Region:Europe

Author(s):Rebecca

Product Code:KRAB1748

Pages:86

Published On:October 2025

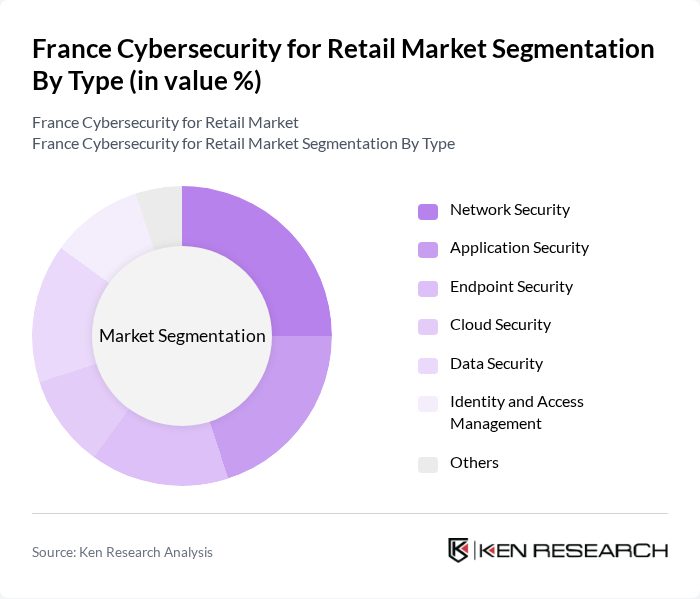

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments addresses specific security challenges faced by retailers, such as protecting payment systems, securing customer data, and defending against ransomware and phishing attacks .

The leading subsegment in this category isNetwork Security, which is essential for protecting the integrity and confidentiality of data transmitted across retail networks. With the increasing number of targeted attacks on retail infrastructure and payment systems, businesses are prioritizing investments in advanced network security solutions to safeguard operations and customer data. This trend is reinforced by compliance requirements and the growing awareness of the financial and reputational risks associated with data breaches .

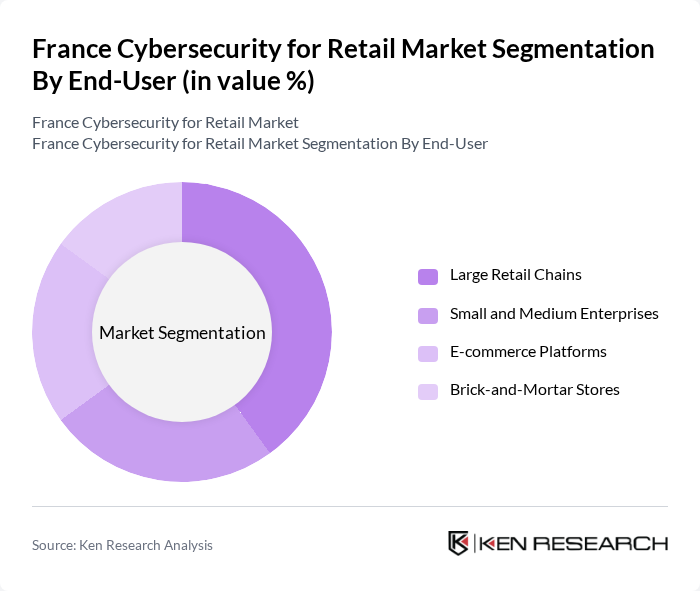

By End-User:The market is segmented by end-user into Large Retail Chains, Small and Medium Enterprises, E-commerce Platforms, and Brick-and-Mortar Stores. Each segment has unique cybersecurity needs based on their operational scale and customer interaction, with e-commerce platforms and large chains facing heightened risks due to higher transaction volumes and data sensitivity .

Large Retail Chainsdominate the market due to their extensive customer bases, significant transaction volumes, and the large amounts of sensitive data they manage. These organizations are more likely to invest in comprehensive cybersecurity solutions to protect their reputation and ensure regulatory compliance. The increasing frequency of cyberattacks targeting large retailers has further accelerated investments in advanced security measures, making them the leading end-user segment .

The France Cybersecurity for Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atos SE, Thales Group, Orange CyberDefense, Capgemini SE, Sogeti, Stormshield, Check Point Software Technologies Ltd., Fortinet, Inc., Palo Alto Networks, Inc., IBM Security, Cisco Systems, Inc., McAfee Corp., Trend Micro Incorporated, FireEye, Inc., CrowdStrike Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity market for retail in France appears promising, driven by technological advancements and increasing awareness of cyber threats. As retailers continue to adopt digital transformation strategies, the demand for innovative security solutions will rise. Additionally, the integration of artificial intelligence and machine learning in cybersecurity practices is expected to enhance threat detection and response capabilities. This evolution will likely lead to a more resilient retail sector, better equipped to handle emerging cyber threats and regulatory challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Large Retail Chains Small and Medium Enterprises E-commerce Platforms Brick-and-Mortar Stores |

| By Application | Payment Security Customer Data Protection Fraud Detection Compliance Management |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Fashion Retail Grocery Retail Electronics Retail Home Improvement Retail |

| By Policy Support | Subsidies for Cybersecurity Investments Tax Incentives for Cybersecurity Solutions Grants for Cybersecurity Training Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cybersecurity Solutions for E-commerce | 100 | IT Security Managers, E-commerce Directors |

| In-store Security Systems | 60 | Store Managers, Loss Prevention Officers |

| Data Protection Compliance | 50 | Compliance Officers, Legal Advisors |

| Consumer Awareness of Cyber Threats | 70 | General Consumers, Retail Shoppers |

| Investment in Cybersecurity Technologies | 80 | Chief Information Officers, IT Directors |

The France Cybersecurity for Retail Market is valued at approximately USD 7.3 billion. This valuation reflects a five-year historical analysis of the broader cybersecurity sector and the retail industry's share within it, driven by increasing cyber threats and e-commerce growth.