Region:Europe

Author(s):Dev

Product Code:KRAA0455

Pages:85

Published On:August 2025

By Type:The freight solutions market in France is segmented into various types, including Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express Freight, Freight Forwarding, Warehousing & Distribution, and Others. Among these, Road Freight is the most dominant segment due to its flexibility, extensive network, and ability to provide door-to-door services, catering to both short and long-distance transportation needs. Rail Freight is significant for bulk and heavy goods, offering cost-effective and sustainable options, while Air Freight is preferred for time-sensitive and high-value shipments. The rapid growth of e-commerce has further boosted the Express Freight segment, making it a key player in the market .

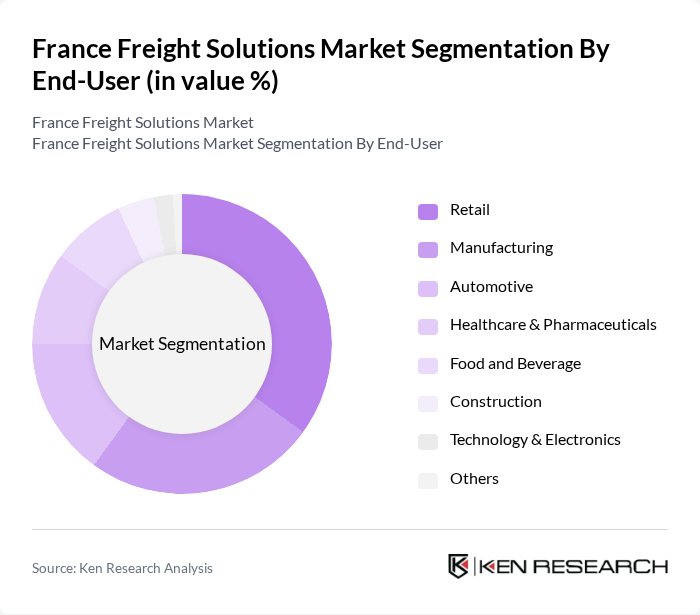

By End-User:The end-user segmentation of the freight solutions market includes Retail, Manufacturing, Automotive, Healthcare & Pharmaceuticals, Food and Beverage, Construction, Technology & Electronics, and Others. The Retail sector is the largest consumer of freight services, driven by the surge in online shopping, omnichannel distribution, and the need for efficient logistics. Manufacturing and Automotive sectors also significantly contribute to demand, requiring reliable transportation for raw materials and finished goods. The Healthcare sector increasingly relies on specialized freight services for temperature-sensitive and high-value products, while the Food and Beverage industry demands timely deliveries to maintain freshness and comply with safety standards .

The France Freight Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geodis, XPO Logistics, DB Schenker, Kuehne + Nagel, DPDgroup (La Poste Group), DHL Supply Chain, SNCF Logistics, Bolloré Logistics, Stef, Rhenus Logistics, TSE Express, Transports Roussel, STG Group, Heppner, and Groupe Charles André contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France freight solutions market appears promising, driven by ongoing technological advancements and infrastructure investments. As e-commerce continues to thrive, logistics providers are expected to enhance their service offerings, focusing on last-mile delivery and automation. Additionally, the emphasis on sustainability will likely lead to increased adoption of green logistics practices. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the evolving freight landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express Freight Freight Forwarding Warehousing & Distribution Others |

| By End-User | Retail Manufacturing Automotive Healthcare & Pharmaceuticals Food and Beverage Construction Technology & Electronics Others |

| By Freight Size | Less than Truckload (LTL) Full Truckload (FTL) Small Package Bulk Freight Oversized Freight Containerized Freight Others |

| By Service Type | Standard Freight Services Expedited Freight Services Specialized Freight Services Warehousing and Distribution Freight Forwarding Supply Chain Management Last-Mile Delivery Others |

| By Delivery Model | Direct Delivery Scheduled Delivery On-Demand Delivery Subscription-Based Delivery Others |

| By Geographic Coverage | National Coverage Regional Coverage International Coverage Urban Coverage Rural Coverage Others |

| By Technology Utilization | GPS Tracking IoT Integration Blockchain for Logistics Automated Warehousing Electric & Alternative Fuel Vehicles Digital Freight Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Solutions | 60 | Rail Operations Managers, Supply Chain Analysts |

| Air Cargo Management | 40 | Air Freight Coordinators, Cargo Operations Managers |

| Maritime Freight Operations | 40 | Port Managers, Shipping Line Executives |

| Last-Mile Delivery Services | 50 | Last-Mile Operations Managers, E-commerce Logistics Heads |

The France Freight Solutions Market is valued at approximately USD 260 billion, reflecting a robust growth trajectory driven by increasing demand for logistics and transportation services, particularly due to e-commerce expansion and globalization.