Region:North America

Author(s):Rebecca

Product Code:KRAB5967

Pages:89

Published On:October 2025

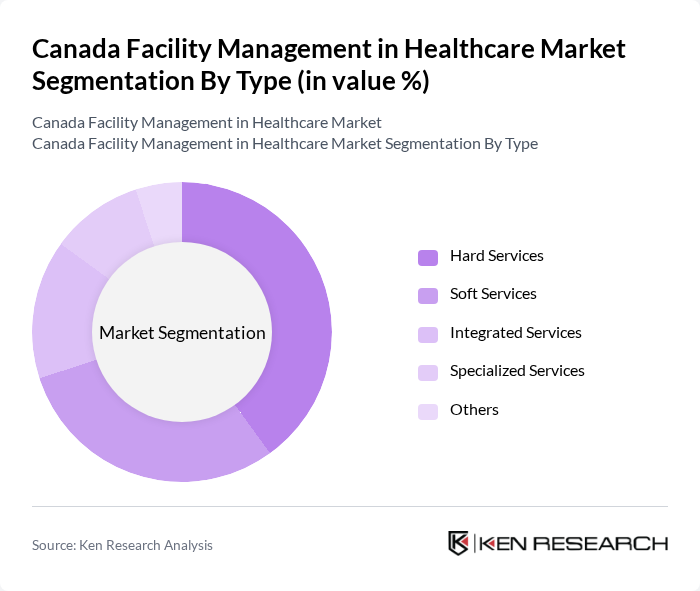

By Type:The facility management market in healthcare is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services include cleaning and catering. Integrated Services combine both hard and soft services for streamlined operations. Specialized Services cater to specific needs such as waste management and security. The Others category includes miscellaneous services that do not fit into the primary classifications.

The Hard Services segment is currently dominating the market due to the critical need for maintenance and repair in healthcare facilities. These services ensure that essential systems such as HVAC, plumbing, and electrical systems are operational, which is vital for patient safety and comfort. The increasing age of healthcare infrastructure and the need for compliance with health regulations further drive the demand for hard services. As healthcare facilities strive to provide uninterrupted services, the focus on hard services is expected to remain strong.

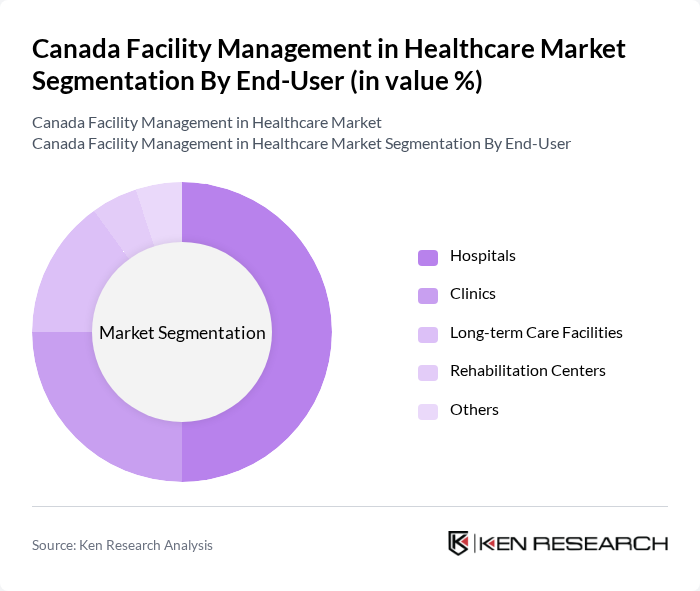

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Long-term Care Facilities, Rehabilitation Centers, and Others. Hospitals represent the largest segment due to their complex operational needs and high patient volumes. Clinics and long-term care facilities also require facility management services to maintain a safe and clean environment. Rehabilitation centers focus on specialized services, while the Others category includes various healthcare-related facilities.

Hospitals are the leading end-user segment, accounting for a significant portion of the market. This dominance is attributed to the extensive range of services required to maintain hospital operations, including emergency services, surgical facilities, and patient care areas. The increasing patient population and the need for advanced medical technologies further necessitate robust facility management solutions in hospitals. As healthcare systems evolve, hospitals will continue to prioritize facility management to enhance operational efficiency and patient satisfaction.

The Canada Facility Management in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Compass Group Canada, Sodexo Canada, Aramark Canada, ISS Facility Services Canada, GDI Integrated Facility Services, Brookfield Global Integrated Solutions, CBRE Group, Inc., C&W Services, Mitie Group plc, Apleona HSG GmbH, JLL (Jones Lang LaSalle), Colliers International, Cushman & Wakefield, EMCOR Group, Inc., Vantage Facilities contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Canada's healthcare sector appears promising, driven by technological advancements and increased government investment. As healthcare facilities adopt smart technologies and sustainable practices, operational efficiency is expected to improve significantly. Additionally, the ongoing expansion of telehealth services will necessitate innovative facility management solutions. These trends indicate a shift towards more integrated and patient-centric approaches, ultimately enhancing the quality of care and operational effectiveness in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Rehabilitation Centers Others |

| By Service Model | Outsourced Services In-house Services Hybrid Model |

| By Region | Ontario Quebec British Columbia Alberta Others |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Service Duration | Short-term Contracts Long-term Contracts |

| By Technology Integration | Building Management Systems IoT Solutions Energy Management Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Facility Management | 150 | Facility Managers, Operations Directors |

| Long-term Care Facility Operations | 100 | Administrative Managers, Care Facility Directors |

| Healthcare Technology Integration | 80 | IT Managers, Biomedical Engineers |

| Healthcare Cleaning and Maintenance Services | 70 | Service Providers, Quality Assurance Managers |

| Healthcare Security Management | 60 | Security Managers, Risk Management Officers |

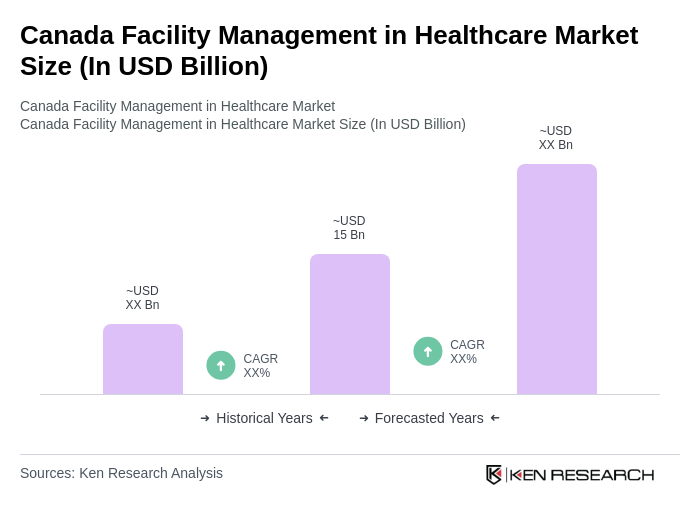

The Canada Facility Management in Healthcare Market is valued at approximately USD 15 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient healthcare services and compliance with stringent regulations.