Region:Asia

Author(s):Rebecca

Product Code:KRAB1743

Pages:86

Published On:October 2025

By Type:The market is segmented into various types of services that address the diverse operational needs of healthcare facilities. The primary segments include Hard Services (such as asset management, MEP & HVAC, fire systems & safety), Soft Services (cleaning, security, catering, office support), Integrated Services (bundled hard and soft services, end-to-end solutions), Specialized Services (healthcare compliance, infection control, medical equipment maintenance), and Others. Each segment plays a vital role in ensuring the smooth operation, regulatory compliance, and safety of healthcare environments. The adoption of integrated and specialized services is growing, driven by the increasing complexity of healthcare operations and the need for tailored solutions .

The Hard Services segment dominates the market, reflecting the critical importance of asset management and maintenance of essential systems such as HVAC and fire safety in healthcare facilities. The increasing complexity of healthcare environments and regulatory requirements necessitate robust management of physical assets to ensure compliance and operational efficiency. Preventive maintenance and the integration of advanced technologies, such as smart sensors and automation, are further driving demand for hard services. Integrated and specialized services are also gaining traction as healthcare providers seek comprehensive solutions for compliance and infection control .

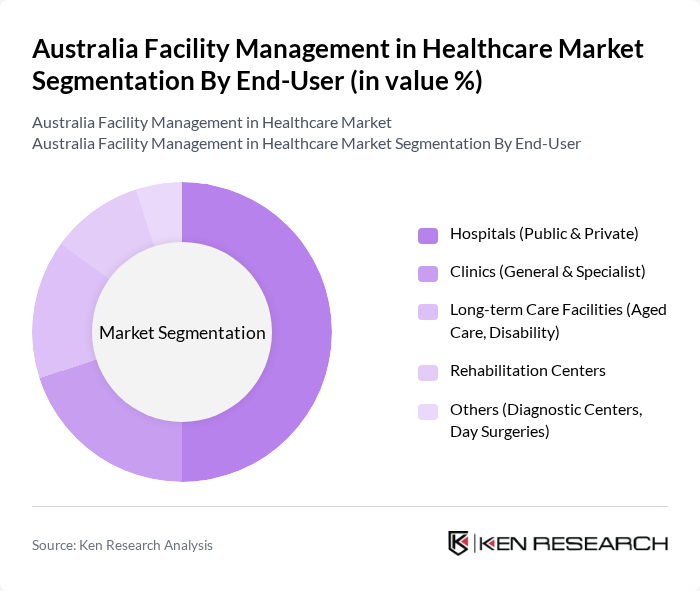

By End-User:The market is segmented by end-users, including Hospitals (Public & Private), Clinics (General & Specialist), Long-term Care Facilities (Aged Care, Disability), Rehabilitation Centers, and Others (Diagnostic Centers, Day Surgeries). Each category has distinct operational and compliance requirements, with hospitals representing the largest segment due to their extensive facility management needs and regulatory obligations. The growing number of hospitals, expansion of healthcare services, and increasing focus on patient safety and infection control are driving demand for comprehensive facility management solutions across all end-user categories .

Hospitals, both public and private, account for the largest end-user segment, driven by their complex operational requirements and stringent regulatory standards. The expansion of hospital infrastructure, increased healthcare investment, and heightened focus on infection prevention and control are key factors supporting this dominance. Other segments, including clinics and long-term care facilities, are also experiencing growth due to the rising demand for specialized healthcare services and the adoption of integrated facility management solutions .

The Australia Facility Management in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Spotless Group (Downer EDI Limited), CBRE Group, Inc., JLL (Jones Lang LaSalle), Sodexo, Compass Group PLC, Programmed Maintenance Services, Serco Group plc, Brookfield Global Integrated Solutions, Ventia, Cushman & Wakefield, G4S plc (Allied Universal), Aegis Facilities Services, Dusseldorp Services, HFM Asset Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Australia's healthcare sector appears promising, driven by ongoing technological advancements and increasing government investments. As healthcare facilities adapt to new operational models, the emphasis on patient-centric designs and integrated management solutions will likely grow. Additionally, the shift towards sustainable practices will shape facility management strategies, ensuring that healthcare providers can meet both regulatory requirements and patient expectations while optimizing resource utilization.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (Asset Management, MEP & HVAC, Fire Systems & Safety, Other Hard FM Services) Soft Services (Cleaning, Security, Catering, Office Support, Other Soft FM Services) Integrated Services (Bundled Hard & Soft Services, End-to-End Solutions) Specialized Services (Healthcare Compliance, Infection Control, Medical Equipment Maintenance) Others |

| By End-User | Hospitals (Public & Private) Clinics (General & Specialist) Long-term Care Facilities (Aged Care, Disability) Rehabilitation Centers Others (Diagnostic Centers, Day Surgeries) |

| By Service Model | Outsourced Services (Single, Bundled, Integrated FM) In-house Services Hybrid Services |

| By Region | New South Wales Victoria Queensland Western Australia Others (South Australia, Tasmania, ACT, Northern Territory) |

| By Compliance Type | Regulatory Compliance (Health, Safety, Building Codes) Environmental Compliance (Sustainability, Waste, Energy) Safety Compliance (Infection Control, Emergency Preparedness) |

| By Technology Adoption | Building Management Systems (BMS) IoT Solutions (Smart Sensors, Remote Monitoring) AI and Automation (Predictive Maintenance, Robotics) |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPPs) Others (Charitable, Community Funding) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Facility Management | 60 | Facility Managers, Operations Directors |

| Aged Care Facility Management | 40 | Care Facility Administrators, Compliance Officers |

| Healthcare Cleaning Services | 45 | Cleaning Supervisors, Procurement Managers |

| Healthcare Security Services | 40 | Security Managers, Risk Management Officers |

| Healthcare Maintenance Services | 50 | Maintenance Supervisors, Technical Services Managers |

The Australia Facility Management in Healthcare Market is valued at approximately USD 8 billion, reflecting a significant growth driven by increasing healthcare service demands and the need for efficient facility management solutions to enhance operational efficiency and patient care.