Region:Middle East

Author(s):Shubham

Product Code:KRAA0926

Pages:96

Published On:August 2025

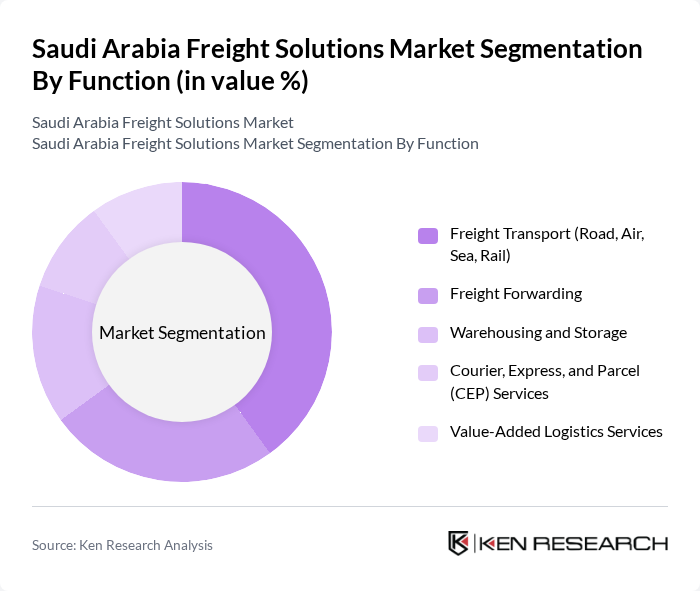

By Function:The freight solutions market can be segmented into various functions, including Freight Transport (Road, Air, Sea, Rail), Freight Forwarding, Warehousing and Storage, Courier, Express, and Parcel (CEP) Services, and Value-Added Logistics Services. Each of these functions plays a vital role in the overall logistics ecosystem, catering to different customer needs and operational requirements .

The Freight Transport segment, encompassing road, air, sea, and rail, is the dominant function in the market, accounting for a significant portion of the overall logistics activities. This dominance is attributed to the increasing demand for efficient and timely transportation solutions, driven by the growth of e-commerce, international trade, and the adoption of digital logistics platforms. Road freight remains the most utilized mode due to its flexibility and extensive network, while air freight is preferred for high-value and time-sensitive shipments. The integration of technology in tracking and managing freight operations has further enhanced the efficiency of this segment .

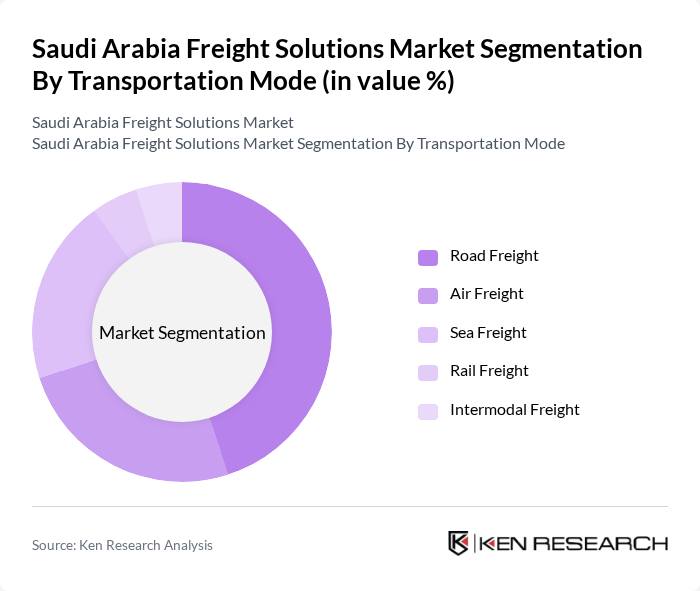

By Transportation Mode:The transportation mode segmentation includes Road Freight, Air Freight, Sea Freight, Rail Freight, and Intermodal Freight. Each mode has its unique advantages and is chosen based on the specific needs of the shipment, such as cost, speed, and type of cargo .

Road Freight is the leading mode of transportation in the Saudi Arabia Freight Solutions Market, primarily due to its extensive road network and the ability to provide door-to-door service. The flexibility and speed of road transport make it the preferred choice for many businesses, especially in the e-commerce sector. Air Freight follows as a significant mode for high-value and time-sensitive goods, while Sea Freight is essential for bulk shipments and international trade. The growing trend towards intermodal solutions is also gaining traction, as it combines the advantages of different transportation modes for enhanced efficiency .

The Saudi Arabia Freight Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahri (National Shipping Company of Saudi Arabia), Saudi Arabian Logistics Company (SAL), Aramex, Agility Logistics, DHL Supply Chain, FedEx, UPS, Kuehne + Nagel, DB Schenker, GAC Group, Wared Logistics, Mosanada Logistics Services, Al-Jazira Transport, Saudi Post, Almajdouie Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia freight solutions market appears promising, driven by ongoing investments in infrastructure and technology. As the government continues to support logistics initiatives, companies are likely to adopt advanced technologies such as AI and automation to enhance operational efficiency. Additionally, the increasing focus on sustainability will push logistics providers to implement greener practices, ensuring compliance with environmental standards while meeting the growing demand for efficient freight solutions.

| Segment | Sub-Segments |

|---|---|

| By Function | Freight Transport (Road, Air, Sea, Rail) Freight Forwarding Warehousing and Storage Courier, Express, and Parcel (CEP) Services Value-Added Logistics Services |

| By Transportation Mode | Road Freight Air Freight Sea Freight Rail Freight Intermodal Freight |

| By End-Use Industry | Manufacturing Consumer Goods and Retail Food and Beverages IT Hardware and Telecom Healthcare and Pharmaceuticals Chemicals Construction Automotive Oil and Gas Others |

| By Service Type | Freight Forwarding Warehousing Customs Brokerage Supply Chain Management Last-Mile Delivery Others |

| By Cargo Type | Perishable Goods Hazardous Materials General Cargo Heavy Machinery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Freight Services | 60 | Air Cargo Managers, Logistics Coordinators |

| Sea Freight Operations | 50 | Port Operations Managers, Shipping Line Executives |

| Land Transportation Solutions | 45 | Fleet Managers, Transportation Planners |

| Cold Chain Logistics | 40 | Supply Chain Directors, Quality Assurance Managers |

| Freight Forwarding Services | 55 | Freight Forwarding Agents, Business Development Managers |

The Saudi Arabia Freight Solutions Market is valued at approximately USD 32 billion, driven by increasing demand for logistics services, e-commerce growth, and government infrastructure investments.