Region:Europe

Author(s):Rebecca

Product Code:KRAD0244

Pages:88

Published On:August 2025

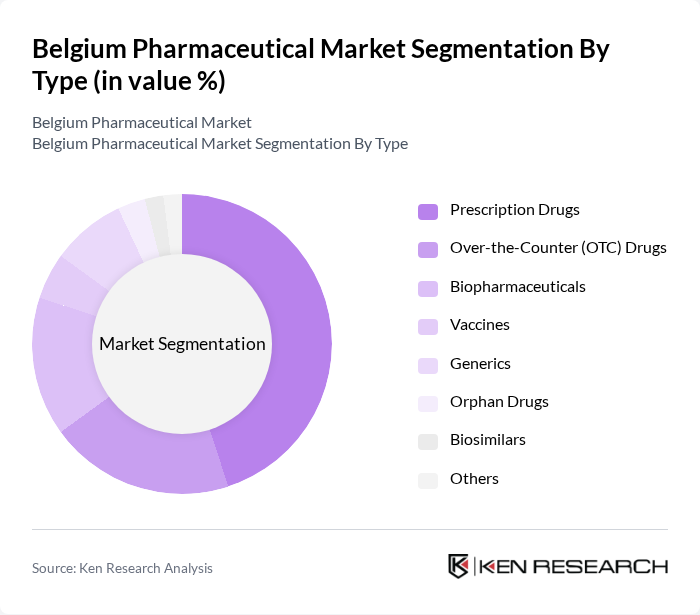

By Type:The pharmaceutical market in Belgium is segmented into Prescription Drugs, Over-the-Counter (OTC) Drugs, Biopharmaceuticals, Vaccines, Generics, Orphan Drugs, Biosimilars, and Others. Among these, Prescription Drugs hold the largest share, driven by the increasing incidence of chronic diseases and the growing demand for advanced and targeted therapies. The trend toward personalized medicine, along with the adoption of innovative treatments such as gene and cell therapies, further strengthens the prescription segment’s growth. OTC drugs are also expanding rapidly, reflecting consumer demand for self-medication and accessible healthcare solutions .

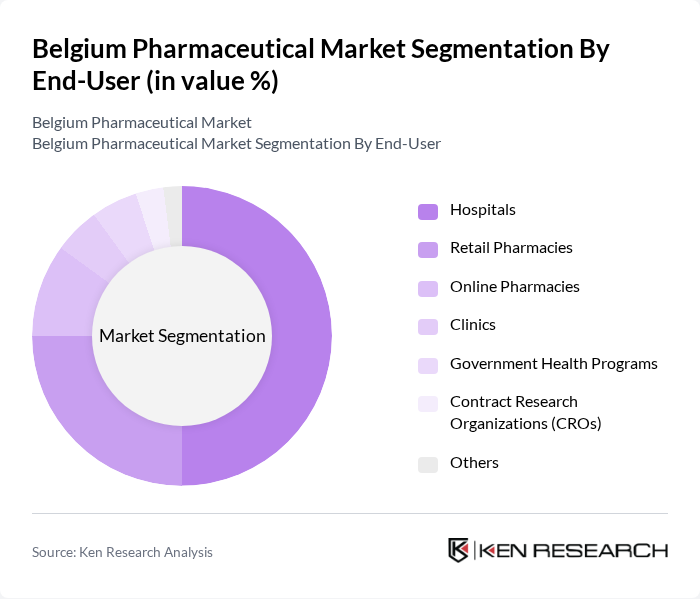

By End-User:The end-user segmentation of the pharmaceutical market includes Hospitals, Retail Pharmacies, Online Pharmacies, Clinics, Government Health Programs, Contract Research Organizations (CROs), and Others. Hospitals are the leading end-user segment, driven by the increasing number of hospital admissions, demand for specialized treatments, and the need for advanced medical care. Retail pharmacies, including nearly 5,800 independent and chain outlets, play a crucial role in medicine distribution and patient access, while online pharmacies are gaining traction due to digitalization and consumer preference for convenience .

The Belgium Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as UCB S.A., Janssen Pharmaceutica NV, GlaxoSmithKline (GSK) Belgium, Pfizer S.A./N.V. Belgium, Novartis Pharma NV Belgium, Merck Sharp & Dohme (MSD) Belgium, Sanofi Belgium, Roche Belgium, AbbVie Belgium, Amgen NV Belgium, Teva Pharma Belgium, Boehringer Ingelheim Belgium, Bayer NV Belgium, Astellas Pharma Belgium, Eli Lilly Benelux S.A./N.V., AstraZeneca Belgium, OncoDNA S.A., and Gedeon Richter Belgium contribute to innovation, geographic expansion, and service delivery in this space .

The Belgium pharmaceutical market is poised for significant transformation, driven by technological advancements and evolving healthcare needs. The integration of artificial intelligence in drug development is expected to streamline processes, reducing time-to-market for new therapies. Additionally, the increasing focus on personalized medicine will likely lead to tailored treatment options, enhancing patient outcomes. As the healthcare landscape evolves, collaboration between pharmaceutical companies and technology firms will be crucial in addressing emerging health challenges and improving overall healthcare delivery in Belgium.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biopharmaceuticals Vaccines Generics Orphan Drugs Biosimilars Others |

| By End-User | Hospitals Retail Pharmacies Online Pharmacies Clinics Government Health Programs Contract Research Organizations (CROs) Others |

| By Distribution Channel | Direct Sales Wholesalers Distributors E-commerce Hospital Pharmacies Others |

| By Therapeutic Area | Cardiovascular Oncology Neurology Infectious Diseases Endocrinology Immunology Respiratory Others |

| By Formulation | Tablets Injectables Topicals Liquids Inhalers Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Cost-Plus Pricing Reference Pricing Others |

| By Market Segment | Specialty Pharmaceuticals Generic Pharmaceuticals OTC Pharmaceuticals Biosimilars Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Sector | 80 | Pharmacy Owners, Retail Pharmacists |

| Healthcare Professionals | 70 | General Practitioners, Specialists |

| Patient Experience and Adherence | 60 | Chronic Disease Patients, Caregivers |

| Pharmaceutical Manufacturers | 50 | Product Managers, Regulatory Affairs Specialists |

| Market Access and Payers | 40 | Health Economists, Insurance Analysts |

The Belgium pharmaceutical market is valued at approximately USD 8.5 billion, driven by factors such as an aging population, rising chronic diseases, and significant investments in research and development.