Region:Asia

Author(s):Rebecca

Product Code:KRAB1724

Pages:82

Published On:October 2025

By Solution Type:The solution type segmentation includes Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, and Other Solutions. Network Security remains the leading subsegment, reflecting the urgent need for advanced defenses against unauthorized access, ransomware, and other cyber threats. Retailers prioritize network security to safeguard critical systems and customer data, while cloud security and application security are also experiencing accelerated adoption due to the shift toward cloud-based retail operations and mobile commerce.

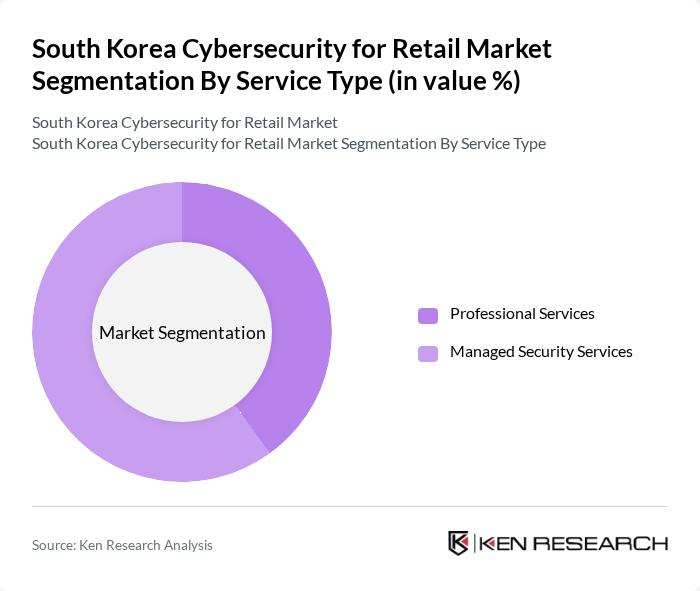

By Service Type:The service type segmentation encompasses Professional Services and Managed Security Services. Managed Security Services is the dominant subsegment, as retailers increasingly outsource cybersecurity operations to specialized providers for 24×7 monitoring, incident response, and compliance management. This trend is driven by the complexity of evolving threats, talent shortages, and the need for continuous protection across digital channels.

The South Korea Cybersecurity for Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, SK Infosec, LG CNS, Hanwha Vision, AhnLab, SoftCamp, Penta Security Systems, NSHC, INCA Internet, S-1 Corporation, Duzon Bizon, SecuLetter, CyberOne, TmaxSoft, Trend Micro contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean cybersecurity landscape for retail is poised for transformative growth, driven by technological advancements and increasing regulatory scrutiny. As retailers adopt AI and machine learning technologies, the ability to predict and mitigate cyber threats will enhance significantly. Furthermore, the shift towards managed security services will allow businesses to focus on core operations while outsourcing cybersecurity needs. This evolving environment will foster innovation and collaboration, ultimately leading to a more secure retail ecosystem in South Korea.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Other Solutions |

| By Service Type | Professional Services Managed Security Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-User Vertical | Retail Chains E-commerce Platforms Brick-and-Mortar Stores Specialty Retail |

| By Region | Seoul Busan Incheon Others |

| By Compliance Requirement | PCI DSS Compliance Personal Information Protection Act (PIPA) ISO 27001 Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cybersecurity Practices in Large Retail Chains | 60 | IT Security Managers, Chief Information Officers |

| Small to Medium Retailer Cybersecurity Strategies | 50 | Operations Managers, IT Directors |

| Impact of Cyber Threats on Retail Operations | 40 | Risk Management Officers, Compliance Managers |

| Investment in Cybersecurity Solutions | 45 | Procurement Officers, Financial Analysts |

| Consumer Perception of Retail Cybersecurity | 55 | Marketing Managers, Customer Experience Directors |

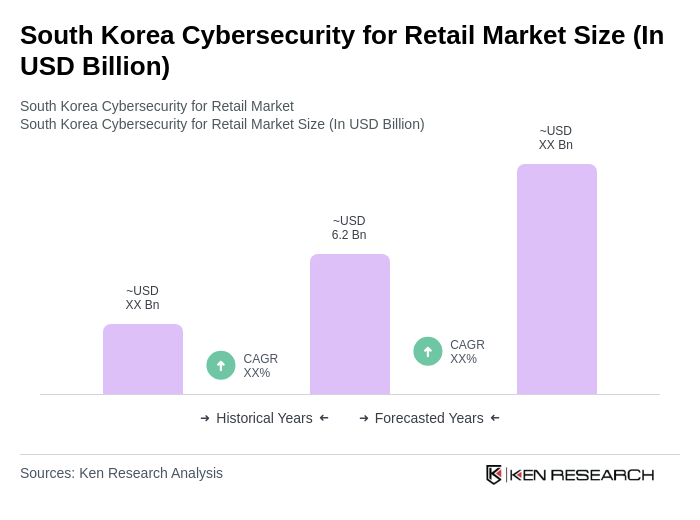

The South Korea Cybersecurity for Retail Market is valued at approximately USD 6.2 billion, reflecting significant growth driven by increasing cyber threats, the adoption of digital payment systems, and the expansion of e-commerce platforms.