Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA8022

Pages:92

Published On:September 2025

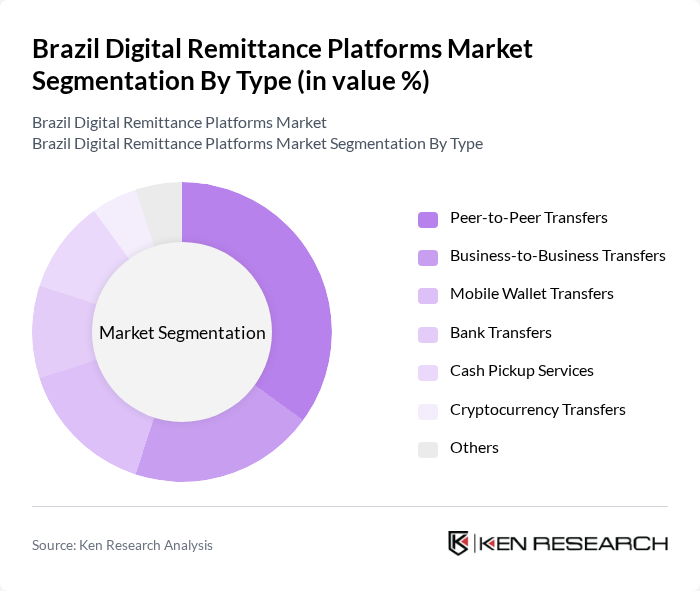

By Type:The market can be segmented into various types of digital remittance services, including Peer-to-Peer Transfers, Business-to-Business Transfers, Mobile Wallet Transfers, Bank Transfers, Cash Pickup Services, Cryptocurrency Transfers, and Others. Among these, Peer-to-Peer Transfers have emerged as the leading sub-segment due to their user-friendly interfaces and the growing trend of individuals sending money directly to friends and family. The convenience and speed of these transactions have made them increasingly popular among consumers.

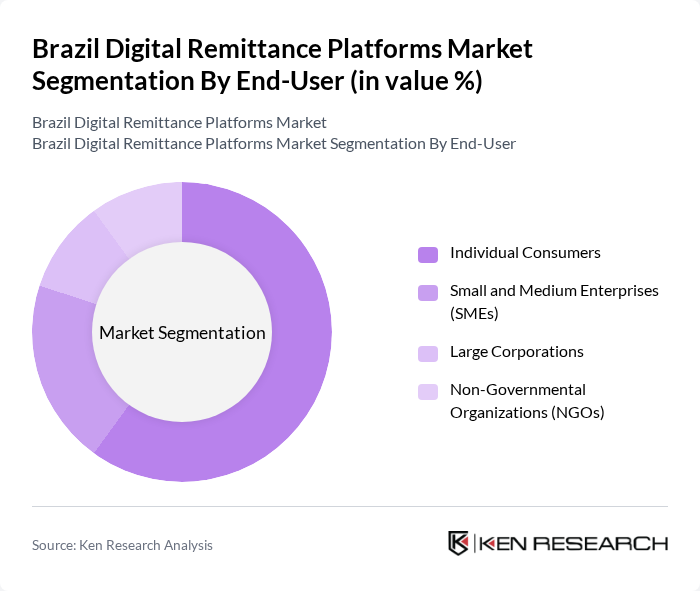

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this segment, driven by the need for personal remittances among families and friends. The increasing reliance on digital platforms for everyday transactions has further solidified the position of individual consumers as the primary users of digital remittance services.

The Brazil Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Remessa Online, Wise (formerly TransferWise), Western Union, MoneyGram, PayPal, PicPay, Banco do Brasil, Nubank, C6 Bank, Mercado Pago, PagSeguro, Wise (formerly TransferWise), Xoom, Remitly, Revolut contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital remittance market appears promising, driven by technological advancements and evolving consumer preferences. As blockchain technology gains traction, it is expected to enhance transaction security and reduce costs. Additionally, the shift towards mobile-first solutions will likely continue, catering to the growing smartphone user base. With increasing remittance volumes from expatriates and a focus on user experience, platforms that innovate and adapt to these trends will be well-positioned for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Transfers Business-to-Business Transfers Mobile Wallet Transfers Bank Transfers Cash Pickup Services Cryptocurrency Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Cash Payments |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Customer Demographics | Age Groups Income Levels Geographic Distribution |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brazilian Expatriates Using Remittance Services | 150 | Individuals aged 18-65, residing in the US and sending money to Brazil |

| Digital Remittance Platform Users | 100 | Users of platforms like mobile apps and online services for remittances |

| Financial Advisors and Consultants | 80 | Professionals providing financial advice to expatriates and immigrants |

| Regulatory Bodies and Policy Makers | 50 | Officials involved in remittance regulations and financial inclusion initiatives |

| Technology Providers in Fintech | 70 | Executives from companies providing technology solutions for remittance services |

The Brazil Digital Remittance Platforms Market is valued at approximately USD 10 billion, reflecting significant growth driven by the increasing number of Brazilians living abroad and the rising adoption of digital payment solutions.