Region:North America

Author(s):Rebecca

Product Code:KRAB4792

Pages:85

Published On:October 2025

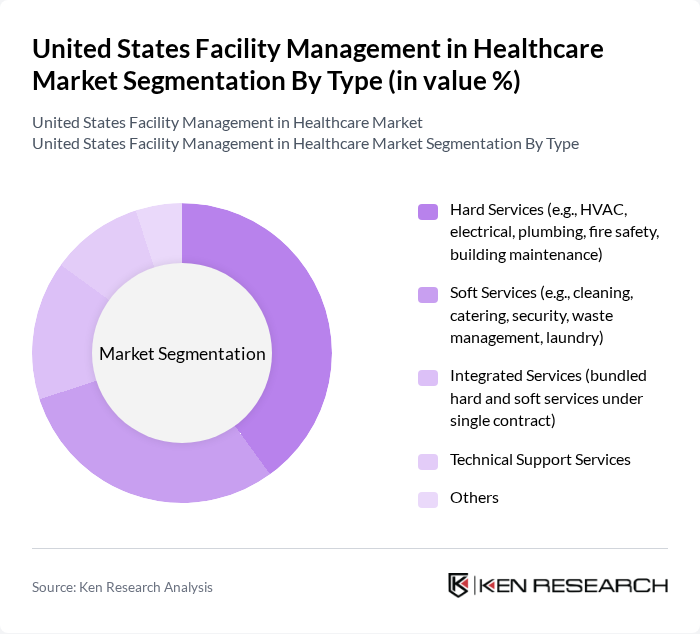

By Type:The market is segmented into various types of services that address the diverse operational and compliance needs of healthcare facilities. The primary segments include Hard Services (such as HVAC, electrical, plumbing, fire safety, and building maintenance), Soft Services (including cleaning, catering, security, waste management, and laundry), Integrated Services (bundling hard and soft services under a single contract), Technical Support Services (covering IT, medical equipment maintenance, and building management systems), and Others. Each segment is essential for ensuring the smooth, safe, and compliant operation of healthcare environments .

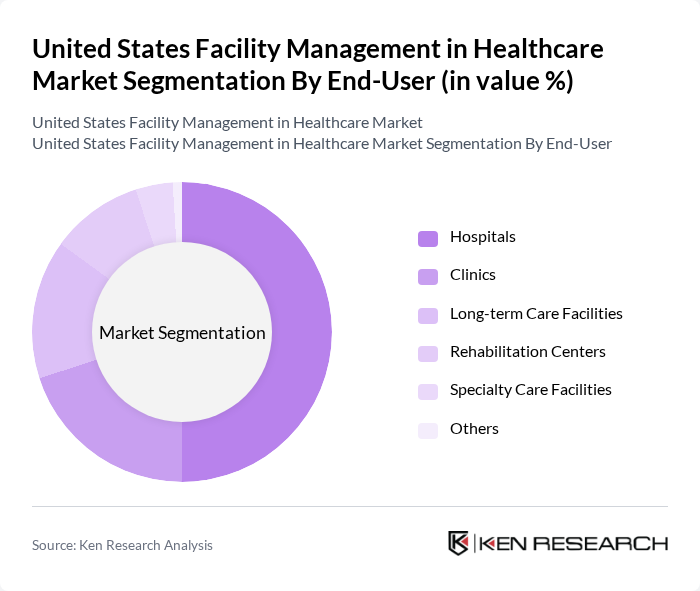

By End-User:The end-user segmentation reflects the varied healthcare facilities utilizing facility management services. This includes Hospitals (large-scale acute care settings), Clinics (outpatient and specialty care centers), Long-term Care Facilities (nursing homes and assisted living), Rehabilitation Centers (post-acute and therapy-focused facilities), Specialty Care Facilities (such as cancer centers and dialysis clinics), and Others. Each segment has distinct operational, regulatory, and patient care requirements, necessitating tailored facility management solutions to optimize efficiency and ensure compliance .

The United States Facility Management in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., Jones Lang LaSalle Incorporated (JLL), Cushman & Wakefield plc, ISS Facility Services, Inc., Aramark Corporation, Sodexo, Inc., ABM Industries Incorporated, EMCOR Group, Inc., GDI Integrated Facility Services Inc., Medxcel Facilities Management, HCA Healthcare, Inc., Tenet Healthcare Corporation, Universal Health Services, Inc., HealthTrust Purchasing Group, L.P., and Compass Group USA, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in healthcare is poised for significant transformation, driven by technological advancements and evolving patient expectations. As healthcare facilities increasingly adopt integrated management solutions, the focus will shift towards enhancing operational efficiency and patient safety. Additionally, the growing emphasis on sustainability will lead to the adoption of eco-friendly practices. These trends indicate a dynamic landscape where facility management will play a crucial role in shaping the future of healthcare delivery in the United States.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., HVAC, electrical, plumbing, fire safety, building maintenance) Soft Services (e.g., cleaning, catering, security, waste management, laundry) Integrated Services (bundled hard and soft services under single contract) Technical Support Services Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Rehabilitation Centers Specialty Care Facilities Others |

| By Service Model | Outsourced Services In-house Services Hybrid Model |

| By Facility Type | Acute Care Facilities Post-acute Care Facilities Non-acute Care Facilities Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Technology Integration | Building Management Systems IoT Solutions Energy Management Systems Advanced Analytics & AI Integration |

| By Investment Source | Private Investments Public Funding Grants and Subsidies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Facility Management | 120 | Facility Managers, Operations Directors |

| Outpatient Clinic Management | 90 | Clinic Administrators, Facility Coordinators |

| Long-term Care Facility Operations | 60 | Care Facility Managers, Compliance Officers |

| Healthcare Technology Integration | 50 | IT Managers, Facility Management Consultants |

| Emergency Services Facility Management | 40 | Emergency Department Managers, Safety Officers |

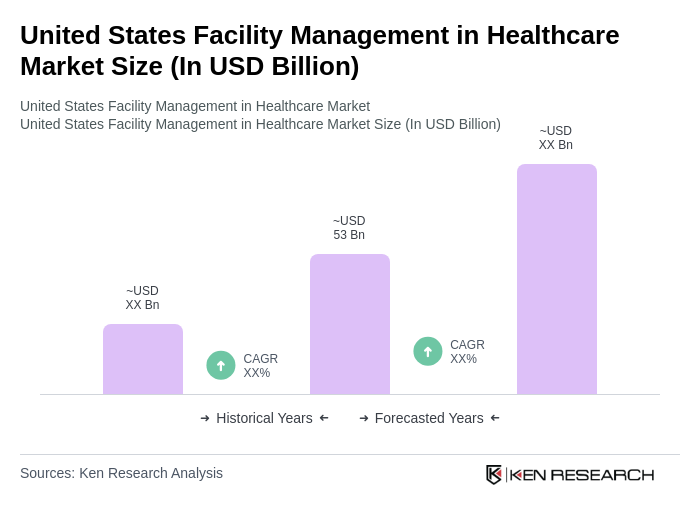

The United States Facility Management in Healthcare Market is valued at approximately USD 53 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient healthcare services and the adoption of advanced technologies.