Region:Europe

Author(s):Shubham

Product Code:KRAC0849

Pages:86

Published On:August 2025

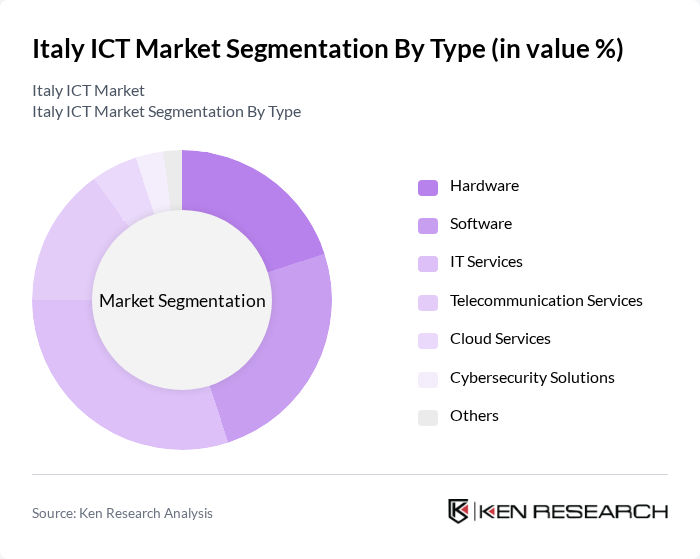

By Type:The Italy ICT Market is segmented into Hardware, Software, IT Services, Telecommunication Services, Cloud Services, Cybersecurity Solutions, and Others. Software and IT Services represent the largest segments, driven by the shift to digital solutions, SaaS models, and managed services. Cloud Services are expanding rapidly, reflecting the adoption of hybrid and public cloud platforms among both large enterprises and SMEs. Cybersecurity Solutions are experiencing double-digit growth as organizations prioritize data protection and regulatory compliance. Hardware remains essential for infrastructure upgrades, while Telecommunication Services support connectivity and 5G expansion .

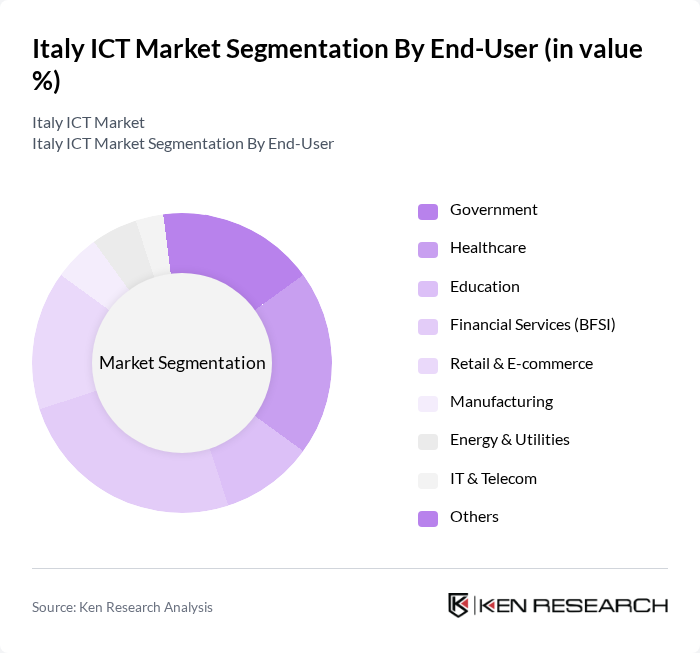

By End-User:The market is segmented by end-users, including Government, Healthcare, Education, Financial Services (BFSI), Retail & E-commerce, Manufacturing, Energy & Utilities, IT & Telecom, and Others. The BFSI sector leads ICT spending, followed by IT & Telecom and Government, reflecting high demand for secure, scalable digital platforms. Healthcare and Education sectors are rapidly digitizing, driven by telemedicine, e-learning, and regulatory mandates. Retail & E-commerce continues to grow due to consumer preference for online shopping and omnichannel experiences. Manufacturing and Energy & Utilities are investing in automation, IoT, and smart infrastructure .

The Italy ICT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telecom Italia S.p.A. (TIM), Fastweb S.p.A., Vodafone Italia S.p.A., Wind Tre S.p.A., Leonardo S.p.A., Engineering Ingegneria Informatica S.p.A., Almaviva S.p.A., Reply S.p.A., Sogei S.p.A., Dedalus S.p.A., Olivetti S.p.A., Eni S.p.A., Accenture S.p.A., IBM Italia S.p.A., Microsoft Italia S.r.l., Cisco Systems Italy S.r.l., Hewlett Packard Enterprise Italia S.r.l., Google Italy S.r.l., SAP Italia S.p.A., Oracle Italia S.r.l., Dell Technologies Italia S.r.l., Com.Tel S.p.A., Capgemini Italia S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian ICT market appears promising, driven by ongoing digital transformation and technological advancements. With government initiatives supporting infrastructure development and a growing emphasis on sustainability, the sector is poised for significant evolution. The integration of emerging technologies such as AI and IoT will likely reshape service delivery and operational efficiency. As businesses adapt to these changes, the demand for innovative solutions will continue to rise, fostering a dynamic and competitive market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software IT Services Telecommunication Services Cloud Services Cybersecurity Solutions Others |

| By End-User | Government Healthcare Education Financial Services (BFSI) Retail & E-commerce Manufacturing Energy & Utilities IT & Telecom Others |

| By Application | Enterprise Resource Planning (ERP) Customer Relationship Management (CRM) Supply Chain Management Data Analytics E-commerce Solutions Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Value-Added Resellers Others |

| By Region | Northern Italy Central Italy Southern Italy Islands Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Startups Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Software Adoption | 120 | CIOs, IT Managers, Software Architects |

| Cloud Services Utilization | 90 | Cloud Solutions Managers, IT Directors |

| Cybersecurity Practices | 70 | Security Officers, Risk Management Executives |

| Telecommunications Infrastructure | 60 | Network Engineers, Telecom Managers |

| Emerging Technologies Insights | 50 | R&D Managers, Innovation Leads |

The Italy ICT market is valued at approximately USD 80.5 billion, driven by the increasing adoption of digital technologies across various sectors, including healthcare, finance, manufacturing, and retail.