Region:Europe

Author(s):Shubham

Product Code:KRAB6174

Pages:93

Published On:October 2025

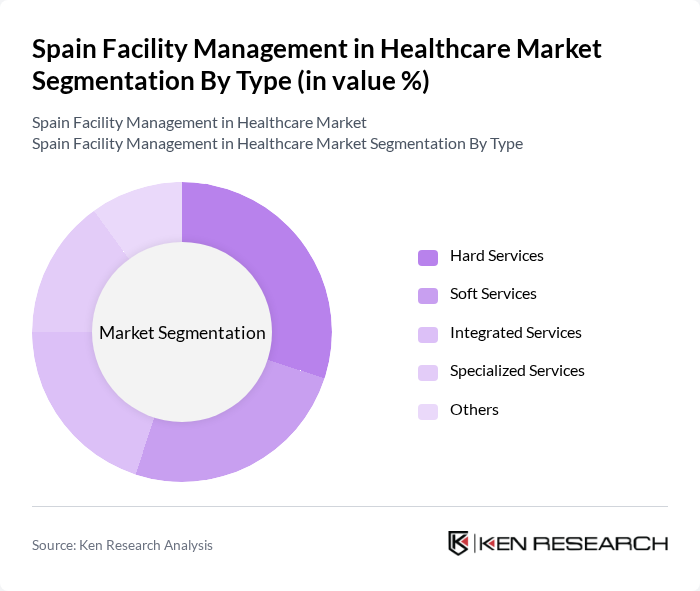

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Each of these segments plays a crucial role in the overall facility management landscape, catering to different operational needs within healthcare facilities.

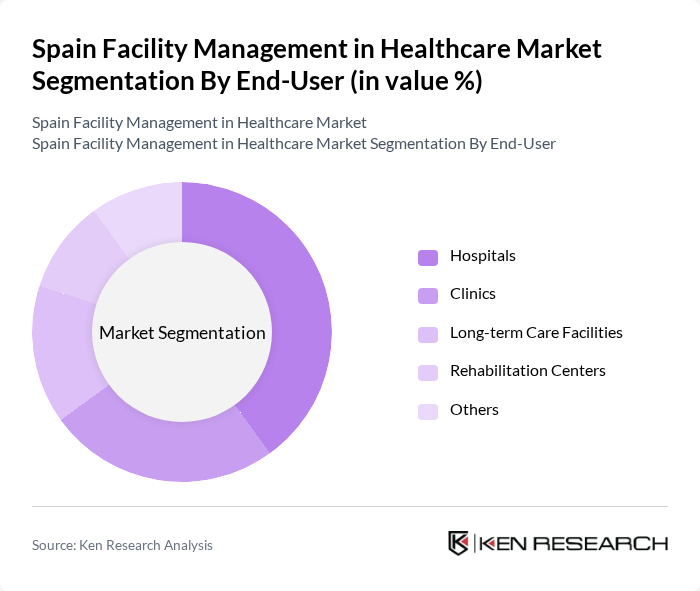

By End-User:The end-user segmentation includes Hospitals, Clinics, Long-term Care Facilities, Rehabilitation Centers, and Others. Each segment represents a unique set of requirements and operational challenges that facility management services must address.

The Spain Facility Management in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo S.A., Aramark Corporation, CBRE Group, Inc., Compass Group PLC, G4S plc, Mitie Group PLC, Serco Group PLC, OCS Group Limited, Apleona GmbH, C&W Services, JLL (Jones Lang LaSalle), Bilfinger SE, EMCOR Group, Inc., Vebego AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Spain's healthcare sector appears promising, driven by technological advancements and increasing demand for efficient services. As healthcare facilities modernize, the integration of smart technologies will enhance operational efficiency and patient care. Additionally, the focus on sustainability and green practices will shape facility management strategies, aligning with government initiatives aimed at improving healthcare infrastructure. These trends indicate a shift towards more integrated and patient-centric facility management solutions in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Rehabilitation Centers Others |

| By Service Model | Outsourced Services In-house Services Hybrid Model |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain |

| By Contract Type | Fixed-term Contracts Long-term Contracts Project-based Contracts |

| By Service Frequency | Daily Services Weekly Services Monthly Services |

| By Investment Source | Public Funding Private Investment International Aid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Facility Management | 150 | Facility Managers, Operations Directors |

| Healthcare Service Providers | 100 | Service Coordinators, Procurement Managers |

| Outpatient Clinic Management | 80 | Clinic Administrators, Facility Coordinators |

| Healthcare Technology Integration | 70 | IT Managers, Facility Management Consultants |

| Regulatory Compliance in Facility Management | 60 | Compliance Officers, Quality Assurance Managers |

The Spain Facility Management in Healthcare Market is valued at approximately USD 5 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient healthcare services and the complexity of healthcare facilities.