Region:Europe

Author(s):Dev

Product Code:KRAA7253

Pages:92

Published On:September 2025

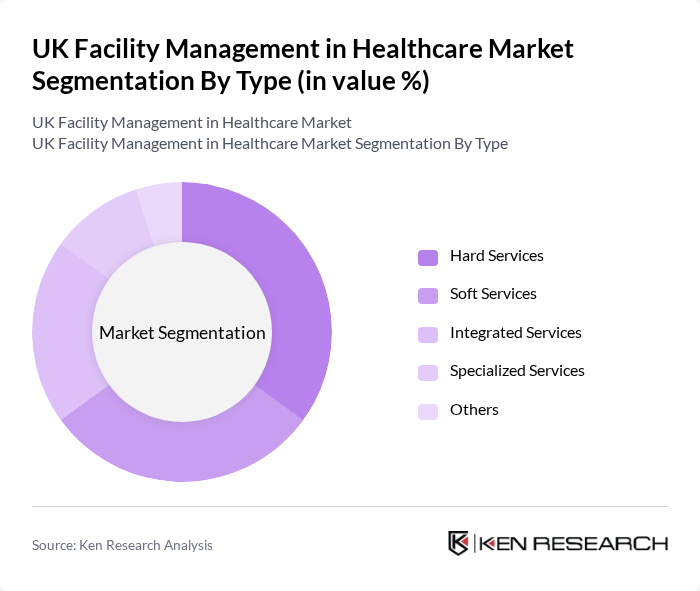

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services include cleaning and catering. Integrated Services combine both hard and soft services for a holistic approach. Specialized Services cater to specific needs, such as waste management and security. Others may include ancillary services that support healthcare operations.

The Hard Services segment is currently dominating the market due to the critical need for maintenance and repair of healthcare facilities. This includes essential services such as HVAC maintenance, electrical repairs, and plumbing, which are vital for ensuring operational efficiency and compliance with health regulations. The increasing focus on facility safety and reliability has led to a higher demand for these services, making them a priority for healthcare providers.

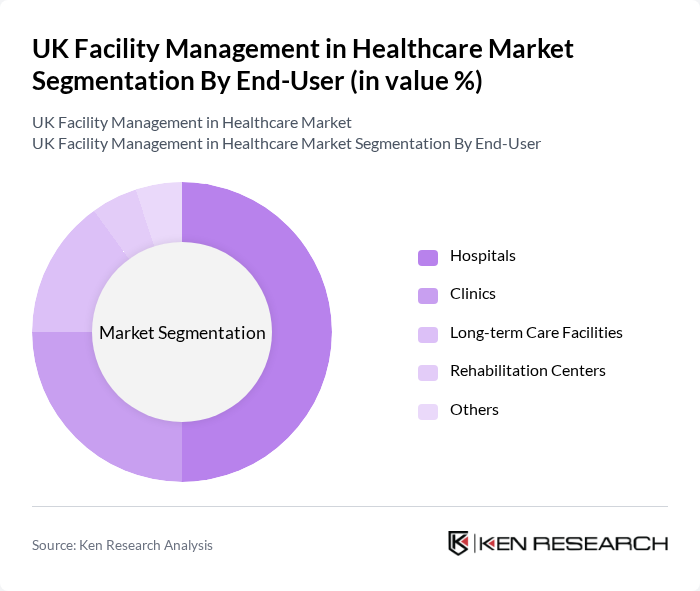

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Long-term Care Facilities, Rehabilitation Centers, and Others. Hospitals represent the largest segment due to their complex operational needs, followed by Clinics and Long-term Care Facilities, which also require specialized facility management services to ensure patient safety and comfort.

Hospitals are the leading end-user segment in the market, driven by their extensive operational requirements and the need for compliance with health and safety regulations. The complexity of hospital operations necessitates a comprehensive approach to facility management, including maintenance, cleaning, and security services. This demand is further fueled by the increasing patient volume and the need for enhanced patient experiences.

The UK Facility Management in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo, Mitie Group PLC, Serco Group PLC, Compass Group PLC, OCS Group UK, Bouygues Energies & Services, G4S Facilities Management, Aramark, CBRE Group, Engie Services, Vinci Facilities, Buro Happold, Apleona, Candover Green contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in the UK healthcare sector is poised for transformation, driven by technological advancements and a heightened focus on patient-centric care. As healthcare facilities increasingly adopt integrated management systems, the demand for data-driven decision-making will rise. Furthermore, the emphasis on sustainability will shape facility management practices, with a growing number of organizations committing to eco-friendly initiatives. These trends will create a dynamic environment for facility management providers, necessitating adaptability and innovation to meet evolving healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Rehabilitation Centers Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services |

| By Region | England Scotland Wales Northern Ireland |

| By Contract Type | Fixed-Term Contracts Performance-Based Contracts Framework Agreements |

| By Facility Type | Acute Care Facilities Outpatient Facilities Emergency Services |

| By Investment Source | Public Funding Private Investment Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Facility Management | 100 | Facility Managers, Operations Directors |

| Private Healthcare Facility Management | 80 | Procurement Managers, Facility Coordinators |

| Healthcare Technology Integration | 60 | IT Managers, Facility Management Consultants |

| Healthcare Compliance and Safety Management | 70 | Compliance Officers, Safety Managers |

| Healthcare Sustainability Initiatives | 50 | Sustainability Officers, Facility Management Executives |

The UK Facility Management in Healthcare Market is valued at approximately USD 15 billion, reflecting a significant growth driven by the increasing demand for efficient healthcare services and compliance with stringent regulations.