Region:Asia

Author(s):Shubham

Product Code:KRAB0822

Pages:95

Published On:August 2025

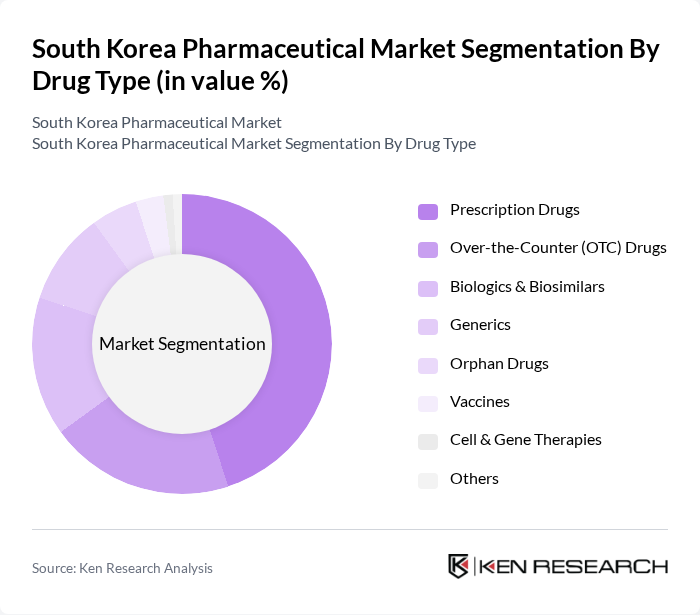

By Drug Type:The drug type segmentation includes Prescription Drugs, Over-the-Counter (OTC) Drugs, Biologics & Biosimilars, Generics, Orphan Drugs, Vaccines, Cell & Gene Therapies, and Others.Prescription drugsdominate the market, driven by the increasing prevalence of chronic diseases and growing demand for specialized treatments. The rise in healthcare expenditure, focus on personalized medicine, and rapid adoption of innovative therapies further bolster growth in this segment. Biologics and biosimilars are expanding rapidly due to South Korea's global leadership in biosimilar manufacturing and export .

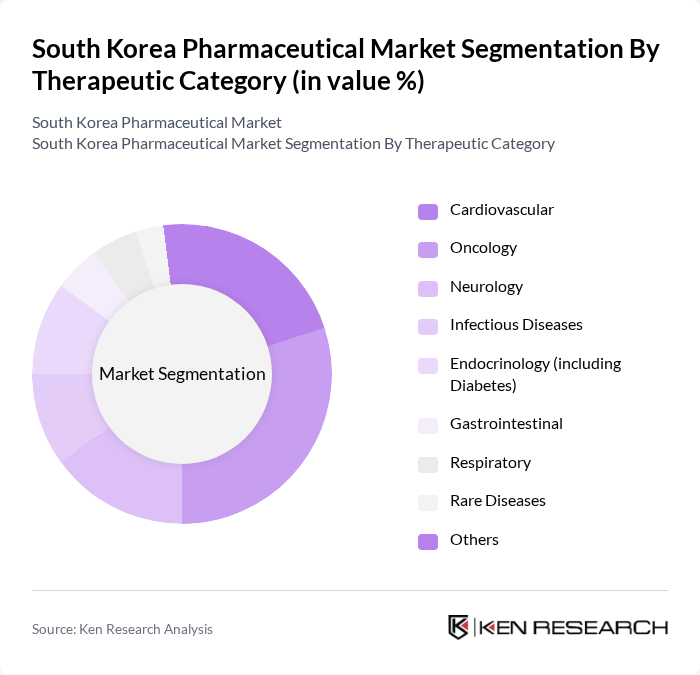

By Therapeutic Category:The therapeutic category segmentation encompasses Cardiovascular, Oncology, Neurology, Infectious Diseases, Endocrinology (including Diabetes), Gastrointestinal, Respiratory, Rare Diseases, and Others.Oncologyis the leading therapeutic area, driven by the rising incidence of cancer and demand for advanced treatment options. Accelerated MFDS approvals, robust domestic R&D funding, and a focus on precision medicine and targeted therapies contribute to the rapid expansion of this segment. Cardiovascular and neurology drugs also show strong growth, supported by government-led chronic disease awareness programs and increased clinical trial activity .

The South Korea Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Biologics, Hanmi Pharmaceutical Co., Ltd., LG Chem Ltd., SK Biopharmaceuticals Co., Ltd., Celltrion, Inc., Daewoong Pharmaceutical Co., Ltd., Chong Kun Dang Pharmaceutical Corp., Dong-A ST Co., Ltd., Yuhan Corporation, GC Biopharma (formerly Green Cross Corporation), Hanall Biopharma Co., Ltd., Ildong Pharmaceutical Co., Ltd., Medytox Inc., CJ Healthcare (now CJ Wellcare), Bukwang Pharmaceutical Co., Ltd., AbbVie Korea Ltd., AstraZeneca Korea, Bayer Korea Ltd., GlaxoSmithKline Korea (GSK Korea), F. Hoffmann-La Roche Ltd. (Roche Korea), Bristol Myers Squibb Korea, Eli Lilly Korea, Merck & Co., Inc. (MSD Korea), Sanofi-Aventis Korea contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean pharmaceutical market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in drug development is expected to streamline processes, reducing time-to-market for new therapies. Additionally, the rise of telemedicine and digital health solutions will enhance patient access to medications, fostering a more patient-centric approach in healthcare delivery. These trends indicate a dynamic future for the pharmaceutical sector, with opportunities for innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Drug Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biologics & Biosimilars Generics Orphan Drugs Vaccines Cell & Gene Therapies Others |

| By Therapeutic Category | Cardiovascular Oncology Neurology Infectious Diseases Endocrinology (including Diabetes) Gastrointestinal Respiratory Rare Diseases Others |

| By Distribution Channel | Retail Pharmacies Hospital Pharmacies E-commerce Wholesalers/Distributors Others |

| By End-User | Hospitals Clinics Homecare Research Institutions Others |

| By Region | Seoul Busan Incheon Daegu Gwangju Daejeon Ulsan Others |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Compliance | MFDS Approved FDA Approved EMA Approved Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Drug Prescriptions | 100 | Oncologists, Clinical Pharmacists |

| Cardiovascular Medication Usage | 80 | Cardiologists, General Practitioners |

| Patient Experience with Generic Drugs | 60 | Patients, Pharmacists |

| Market Trends in Biopharmaceuticals | 50 | Biotech Researchers, Regulatory Affairs Specialists |

| Healthcare Policy Impact on Drug Access | 40 | Health Economists, Policy Makers |

The South Korea pharmaceutical market is valued at approximately USD 28.8 billion, driven by factors such as an aging population, increased healthcare spending, and advancements in biotechnology and pharmaceuticals.