Region:Middle East

Author(s):Rebecca

Product Code:KRAC9699

Pages:80

Published On:November 2025

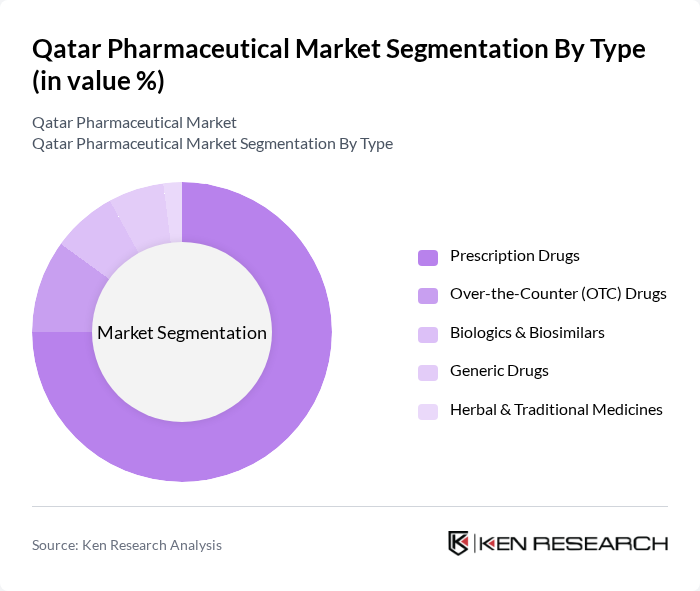

By Type:The pharmaceutical market is segmented into Prescription Drugs, Over-the-Counter (OTC) Drugs, Biologics & Biosimilars, Generic Drugs, and Herbal & Traditional Medicines. Prescription Drugs dominate the market, accounting for the majority share due to the high prevalence of chronic and infectious diseases and the widespread trust in physician-recommended treatments. OTC drugs are experiencing increased demand as consumers become more health-conscious and seek convenient options for minor ailments. Biologics & Biosimilars are gaining traction with the rising focus on specialized therapies, while generic drugs and herbal medicines continue to serve cost-sensitive and traditional segments.

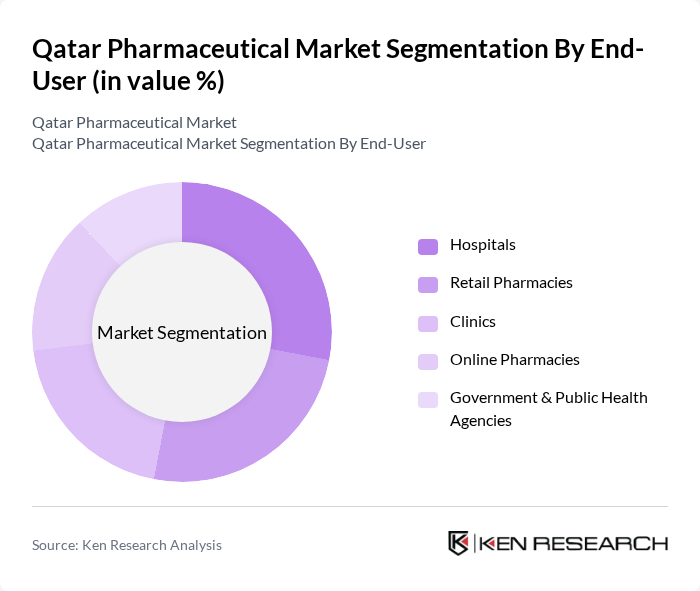

By End-User:The end-user segmentation includes Hospitals, Retail Pharmacies, Clinics, Online Pharmacies, and Government & Public Health Agencies. Hospitals are the leading end-user segment, accounting for the largest share due to the high volume of patients and the dominance of hospital-based pharmacies. Retail pharmacies remain significant for public access to medications, while online pharmacies are expanding rapidly due to the convenience of home delivery and digital health trends. Clinics and government agencies contribute to specialized and public health-focused distribution.

The Qatar Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Pharma, Doha Pharma, Gulf Pharmaceutical Industries (Julphar), Al Ahli Pharmaceutical, Qatar Biotech, United Pharmaceutical Manufacturing Company, Al Jazeera Pharmaceutical, Aster DM Healthcare, Hikma Pharmaceuticals, Novartis Qatar, Pfizer Qatar, Sanofi Qatar, Merck Qatar, Roche Qatar, Sandoz Qatar, Mylan Pharmaceuticals Qatar, Teva Pharmaceuticals Qatar, Amoun Pharmaceutical Qatar, Pharmaplast Qatar, Sidra Medicine contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar pharmaceutical market appears promising, driven by ongoing investments in healthcare infrastructure and a growing emphasis on innovative treatments. As the population ages and the prevalence of chronic diseases rises, the demand for advanced pharmaceuticals is expected to increase. Additionally, the integration of digital health solutions and telemedicine is likely to enhance patient access to medications, further shaping the market dynamics. Collaborative efforts with international firms will also play a crucial role in fostering innovation and expanding the local pharmaceutical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biologics & Biosimilars Generic Drugs Herbal & Traditional Medicines |

| By End-User | Hospitals Retail Pharmacies Clinics Online Pharmacies Government & Public Health Agencies |

| By Therapeutic Area | Cardiovascular Oncology Neurology Infectious Diseases Endocrinology (Diabetes) Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Wholesale Stores Specialty Stores |

| By Region | Doha Al Rayyan Al Wakrah Others |

| By Product Formulation | Tablets Injectables Topicals Liquids Others |

| By Policy Support | Subsidies for local manufacturers Tax incentives for R&D Grants for healthcare innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Pharmacy Insights | 100 | Pharmacy Owners, Store Managers |

| Hospital Pharmacy Operations | 80 | Pharmacists, Hospital Administrators |

| Healthcare Provider Perspectives | 70 | Doctors, Nurses, Healthcare Administrators |

| Patient Experience Surveys | 90 | Patients, Caregivers |

| Regulatory Insights | 50 | Regulatory Affairs Specialists, Compliance Officers |

The Qatar Pharmaceutical Market is valued at approximately USD 480 million, reflecting significant growth driven by increased healthcare expenditure, a rising prevalence of chronic diseases, and a demand for specialized medical treatments.