Region:North America

Author(s):Geetanshi

Product Code:KRAA6060

Pages:96

Published On:September 2025

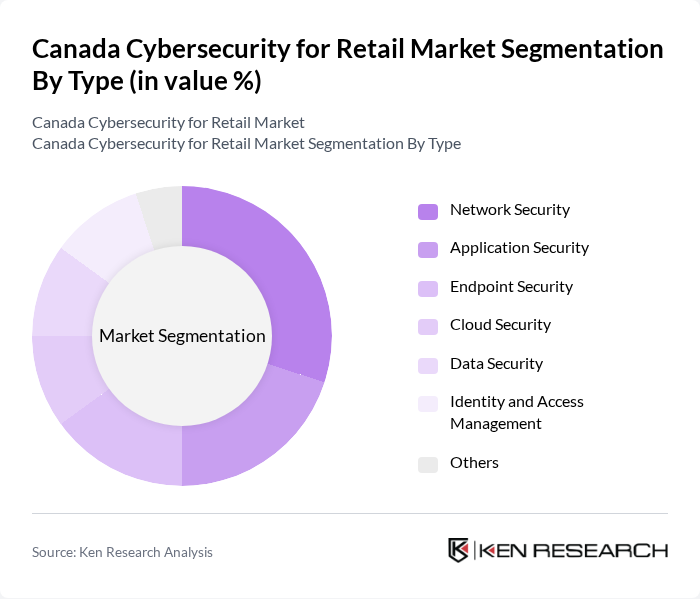

By Type:The segmentation by type includes various cybersecurity solutions tailored for retail businesses. The subsegments are Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, and Others. Among these, Network Security is currently the leading subsegment due to the increasing need for secure network infrastructures to protect against data breaches and cyber threats.

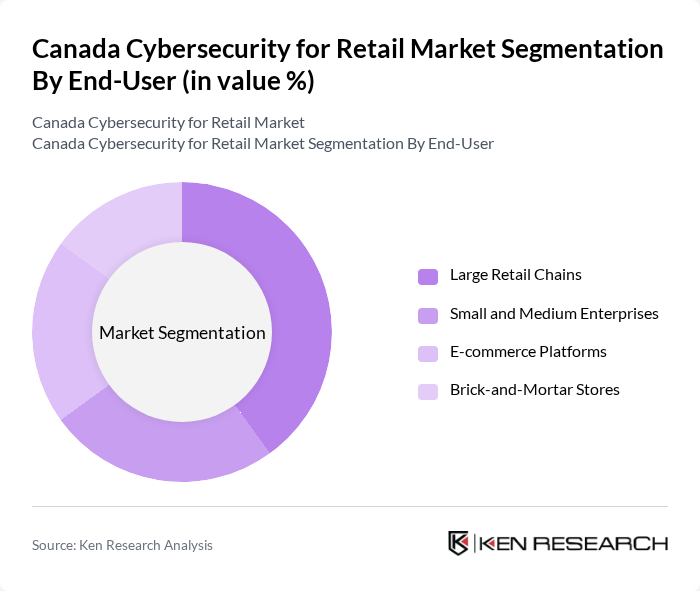

By End-User:The end-user segmentation includes Large Retail Chains, Small and Medium Enterprises, E-commerce Platforms, and Brick-and-Mortar Stores. Large Retail Chains dominate this segment as they require comprehensive cybersecurity solutions to protect vast amounts of customer data and maintain operational continuity across multiple locations.

The Canada Cybersecurity for Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fortinet, Inc., Palo Alto Networks, Inc., Cisco Systems, Inc., Check Point Software Technologies Ltd., McAfee Corp., Trend Micro Incorporated, IBM Security, FireEye, Inc., CrowdStrike Holdings, Inc., Sophos Group plc, NortonLifeLock Inc., RSA Security LLC, CyberArk Software Ltd., Splunk Inc., Zscaler, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape in Canada's retail sector appears promising, driven by technological advancements and increasing regulatory scrutiny. As retailers continue to adopt innovative solutions, such as artificial intelligence and machine learning, the effectiveness of cybersecurity measures is expected to improve significantly. Additionally, the growing emphasis on data privacy will likely lead to more stringent regulations, compelling retailers to enhance their security frameworks and invest in comprehensive cybersecurity strategies to protect consumer data.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Large Retail Chains Small and Medium Enterprises E-commerce Platforms Brick-and-Mortar Stores |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers |

| By Deployment Mode | On-Premises Cloud-Based |

| By Region | Ontario Quebec British Columbia Alberta Others |

| By Compliance Standards | PCI DSS ISO 27001 NIST Cybersecurity Framework |

| By Policy Support | Government Grants Tax Incentives Training Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cybersecurity Strategies in E-commerce | 100 | eCommerce Managers, IT Security Directors |

| Data Protection Measures in Brick-and-Mortar Retail | 80 | Store Managers, Compliance Officers |

| Incident Response Planning in Retail | 70 | Risk Management Executives, IT Managers |

| Investment in Cybersecurity Technologies | 90 | Chief Information Officers, Procurement Managers |

| Consumer Trust and Data Privacy in Retail | 85 | Marketing Directors, Customer Experience Managers |

The Canada Cybersecurity for Retail Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increasing cyber threats and the adoption of digital payment systems and e-commerce platforms.