Region:Central and South America

Author(s):Rebecca

Product Code:KRAA4833

Pages:100

Published On:September 2025

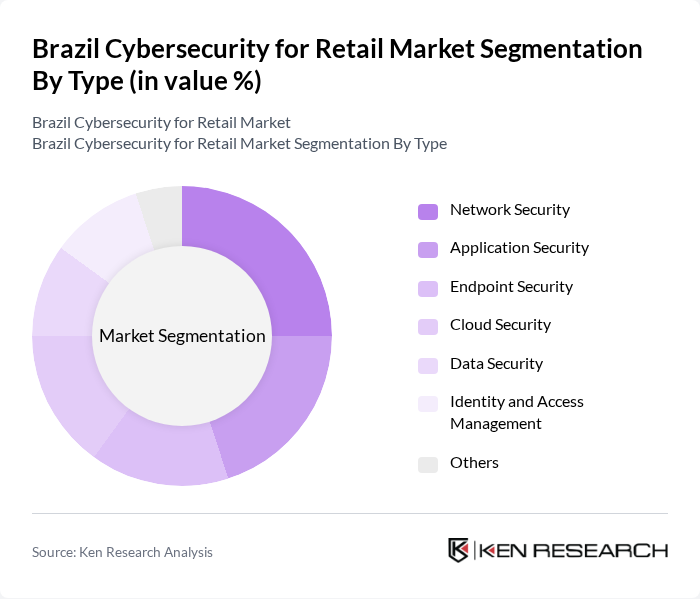

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a crucial role in protecting retail businesses from cyber threats.

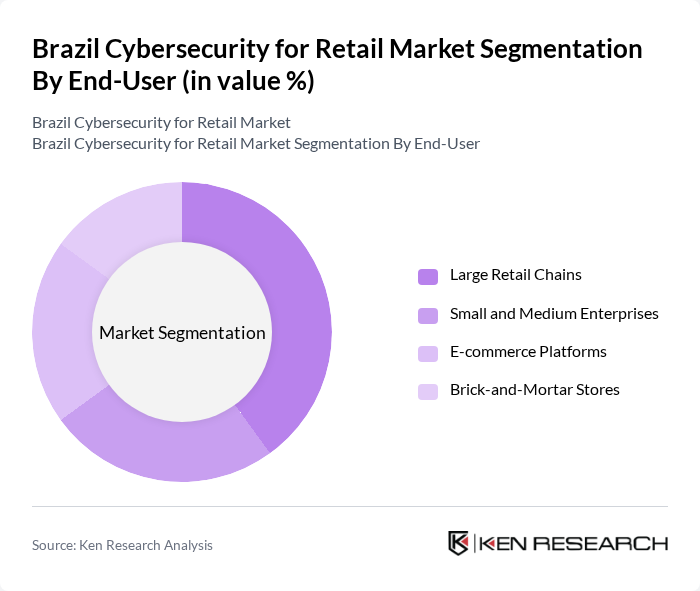

By End-User:The end-user segmentation includes Large Retail Chains, Small and Medium Enterprises, E-commerce Platforms, and Brick-and-Mortar Stores. Each segment has unique cybersecurity needs based on their operational scale and digital presence.

The Brazil Cybersecurity for Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Security, Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., McAfee Corp., Trend Micro Incorporated, FireEye, Inc., CrowdStrike Holdings, Inc., Sophos Group plc, Kaspersky Lab, Bitdefender LLC, CyberArk Software Ltd., RSA Security LLC, Proofpoint, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian cybersecurity landscape for retail is poised for transformative growth, driven by increasing digitalization and regulatory pressures. As retailers enhance their cybersecurity frameworks, the adoption of advanced technologies such as artificial intelligence and machine learning will become prevalent. Additionally, the shift towards zero trust security models will redefine how retailers approach data protection. The focus on incident response and recovery will also intensify, ensuring that businesses can swiftly address breaches and minimize damage, fostering a more secure retail environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Large Retail Chains Small and Medium Enterprises E-commerce Platforms Brick-and-Mortar Stores |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers |

| By Deployment Mode | On-Premises Cloud-Based |

| By Industry Vertical | Fashion Retail Grocery Retail Electronics Retail Home Goods Retail |

| By Compliance Requirement | GDPR Compliance PCI DSS Compliance LGPD Compliance |

| By Policy Support | Government Grants Tax Incentives Subsidies for Cybersecurity Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cybersecurity Solutions for E-commerce | 100 | IT Security Managers, E-commerce Directors |

| Data Protection Strategies in Retail | 80 | Compliance Officers, Data Privacy Managers |

| Incident Response Planning | 70 | Risk Management Executives, IT Directors |

| Cybersecurity Training Programs | 60 | HR Managers, Training Coordinators |

| Threat Intelligence and Monitoring | 90 | Cybersecurity Analysts, Operations Managers |

The Brazil Cybersecurity for Retail Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased digitization, rising cyber threats, and compliance with data protection regulations like the General Data Protection Law (LGPD).