Region:Central and South America

Author(s):Rebecca

Product Code:KRAA6101

Pages:90

Published On:September 2025

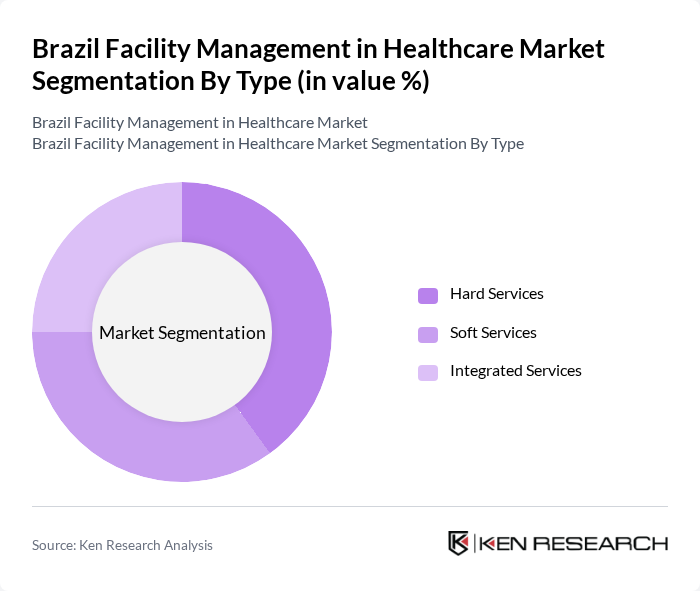

By Type:The market is segmented into Hard Services, Soft Services, and Integrated Services. Hard Services include maintenance and repair of physical assets, while Soft Services encompass cleaning, catering, and security. Integrated Services combine both hard and soft services to provide a comprehensive management solution. The demand for integrated services is growing as healthcare facilities seek streamlined operations and cost efficiencies.

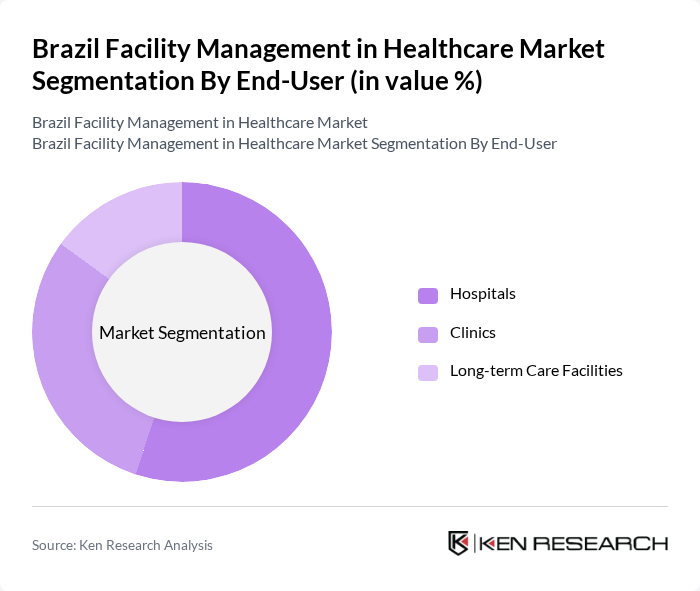

By End-User:The market is categorized into Hospitals, Clinics, and Long-term Care Facilities. Hospitals represent the largest segment due to their complex operational needs and regulatory requirements. Clinics and long-term care facilities also contribute significantly, driven by the increasing demand for outpatient services and elder care. The trend towards outpatient care is influencing the growth of facility management services in clinics.

The Brazil Facility Management in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo Brasil, Grupo Serval, JLL Brasil, CBRE Brasil, G4S Brasil, Prosegur Brasil, Atento, Tenda Atacado, Grupo Madero, Grupo SBF, Grupo Pão de Açúcar, Unimed, Hospital de Câncer de Barretos, Hospital das Clínicas contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Brazil's healthcare sector appears promising, driven by ongoing investments in technology and infrastructure. As the government continues to prioritize healthcare improvements, facility management services will increasingly focus on integrating smart technologies and sustainable practices. Additionally, the shift towards patient-centric care will necessitate innovative solutions that enhance operational efficiency and patient satisfaction. These trends indicate a dynamic landscape for facility management, with significant opportunities for growth and development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services |

| By End-User | Hospitals Clinics Long-term Care Facilities |

| By Service Model | Outsourced Services In-house Services |

| By Facility Type | Acute Care Facilities Rehabilitation Centers Diagnostic Centers |

| By Region | Southeast Brazil South Brazil North Brazil |

| By Investment Source | Private Investment Public Funding International Aid |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Facility Management | 150 | Facility Managers, Operations Directors |

| Outpatient Clinic Management | 100 | Clinic Administrators, Facility Coordinators |

| Healthcare Technology Integration | 80 | IT Managers, Biomedical Engineers |

| Regulatory Compliance in Facilities | 70 | Compliance Officers, Quality Assurance Managers |

| Emergency Preparedness in Healthcare Facilities | 60 | Emergency Management Coordinators, Safety Officers |

The Brazil Facility Management in Healthcare Market is valued at approximately USD 5 billion, reflecting a significant growth driven by the increasing demand for healthcare services and the expansion of healthcare facilities across the country.