Region:Africa

Author(s):Shubham

Product Code:KRAA0709

Pages:83

Published On:August 2025

By Type:The freight solutions market in Nigeria is segmented into various types, including Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express & Parcel (CEP) Services, Warehousing & Storage, and Value-Added Logistics Services. Each of these segments plays a vital role in the overall logistics ecosystem, catering to different transportation needs and customer preferences. Road freight remains the dominant mode due to Nigeria’s extensive road network and the flexibility it offers for domestic distribution. Rail and sea freight are critical for bulk and international shipments, while air freight is increasingly important for high-value and time-sensitive goods, especially with the growth of e-commerce. Express & Parcel (CEP) services are expanding rapidly, driven by the surge in online retail, and warehousing & storage solutions are evolving with the adoption of modern inventory management and automation technologies.

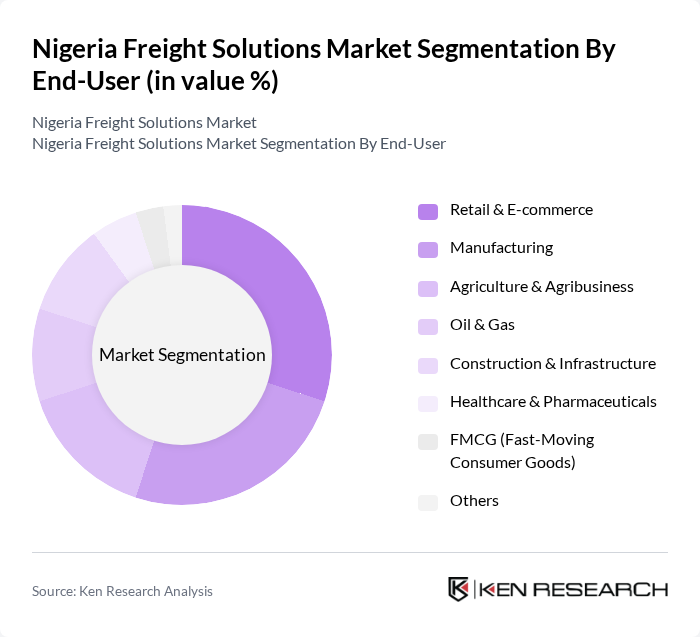

By End-User:The end-user segmentation of the freight solutions market includes Retail & E-commerce, Manufacturing, Agriculture & Agribusiness, Oil & Gas, Construction & Infrastructure, Healthcare & Pharmaceuticals, FMCG (Fast-Moving Consumer Goods), and Others. Each sector has unique logistics requirements, influencing the demand for specific freight services. Retail & e-commerce is a major driver, reflecting the rapid adoption of online shopping and the need for efficient last-mile delivery. Manufacturing and agriculture sectors require robust freight solutions for raw material movement and finished goods distribution, while oil & gas and construction sectors depend on specialized logistics for heavy and hazardous cargo.

The Nigeria Freight Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maersk Nigeria, DHL Nigeria, GIG Logistics, Kuehne + Nagel Nigeria, Red Star Express, Nigerian Ports Authority, Transcorp Logistics, APM Terminals Nigeria, FedEx Nigeria, Jumia Logistics, Bolloré Transport & Logistics Nigeria, Swift Logistics, Cargo Services Nigeria, Nigerian Railway Corporation, and ABC Transport Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria freight solutions market appears promising, driven by technological advancements and a growing emphasis on sustainability. As logistics companies increasingly adopt digital platforms and data analytics, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable practices will likely lead to innovations in green logistics, positioning the market for robust growth. The combination of these trends will enhance service delivery and customer satisfaction, fostering a more competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express & Parcel (CEP) Services Warehousing & Storage Value-Added Logistics Services |

| By End-User | Retail & E-commerce Manufacturing Agriculture & Agribusiness Oil & Gas Construction & Infrastructure Healthcare & Pharmaceuticals FMCG (Fast-Moving Consumer Goods) Others |

| By Service Type | Freight Forwarding Warehousing & Cold Chain Customs Brokerage Supply Chain Management Last-Mile Delivery Value-Added Services (Packaging, Labelling, etc.) Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Freight Brokers & Agents Digital Freight Platforms Others |

| By Pricing Model | Flat Rate Pricing Variable Pricing (Distance/Weight-Based) Subscription-Based Pricing Pay-Per-Use Pricing Others |

| By Cargo Type | Perishable Goods Non-Perishable Goods Hazardous Materials Bulk Cargo Containerized Cargo Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Non-Governmental Organizations (NGOs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 120 | Logistics Coordinators, Fleet Managers |

| Air Cargo Operations | 60 | Air Freight Managers, Airport Operations Managers |

| Maritime Freight Solutions | 50 | Shipping Line Executives, Port Authority Officials |

| Rail Freight Transportation | 40 | Railway Operations Managers, Freight Planners |

| Customs Brokerage Services | 45 | Customs Brokers, Compliance Officers |

The Nigeria Freight Solutions Market is valued at approximately USD 15.4 billion, driven by increasing demand for efficient logistics services, urbanization, and e-commerce expansion. This market is crucial for Nigeria's economic landscape, reflecting the growth in trade activities.