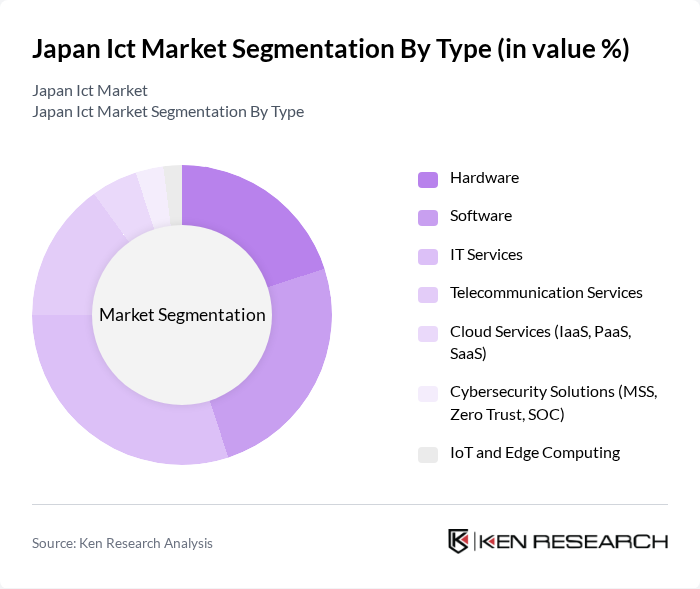

By Type:The Japan ICT market can be segmented into various types, including hardware, software, IT services, telecommunication services, cloud services, cybersecurity solutions, and IoT and edge computing. Each of these segments plays a crucial role in the overall market dynamics, with specific trends and consumer preferences influencing their growth.

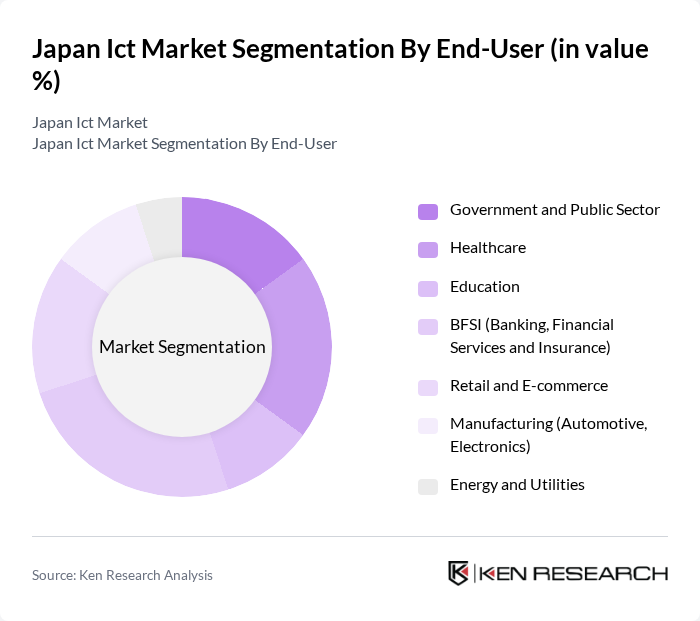

By End-User:The end-user segmentation of the Japan ICT market includes government and public sector, healthcare, education, BFSI (Banking, Financial Services and Insurance), retail and e-commerce, manufacturing, and energy and utilities. Each sector has unique requirements and challenges, driving the demand for tailored ICT solutions.

The Japan ICT market is characterized by a dynamic mix of regional and international players. Leading participants such as NTT DATA Corporation, Fujitsu Limited, NEC Corporation, Hitachi, Ltd., SoftBank Corp., KDDI Corporation, Rakuten Group, Inc. (including Rakuten Mobile and Rakuten Symphony), NTT Communications Corporation, Sony Group Corporation, Panasonic Holdings Corporation, Toshiba Corporation, IBM Japan, Ltd., Nomura Research Institute, Ltd. (NRI), ITOCHU Techno-Solutions Corporation (CTC), SCSK Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japanese ICT market appears promising, driven by technological advancements and government support. As businesses increasingly adopt digital solutions, the demand for innovative services will rise. The integration of AI and IoT technologies is expected to enhance operational efficiency across various sectors. Additionally, the ongoing development of smart cities will create new opportunities for ICT providers, fostering a more connected and sustainable urban environment, ultimately contributing to economic growth and improved quality of life.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software IT Services Telecommunication Services Cloud Services (IaaS, PaaS, SaaS) Cybersecurity Solutions (MSS, Zero Trust, SOC) IoT and Edge Computing |

| By End-User | Government and Public Sector Healthcare Education BFSI (Banking, Financial Services and Insurance) Retail and E-commerce Manufacturing (Automotive, Electronics) Energy and Utilities |

| By Application | Enterprise Resource Planning (ERP) Customer Relationship Management (CRM) Supply Chain Management Data Analytics & AI/ML Network & Infrastructure Management Unified Communications & Collaboration |

| By Sales Channel | Direct Enterprise Sales Online and Cloud Marketplaces Systems Integrators & VARs Telecom Operator Channels Distributors |

| By Distribution Mode | On-premises Deployment Cloud-based Deployment Hybrid Deployment Managed Services |

| By Price Range | Budget Mid-Range Premium |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups and Digital-Native Businesses Public Institutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Software Solutions | 120 | IT Directors, Software Development Managers |

| Telecommunications Services | 100 | Network Engineers, Telecom Operations Managers |

| Cloud Computing Adoption | 110 | Cloud Architects, IT Infrastructure Managers |

| Cybersecurity Solutions | 80 | Chief Information Security Officers, Risk Management Executives |

| Consumer Electronics Trends | 90 | Product Managers, Market Analysts |

The Japan ICT market is valued at approximately USD 460 billion, driven by the increasing adoption of digital technologies, cloud computing services, and cybersecurity solutions. This growth reflects significant investments in infrastructure and innovation across various sectors.