Region:Central and South America

Author(s):Dev

Product Code:KRAA0459

Pages:83

Published On:August 2025

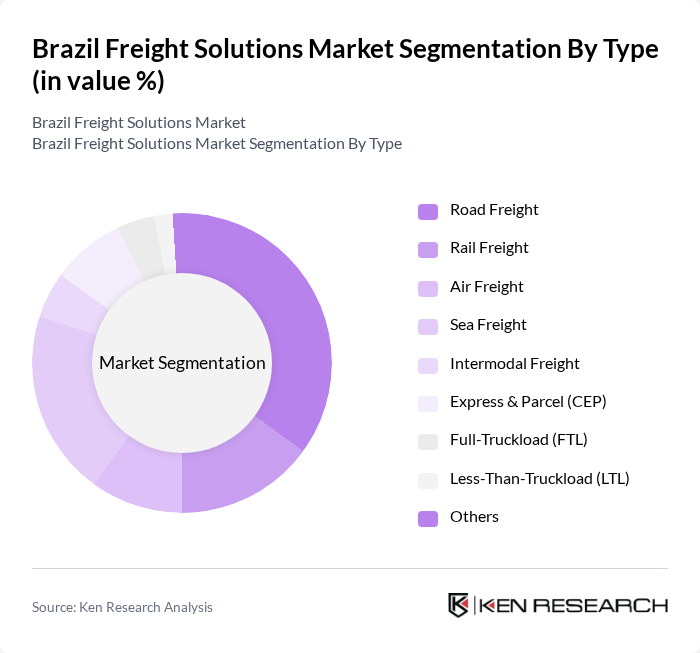

By Type:The freight solutions market can be segmented into Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express & Parcel (CEP), Full-Truckload (FTL), Less-Than-Truckload (LTL), and Others. Each segment plays a crucial role in the logistics framework, addressing diverse transportation needs and cargo types. Road freight dominates due to Brazil’s vast geography and the predominance of domestic trade, while rail and sea freight are vital for bulk and international shipments. Air freight and CEP are increasingly important for high-value and time-sensitive goods, especially with the rise of e-commerce. Intermodal solutions are gaining traction as companies seek efficiency and sustainability .

By End-User Industry:The freight solutions market is also segmented by end-user industries, including Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Automotive; Pharmaceuticals & Healthcare; Food and Beverage; and Others. Each industry has unique logistics requirements that influence the demand for specific freight solutions. Manufacturing and wholesale/retail trade are the largest consumers, driven by Brazil’s industrial base and consumer market. Agriculture and mining are significant due to Brazil’s export profile, while pharmaceuticals and food sectors require specialized, often temperature-controlled, logistics .

The Brazil Freight Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as JSL S.A., Rumo Logística, Tegma Gestão Logística, Grupo TPC, Log-In Logística Intermodal, Rodonaves (RTE Rodonaves), Sequoia Logística, DHL Supply Chain Brazil, FedEx Express Brasil, Kuehne + Nagel Brazil, DB Schenker Brazil, UPS Brazil, Grupo Águia Branca, Loggi, TNT Mercurio contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's freight solutions market appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery capabilities. Additionally, the push for sustainability will lead to the adoption of green logistics practices, aligning with global trends. Companies that leverage data analytics and smart technologies will likely gain a competitive edge, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express & Parcel (CEP) Full-Truckload (FTL) Less-Than-Truckload (LTL) Others |

| By End-User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas Mining and Quarrying Wholesale and Retail Trade Automotive Pharmaceuticals & Healthcare Food and Beverage Others |

| By Cargo Type | Perishable Goods Hazardous Materials Bulk Cargo General Cargo Containerized Cargo Temperature-Controlled Cargo Others |

| By Service Type | Freight Forwarding Customs Brokerage Warehousing and Storage Distribution Value-Added Services Logistics Management Others |

| By Region | Southeast Brazil South Brazil North Brazil Central-West Brazil Northeast Brazil |

| By Technology Adoption | Automated Freight Systems IoT in Logistics Blockchain for Supply Chain AI and Machine Learning Digital Tracking Platforms Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Managers, Fleet Operations Directors |

| Maritime Freight Solutions | 60 | Port Operations Managers, Shipping Line Executives |

| Air Cargo Services | 40 | Air Freight Managers, Customs Compliance Officers |

| Rail Freight Operations | 40 | Railway Logistics Coordinators, Supply Chain Analysts |

| Third-Party Logistics Providers | 50 | Business Development Managers, Operations Supervisors |

The Brazil Freight Solutions Market is valued at approximately USD 105 billion, reflecting significant growth driven by the demand for efficient logistics, e-commerce expansion, and improved supply chain management over the past five years.