Region:Europe

Author(s):Shubham

Product Code:KRAC0598

Pages:100

Published On:August 2025

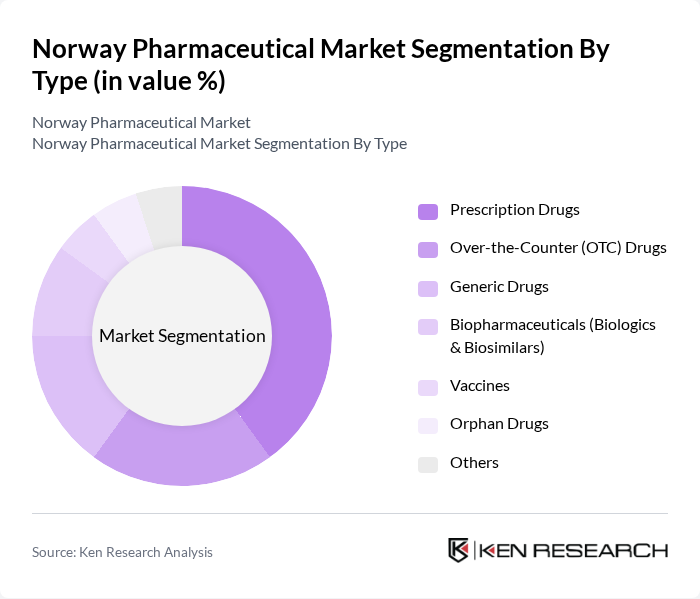

By Type:The pharmaceutical market can be segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Generic Drugs, Biopharmaceuticals (Biologics & Biosimilars), Vaccines, Orphan Drugs, and Others. Each of these subsegments plays a crucial role in addressing different healthcare needs and preferences among consumers.

The Prescription Drugs subsegment dominates the market due to the increasing prevalence of chronic diseases and the growing demand for advanced therapies. Patients increasingly rely on prescription medications for managing conditions such as diabetes, cardiovascular diseases, respiratory diseases, and cancer; expanding use of specialty and biologic therapies reinforces this dominance. The rise in healthcare expenditure and the focus on personalized medicine further contribute to the growth of this subsegment, making it a critical area for pharmaceutical companies.

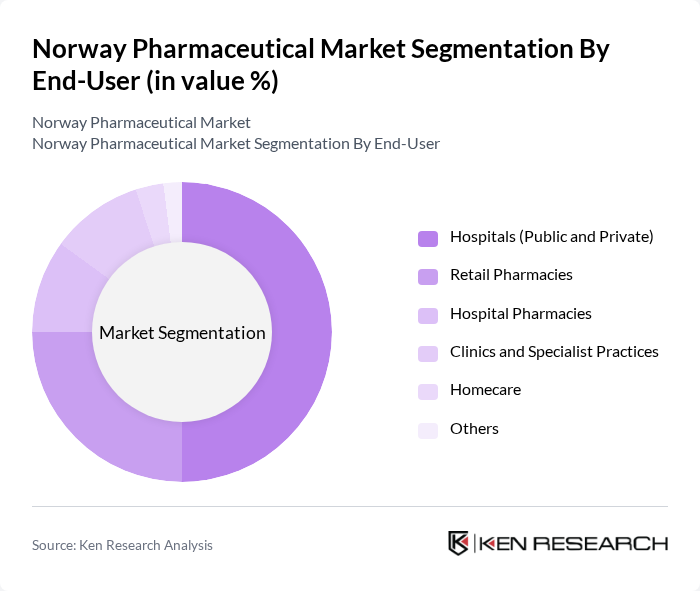

By End-User:The pharmaceutical market can also be segmented by end-user categories, including Hospitals (Public and Private), Retail Pharmacies, Hospital Pharmacies, Clinics and Specialist Practices, Homecare, and Others. Each of these segments serves different patient demographics and healthcare delivery models.

The Hospitals (Public and Private) segment is the largest end-user category, driven by the high volume of patients requiring medications for various treatments. Hospitals are increasingly investing in advanced medical technologies and therapies, leading to a higher demand for prescription drugs and biopharmaceuticals; complex therapies such as oncology and immunology are primarily initiated and managed in hospital settings. The focus on improving patient outcomes and the integration of healthcare services further solidify the dominance of this segment in the pharmaceutical market.

The Norway Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer AS (Norway), Novartis Norge AS, Roche Norge AS, AstraZeneca AS (Norway), Sanofi AS (Norway), Merck (MSD) Norge AS, Johnson & Johnson (Janssen-Cilag AS, Norway), GSK (GlaxoSmithKline AS, Norway), Bayer AS (Norway), Boehringer Ingelheim Norge AS, AbbVie AS (Norway), Amgen AB, Norway Branch, Takeda AS (Norway), Eli Lilly Norge AS, Teva Norway AS, STADA Arzneimittel Norge AS, Viatris AS (Norway), Orion Pharma AS (Norway), Apotek Hjertemedier AS (Retail Pharmacy Group), Apotek 1 Gruppen AS (Retail Pharmacy Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical market in Norway appears promising, driven by technological advancements and a growing focus on personalized medicine. As the healthcare system increasingly embraces digital health solutions, pharmaceutical companies are likely to invest in innovative therapies that cater to individual patient needs. Additionally, the expansion of telemedicine will facilitate better access to healthcare services, enhancing patient engagement and adherence to treatment regimens, ultimately benefiting the pharmaceutical sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Generic Drugs Biopharmaceuticals (Biologics & Biosimilars) Vaccines Orphan Drugs Others |

| By End-User | Hospitals (Public and Private) Retail Pharmacies Hospital Pharmacies Clinics and Specialist Practices Homecare Others |

| By Distribution Channel | Direct Sales to Hospitals Wholesalers/Distributors Retail Pharmacies Online Pharmacies/E-prescriptions Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology (CNS) Endocrinology (e.g., Diabetes) Infectious Diseases Immunology/Autoimmune Respiratory Others |

| By Formulation | Oral (Tablets/Capsules) Injectables (IV/IM/Subcutaneous) Inhalation Topicals Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing/Outcome-Based Agreements Reference Pricing/Reimbursement Bands Others |

| By Market Segment | Hospital Segment Retail Segment Institutional/Public Procurement Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Market | 120 | Pharmacy Owners, Retail Pharmacists |

| Hospital Pharmacy Operations | 100 | Hospital Pharmacists, Pharmacy Directors |

| Generic Drug Market Insights | 80 | Generic Drug Manufacturers, Regulatory Affairs Specialists |

| Patient Adherence Programs | 70 | Healthcare Providers, Patient Advocacy Groups |

| Pharmaceutical Marketing Strategies | 90 | Marketing Managers, Brand Managers |

The Norway Pharmaceutical Market is valued at approximately USD 3.1 billion, reflecting a significant growth driven by factors such as an aging population, increasing chronic diseases, and advancements in biotechnology and pharmaceuticals.