Region:Asia

Author(s):Dev

Product Code:KRAC3365

Pages:88

Published On:October 2025

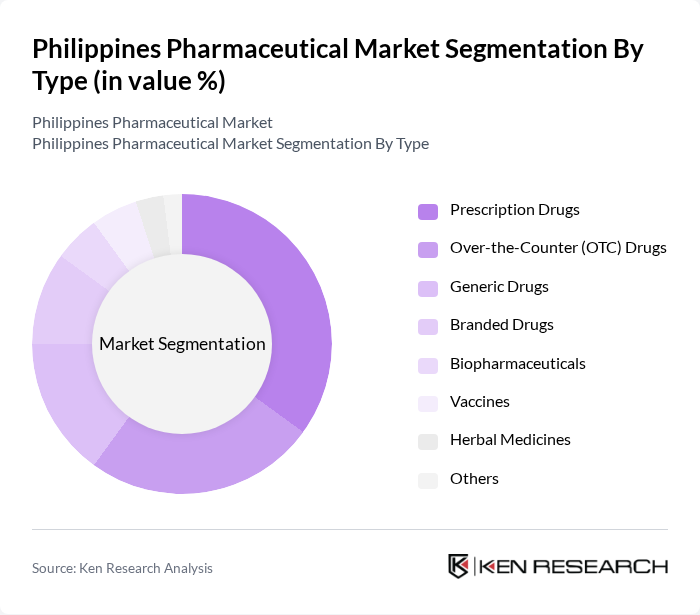

By Type:The pharmaceutical market can be segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Generic Drugs, Branded Drugs, Biopharmaceuticals, Vaccines, Herbal Medicines, and Others. Each of these sub-segments plays a crucial role in addressing the diverse healthcare needs of the population. The market is witnessing a shift towards affordable generics, expanding OTC and herbal remedies, and increased adoption of digital and online pharmacy services.

ThePrescription Drugssegment dominates the market due to the increasing prevalence of chronic diseases such as diabetes, hypertension, and cancer. This segment is characterized by a growing demand for innovative therapies and advanced treatment options. The rise in healthcare awareness and the expansion of health insurance coverage have also contributed to the increased consumption of prescription medications. Ongoing research and development efforts by pharmaceutical companies to introduce new drugs are expected to sustain the growth of this segment.

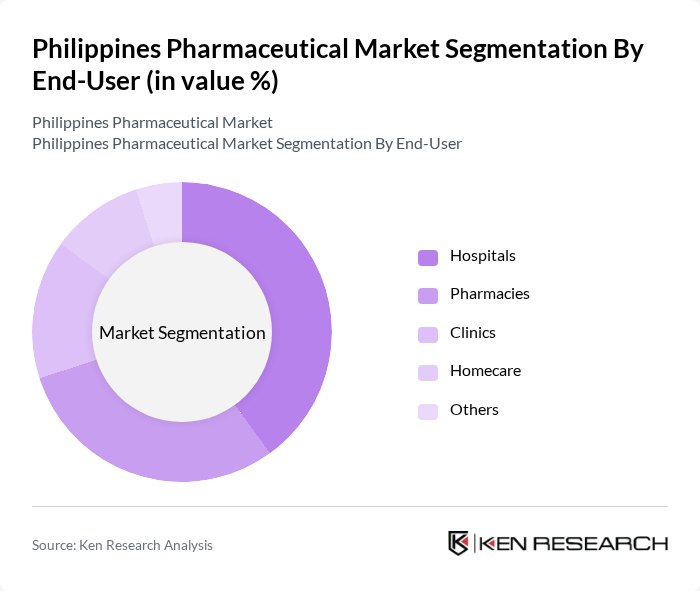

By End-User:The market can be segmented based on end-users, including Hospitals, Pharmacies, Clinics, Homecare, and Others. Each end-user category reflects the different channels through which pharmaceuticals are distributed and consumed. Hospitals and pharmacies remain the primary points of access, with hospitals leading due to the high volume of patients and expansion of healthcare facilities. Pharmacies are crucial for retail distribution, while clinics and homecare are growing as outpatient and preventive care trends increase.

Hospitalsrepresent the largest end-user segment, driven by the high volume of patients requiring medications for various treatments. The increasing number of healthcare facilities and the expansion of hospital services have led to a higher demand for pharmaceuticals. Additionally, the trend towards outpatient care and the growing focus on preventive healthcare are contributing to the rising consumption of medications in hospitals. Pharmacies also play a significant role, serving as the primary point of access for patients to obtain their medications.

The Philippines Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sanofi Philippines, Inc., GlaxoSmithKline Philippines, Inc., Pfizer Philippines, Inc., Merck Sharp & Dohme (MSD) Philippines, Abbott Laboratories (Philippines) Inc., Novartis Healthcare Philippines, Inc., Roche Philippines, Inc., AstraZeneca Pharmaceuticals (Philippines), Inc., United Laboratories, Inc. (Unilab), Zuellig Pharma Corporation, Pascual Laboratories, Inc., Ferring Pharmaceuticals Philippines, Inc., Eli Lilly and Company (Philippines), Inc., Hizon Laboratories, Inc., Interphil Laboratories, Inc., Lloyd Laboratories, Inc., Cathay Drug Company, Inc., Euro-Med Laboratories Phil., Inc., Metro Drug, Inc., RiteMed Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines pharmaceutical market is poised for significant transformation, driven by digital health innovations and a growing emphasis on personalized medicine. As telemedicine becomes more prevalent, healthcare providers are increasingly adopting technology to enhance patient engagement and treatment outcomes. Additionally, the focus on preventive healthcare is expected to reshape pharmaceutical offerings, encouraging the development of preventive therapies and wellness products. These trends will likely create a more dynamic and responsive market landscape, fostering growth and improving healthcare access.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Generic Drugs Branded Drugs Biopharmaceuticals Vaccines Herbal Medicines Others |

| By End-User | Hospitals Pharmacies Clinics Homecare Others |

| By Distribution Channel | Retail Pharmacies Hospital Pharmacies Online Pharmacies Wholesalers Others |

| By Therapeutic Area | Cardiovascular Diseases Oncology Central Nervous System Disorders Infectious Diseases Diabetes Others |

| By Price Range | Low-cost Mid-range Premium |

| By Packaging Type | Bottles Blisters Vials Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Market | 100 | Pharmacy Owners, Retail Managers |

| Hospital Pharmacy Operations | 60 | Pharmacy Directors, Hospital Pharmacists |

| Generic Drug Utilization | 50 | Healthcare Providers, Pharmacists |

| Prescription Drug Trends | 80 | Doctors, Medical Representatives |

| Patient Experience with Pharmaceuticals | 40 | Patients, Caregivers |

The Philippines Pharmaceutical Market is valued at approximately USD 3.3 billion, driven by factors such as rising healthcare expenditure, increasing prevalence of chronic diseases, and expanding access to innovative therapies and generic medications.